Measuring Social and Environmental Returns in Private Equity

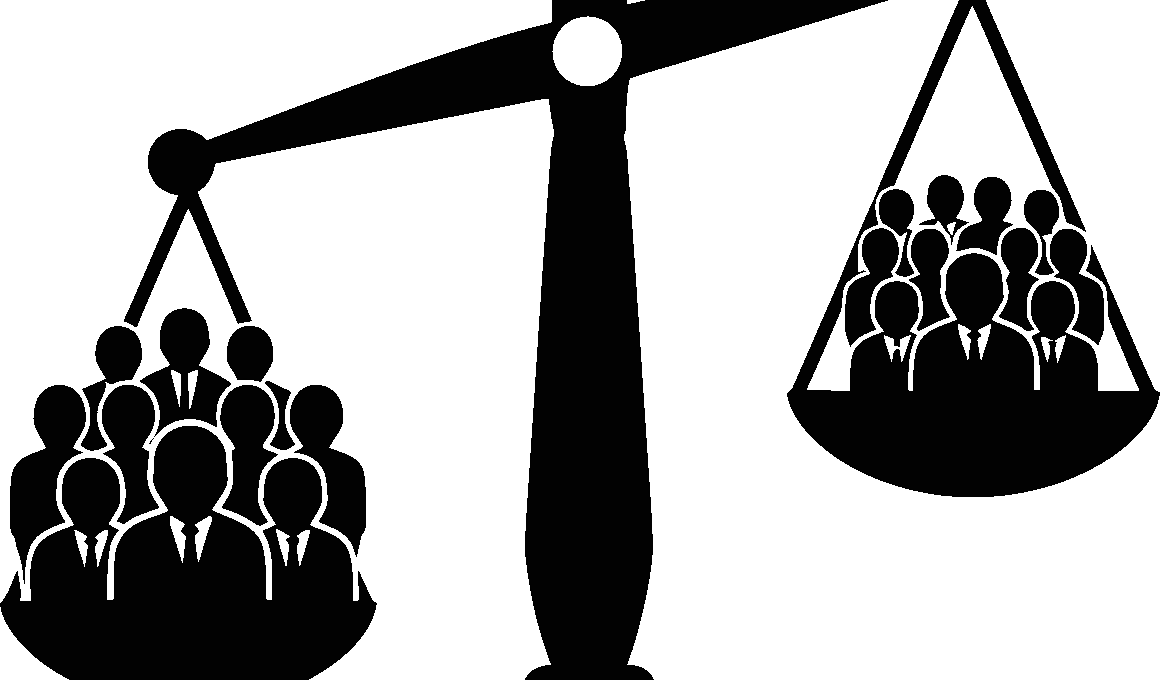

Impact investing in private equity presents firms with a unique opportunity to create social and environmental value. As financial markets evolve, investors seek metrics to assess the performance of their portfolios beyond just monetary returns. The challenge lies in establishing a standard framework to effectively measure these outcomes. Among various methodologies, stakeholder assessments and social impact metrics provide insights into value creation. These tools facilitate clarity for investors aiming to align their financial goals with broader societal benefits. Additionally, quantitative measures such as Social Return on Investment (SROI) offer compelling narratives. In effect, this drives transparency, accountability, and informed decision-making. Both investors and recipients can benefit from stronger links rooted in objective metrics. The growing trend is not merely philanthropic but embodies a shift toward sustainability and responsible investing. For private equity firms, measuring impact necessitates a holistic understanding of community dynamics and ecological systems. Therefore, companies must prioritize frameworks that encompass diverse factors. Doing so supports effective resource allocation and maximizes opportunities for long-term value creation. This article explores innovative strategies to measure these returns in private equity, fostering an environment conducive to growth and positive change.

Various stakeholders, including investors and communities, demand clarity in the impact achieved through private equity investments. Therefore, there are calls for standardized metrics to ensure consistent evaluation of both social and environmental returns. For instance, adopting a framework like the Global Impact Investing Network (GIIN) can guide firms in aligning their strategies. By utilizing frameworks endorsed by thought leaders in impact investing, private equity firms can achieve improved credibility and trust. Furthermore, the integration of Environmental, Social, and Governance (ESG) criteria is becoming pivotal. Investors increasingly utilize ESG ratings to assess investment opportunities, ensuring alignment with ethical values. As competitive advantages validate strategies focusing on impact, investors may increasingly demand impact performance data. This data can influence investment decisions, highlighting opportunities that align with mission-driven funds. A growing body of literature provides evidence that investment performance and impact measurement can positively correlate. Therefore, improving impact measurement encourages greater participation and openness within the private equity ecosystem. This growth signifies fundamental changes in investor expectations. The transition towards measuring social returns in private equity substantially enhances institutional capacity for delivering value, fostering sustainable development in targeted sectors.

Frameworks and Tools for Measuring Impact

As the landscape of impact investing continues to evolve, a variety of frameworks and tools emerge that cater to the specific needs of private equity firms. One popular approach is the IRIS+ system developed by the GIIN. This system provides standardized metrics for measuring, managing, and optimizing impact. By focusing on indicators that align with a firm’s mission and desired outcomes, organizations can better communicate their impact. Notably, integrating qualitative assessments alongside quantitative data enriches the storytelling aspect of impact measurement. Understanding the narratives behind the numbers allows investors to comprehend the broader implications of their investments. Alternative frameworks, such as the B Impact Assessment, offer valuable insights into social and environmental performance. Utilizing these can foster improvements within an organization while promoting accountability in investors. Moreover, bespoke impact measurement strategies tailored to unique investment contexts add significant value. By leveraging innovative techniques and tailored solutions, private equity firms can navigate myriad challenges efficiently. These advancements signal a promising shift towards accountability and transparency that resonates with ethical investment philosophies. Additionally, aligning internal practices with external expectations enhances organizational credibility, positioning firms favorably in the competitive impact investing market.

A critical aspect of measuring social and environmental returns is stakeholder engagement. Engaging stakeholders fosters a collaborative approach to impact measurement, facilitating alignment between investors, communities, and other key players. Mechanisms such as structured surveys and interviews can glean valuable insights into stakeholder perspectives and expectations. Engaging communities directly ensures that the initiatives and investments resonate with their actual needs. Further, continuous engagement helps identify necessary adjustments throughout the investment lifecycle, enabling more agile and responsive strategies. Incorporating stakeholder feedback not only strengthens relationships but also informs better decision-making by grounding it in real-world experiences. Firms can build trust and transparency through this participatory approach, validating their commitment to social accountability. Furthermore, adopting dispersed methodologies across different impact themes allows for more comprehensive assessments of their investments. Therefore, impact investment strategies must include ongoing stakeholder engagement as a core element. This iterative process supports meaningful adjustments and strategy refinements that enhance long-term impact. In this manner, firms can spur authentic engagement, resulting in investments that deliver tangible benefits to communities while simultaneously achieving their financial objectives. In essence, participatory approaches in measuring impact help bridge gaps between investors and stakeholders effectively.

The Role of Technology in Impact Measurement

Recent advancements in technology have greatly enhanced the ability of private equity firms to measure social and environmental returns accurately. Through software solutions and data analytics, firms can streamline data collection and gain valuable insights. These technological innovations enable firms to track metrics effectively over time, providing deeper understanding of the impact generated by their investments. Automation tools can significantly reduce the administrative burden associated with impact measurement, allowing teams to focus on strategic analysis. Furthermore, big data offers an unprecedented opportunity to analyze patterns and correlations in impact results, driving better decision-making processes. By harnessing this wealth of information, private equity firms can refine their investment strategies to maximize impact. Moreover, technologies such as blockchain ensure transparency and traceability throughout the investment chain. This fortifies stakeholder trust by providing verifiable data on impact performance. Additionally, mobile solutions facilitate real-time reporting from community partners, enhancing responsiveness and accountability. As technology evolves, it becomes a cornerstone of effective impact measurement practices. Consequently, private equity firms that leverage technology not only enhance their impact reporting capabilities but also contribute to a more sustainable and responsible investment ecosystem.

In addressing the challenges of measuring social and environmental returns in private equity, it is essential to determine effective governance structures. Establishing clear roles and responsibilities ensures a streamlined approach to impact measurement. Boards must prioritize impact assessment by embedding it within their governance frameworks. Furthermore, creating specialized committees can enhance oversight concerning impact performance. This allows for focused attention on evaluating the returns generated by investments, aligning with broader organizational objectives. Integrating impact performance metrics into decision-making processes also enables leaders to make informed choices. In particular, assessing how these performance metrics align with financial returns promotes a balanced approach to investment strategies. Additionally, cultivating an organizational culture that emphasizes impact facilitates buy-in from teams at various levels. Building this culture nurtures a shared understanding of the organization’s social mission and encourages innovation in finding solutions. Indeed, a strong governance framework plays a vital role in supporting long-term impact. By reinforcing accountability and transparency, these structures strengthen stakeholder confidence. The journey toward optimizing social and environmental returns necessitates unwavering commitment and effective governance mechanisms. Hence, private equity firms must prioritize governance practices crucial to driving meaningful impact.

Future Directions in Impact Measurement

Looking ahead, the future of measuring social and environmental returns in private equity lies in continuous evolution and innovation. As impact investing matures, investors will increasingly demand robust evidence of impact performance. Advanced methodologies will continue to emerge, refining how outcomes are evaluated. For instance, incorporating machine learning and artificial intelligence can provide predictive analytics to assess future impact. This capability would enhance strategic decision-making, allowing firms to allocate resources more effectively. Emerging trends also indicate a potential shift toward collective impact frameworks, where multiple stakeholders collaborate on shared goals, amplifying their impact collectively. Such collaborations can promote knowledge sharing and unify diverse perspectives to enhance measurement methods. Furthermore, there will likely be a move toward integrating impact measurement into the core business model rather than treating it as a separate initiative. This integration underscores the importance of aligning mission with financial objectives seamlessly. As the demand for transparency and accountability grows, firms must continually innovate and adapt their measurement practices. Therefore, embracing change and utilizing the latest tools will be integral in navigating this evolving landscape. Adopting such an approach will be essential for cultivating lasting impacts in private equity.

Ultimately, measuring social and environmental returns in private equity is a multifaceted journey that mandates dedication from investors and firms alike. The growing understanding of the importance of impact underscores the necessity for effective measurement frameworks. Integrated strategies provide a path toward assessing not only financial performance but also the broader implications of investments. Moreover, fostering a culture of collaboration allows stakeholders to engage actively in impact evaluation. By linking metrics to organizational objectives, firms can enhance both accountability and performance over time. The private equity landscape is rapidly evolving, reflecting broader societal demands for responsible investing. Stakeholder expectations are shifting, with an increasing push for transparency and meaningful engagement with communities. In response, the sector must embrace innovative practices while committing to rigorous evaluation techniques. As we move towards this future, the potential for transformative change is immense. By developing comprehensive frameworks that encapsulate both social and environmental dimensions, private equity firms can drive impactful success. They must be prepared to adapt continuously and refine their approaches in alignment with emerging trends. Therefore, measuring these returns not only supports intentional investments but also fosters a sustainable, ethical, and inclusive financial ecosystem.