Recognition of Provisions and Other Liabilities in Financial Statements

In financial reporting, provisions and liabilities are crucial as they indicate the company’s obligations. The recognition of these elements involves ample judgment concerning the timing and measurement of various incurred expenses. According to accounting standards, provisions must be recognized when they meet specific criteria. These are legal or constructive obligations resulting from past events, with a reliable estimate of the amount necessary to settle the obligations. Notably, this requires careful documentation and assessment of any associated risks. A notable aspect is determining the expected outflow of resources that embody economic benefits. This assessment might also involve forecasting potential cash flows. Entities must evaluate all information available relevant to the liabilities. Records must stay compliant with regulations such as IFRS or GAAP. A company’s liabilities can include both long-term and short-term classifications, impacting financial statements significantly. To ensure transparency, all provisions should be clearly disclosed in financial notes, detailing their nature and timing. This approach fosters trust and clarity for investors and stakeholders alike in assessing the financial health and operational efficiency of an organization.

Furthermore, liabilities categorized under provisions are often subject to changes over time. This means that businesses must frequently revisit and reassess their estimates in light of new information or changing circumstances. Such adjustments could arise from various factors, including alterations in market conditions, legal contexts, or operational performances. It is essential for companies to maintain accuracy in their accounting records because inaccuracies could lead to misallocated resources or financial distress. For instance, if a business underestimates its provisions, it may face insolvency risks that could threaten its ongoing operations. Therefore, recognizing the need for a reasonable basis for estimating liabilities is paramount, leading to more sound decision-making. An established framework should guide organizations on how to approach their obligations systematically, narrowing down the estimates while minimizing the associated risks. Consistent methods for measurement also play a critical role in budget formulation and financial forecasting. In sum, maintaining a robust process for recognizing and measuring provisions assists stakeholders in understanding the financial landscape effectively. Adjustments and updates should be recorded accurately to reflect current obligations in the financial statements.

Legal and Constructive Obligations

Understanding the distinction between legal and constructive obligations is pivotal when recognizing provisions in financial statements. Legal obligations arise from contracts or regulations mandating specific performances or payments. On the other hand, constructive obligations stem from a company’s past actions or established practices that create an expectation among stakeholders. For instance, if an organization regularly resolves disputes with customers by settling claims, it can become constructively obligated to provide similar settlements in the future. Accurate assessment of these obligations is critical, as it influences financial outcomes presented in the balance sheet. Moreover, companies must ensure they remain compliant with applicable accounting standards, which offer clear guidance on how liabilities should be classified and measured. Companies may also consider involving legal counsel when determining the validity or extent of their obligations, as this can impact their financial health. Strong documentation practices will support purposes such as audits and improve accountability. A comprehensive understanding of various obligations enables organizations to navigate liabilities more effectively, thereby influencing their overall strategic planning and financial management.

Moreover, the recognition of provisions involves a rigorous analysis of potential future outflows. Entities must take great care to avoid overstating or understating these liabilities. Companies usually rely on various techniques and estimates to forecast the necessity and amount of provisions accurately. For example, well-founded projections take into account historical trends, expert opinions, and statistical models. Following a structured approach assists in ensuring that each provision meets the criteria established by accounting frameworks, such as the requirement that the obligation must be probable. Transparent reporting of provisions promotes business integrity, as stakeholders can view clearly documented estimates and the rationale behind them. Furthermore, regularly updating these estimates in annual reports allows stakeholders to track changes in provisions accurately. Trends observed over multiple reporting periods provide insights into potential future liabilities. As a result, the continuous evaluation enhances the organization’s forecasting capability. The appropriate level of conservatism should be applied when estimating provisions, ensuring that all potential liabilities are disclosed without compromising the reliability of financial statements. This responsible approach not only maintains trust with investors but also protects the organization’s financial integrity.

Disclosure Requirements

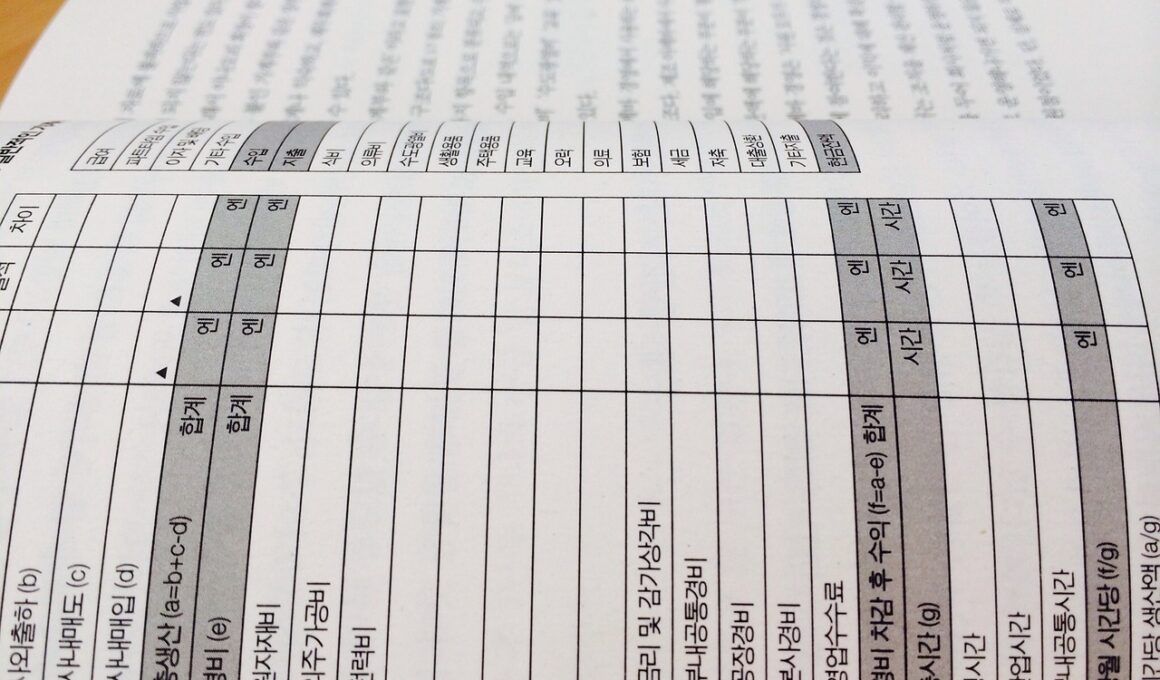

Disclosure requirements concerning provisions and liabilities are essential, ensuring transparency and accountability in financial statements. Companies must provide sufficient details about the key assumptions and estimates used in measuring provisions. This information allows users of financial statements to understand the timing and uncertainty surrounding the outflows. Principles followed for disclosures may vary depending on the relevant reporting framework. For instance, under IFRS, entities are required to disclose the nature of the obligation, expected outflows, and any uncertainties regarding the amount or timing. Consequently, this leads to better judgment by stakeholders concerning financial performance and risks. Furthermore, organizations need to disclose significant changes in provisions from one period to another, including any reversals. Proper documentation of these aspects in the notes to financial statements allows users to analyze the effect on performance comprehensively. In addition, this disclosure practice enhances comparability across periods, fostering informed decision-making. Auditors will specifically look for compliance with these disclosure requirements during their assessments. Thus, adhering to disclosure guidance not only informs stakeholders but also contributes to better corporate governance.

Besides compliance, organizations should also acknowledge the significance of tracking provisions through efficient accounting practices. The ongoing review process should be implemented to manage and adjust provisions as needed, allowing the organization to respond proactively to changes. For example, if uncertain circumstances surrounding a contingent liability evolve, reevaluating the related provision accordingly ensures accurate financial statements. Utilizing technology, such as accounting software, can streamline this process and provide real-time updates on liabilities and provisions where applicable. Proper integration of accounting systems also aids in better data analysis, facilitating prompt decision-making. It ensures that decision-makers have access to the latest information relevant to financial obligations. Furthermore, engaging knowledgeable financial personnel contributes to a more robust recognition and measurement process. Employees trained in understanding provisions and liabilities can significantly impact a company’s financial health. Regular training sessions and workshops will enhance overall compliance and efficiency when recognizing provisions. By establishing effective communication regarding liabilities and fostering awareness across departments, companies can operate with a unified front in managing obligations.

Conclusion

In conclusion, the recognition of provisions and liabilities in financial statements is a complex yet necessary task. By understanding legal and constructive obligations, and the requirements around disclosure, organizations can better navigate their financial responsibilities. Incorporating sound accounting practices bolsters the reliability of financial information provided to stakeholders. Accurate recognition promotes not just compliance but also enhances stakeholder confidence in the reported figures. Companies must take an analytical approach to create a proactive culture concerning their obligations. Empowering employees with knowledge about financial statements aids in compliance and the continuous improvement of the accounting processes. Additionally, companies should maintain a commitment to reevaluation and updating estimates regularly. This conscientious practice of addressing any inaccuracies or changes to provisions will boost organizational effectiveness. An unmistakably transparent approach towards provisions shapes how stakeholders view the ongoing financial commitments. Through effective documentation practices and proper disclosures, a clearer understanding of financial health arises. Ultimately, recognizing the impact of provisions provides a framework within which organizations can plan strategically for future growth while simultaneously safeguarding their financial integrity.