Interpreting Expense Breakdown Trends Over Time

Understanding the trends in expense breakdown is crucial for businesses aiming for financial acuity. It helps organizations analyze where their money is going and identify critical areas needing attention. Variations in expense categories can signify changes in operational strategy or shifts in market conditions. Tracking these trends over time empowers managers to make informed decisions based on empirical evidence. By carefully observing the data, businesses can spot rising costs, evaluate the effectiveness of budgeting strategies, and adjust accordingly. It is also essential to look for spikes or unexpected increases in specific spending areas that might warrant immediate investigation. Moreover, comparisons against industry benchmarks can provide useful insights into cost management effectiveness. Companies operating in competitive markets will find this particularly relevant, as controlling expenses directly influences profitability. Effective expense analysis must also include a thorough understanding of fixed versus variable costs. Both play unique roles in the financial health of an organization. Regularly reviewing and interpreting expense breakdowns can position a company not just to survive but to thrive by leveraging this information into strategic financial planning.

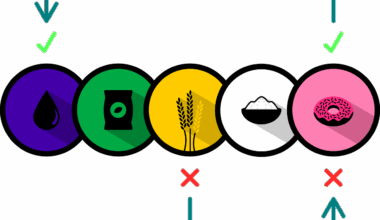

To effectively uncover trends in expense breakdown, categorization is fundamental. Businesses should implement a structured approach to categorize expenses into fixed and variable types. Fixed expenses, such as rent and utilities, tend to remain stable over time, while variable expenses fluctuate with production levels. Detailed categorization aids in targeted analysis, allowing identification of specific cost drivers. An example of categorization may include grouping expenses into marketing, operational, administrative, and research categories. This breakdown helps in assessing how each of these segments impacts overall profitability. Additionally, the identification of seasonal trends can reveal patterns that are not immediately evident in aggregated data. For instance, some businesses might experience increased marketing expenses during the holiday season. Recognizing these occurrences can facilitate better budget planning and resource allocation in the future. Moreover, advanced financial tools and software can automate the categorization process, leading to more accurate and timely reporting. However, human interpretation remains valuable in understanding the context behind the numbers. Employers should combine quantitative analysis with qualitative insights to paint a comprehensive picture.

Analyzing Historical Data

Historical data analysis is a cornerstone of expense breakdown interpretation. The evaluation of past financial periods allows business leaders to recognize long-term expense trends. This understanding can highlight potential areas for efficiency improvements or identify unanticipated expense growth. A thoughtful analysis will also include identifying recurring patterns across monthly, quarterly, and annual expense data. This helps in establishing realistic forecasts and budgets going forward. Moreover, reviewing historical breakdowns enables organizations to assess how external factors, such as economic shifts or global events, influence expenses. For instance, if historical data shows a consistent rise in material costs due to inflationary pressures, proactive measures can be taken. Such foresight can mitigate potential impacts on profit margins. Tools like financial planning software can simplify this process by providing dashboards that visualize expense trends historically. Visual insights facilitate easier interpretation of complex data and enhance communication among stakeholders. Additionally, a strategic economic analysis could foresee potential market shifts. Armed with this knowledge, businesses will better position themselves for agile adaptability to changes.

In evaluating expense trends, businesses should focus on the variance analysis approach. Variance analysis compares actual expenses incurred against projected budgets. By examining the discrepancies, companies gain invaluable insights into operational performance. Negative variances may indicate overspending or miscalculations in the budgeting process, presenting opportunities for corrective action. Conversely, positive variances can provide room for reallocation of funds to strategic initiatives. A further benefit of variance analysis lies in its ability to assist in forecasting future expenses based on historical performance. It’s essential to include staff training in this assessment process, ensuring employees understand variances and their roles in cost management. Regular training sessions could enhance awareness and accountability. Furthermore, companies should ensure their expenses are analyzed within the context of revenue changes as well. The relationship between expenses and revenues can provide a more comprehensive operational overview. Key Performance Indicators (KPIs) relevant to expense breakdowns should also be monitored to ensure ongoing alignment with strategic goals. KPIs may include cost per project, margin variance, and operating profit margins, informing budgeting and forecasting processes.

Using Technology in Expense Monitoring

The integration of technology is revolutionizing how expenses are monitored and analyzed over time. Digital tools and cloud-based software have streamlined expense tracking and provided real-time insights. Applications that automatically categorize expenses allow for rapid evaluations. These innovations contribute significantly to the overall efficiency of financial management. Machine learning algorithms can analyze patterns and predict future expenses based on historical spending data, reducing the burden on financial teams. Furthermore, these advanced tools provide businesses with enhanced visibility into their expense landscape. Dashboards that aggregate data from different expense categories can simplify analysis processes for management. Real-time alerts on unusual spending patterns serve as proactive measures against potential financial issues. Over time, adopting such technological tools can lead to improved decision-making and cost reduction. Additionally, incorporating mobile applications enables employees to log expenses wherever they are, fostering a culture of accountability and transparency. This practice assures accurate and timely data collection, essential for effective expense review. Overall, the technological approach enhances adaptability and responsiveness in managing expenses in real-world scenarios, ensuring sustainable growth for an organization.

Another crucial aspect of expense breakdown is considering the impact of external factors on business finances. These external influences can include economic conditions, market competition, and regulatory changes. A diligent review of how such factors affect spending patterns is essential for accurate expense interpretation. For instance, economic downturns may force businesses to scale back on discretionary spending. In contrast, regulatory changes might necessitate increased compliance costs. Organizations should also assess the competitive landscape proactively. It’s not uncommon for businesses to ramp up marketing expenses during competitive periods to maintain market share. Keeping insights on external factors allows for strategic foresight in expense planning. Economic indicators such as inflation rates and unemployment statistics can guide budget settings and expense projections. By closely monitoring these conditions, businesses can remain agile and make informed decisions. Furthermore, collaboration with industry analysts or consultants provides external perspectives that may illuminate hidden pitfalls or opportunities. Engaging with benchmarking services can clarify how expense levels compare with industry standards, ensuring effective financial management. Understanding external factors enhances strategic oversight and fosters long-term resilience.

Conclusion: Strategic Expense Management

Collectively understanding expense breakdown trends equips organizations with the key to strategic financial management. The amalgamation of historical data analysis, variance assessments, technological integrations, and awareness of external factors enhances a business’s readiness to adapt. Strategic expense management is not merely about cutting costs; instead, it revolves around making informed choices that align spending with growth ambitions. For instance, businesses can assess investing in employee training against associated long-term benefits. Additionally, recognizing expense trends can lead to budget reallocations toward high-impact areas, fostering innovation and new opportunities for growth. Management must encourage a culture of expense awareness and regularly review benchmarks to gauge operational efficiency. Investing in continuous training and technology tools fosters an environment capable of adapting to challenges swiftly. Furthermore, collaborations with financial experts can heighten the effectiveness of expense management efforts while delivering insights into market positioning. Overall, a comprehensive approach to interpreting expense breakdowns cultivates an environment where opportunities are identified and challenges become manageable, paving the way for sustained organizational success. Thus, companies can navigate the financial landscape with confidence and foresight.

The discipline of expense breakdown interpretation is pivotal, and businesses should prioritize this aspect for improvement.