The Influence of Ethical Lending on Financial Inclusion

Ethical lending practices are essential for promoting financial inclusion, especially among underprivileged segments of society. By providing fair and equitable access to credit, ethical lenders contribute to empowering individuals and communities who may be excluded from traditional financial institutions. These practices ensure that loans are not just available but are also given under transparent and responsible terms. Ethical lenders assess applicants based on their capability and viability rather than solely on credit scores or collateral. This approach fosters a more inclusive financial landscape. When individuals feel they can access credit fairly, it encourages entrepreneurship and stimulates local economies. Furthermore, ethical lending practices prioritize consumer education and support, allowing borrowers to understand their financial options better. This knowledge helps borrowers make informed decisions, reducing the likelihood of default and enhancing financial literacy. In turn, this fosters healthy borrower-lender relationships built on trust and duty. Individuals empowered through ethical lending can invest in businesses, education, and homes. Thus, ethical lending serves as a critical bridge toward broader financial inclusion and equitable economic opportunities for all.

Understanding Ethical Lending Practices

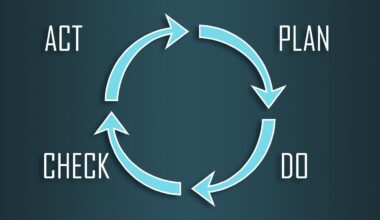

Ethical lending practices focus on principles that prioritize borrower welfare while ensuring financial stability. These principles integrate fairness, transparency, and respect into credit and lending processes. Ethical lenders typically evaluate loan applications by considering personal circumstances alongside financial history. Instead of blanket criteria, they employ tailored assessments to identify suitable lending solutions for borrowers. Lending ethics encompass responsible lending guidelines and emphasize lending products that meet consumer needs, thus helping avoid situations where individuals are trapped in cycles of debt. Additionally, ethical lending programs often include educational elements, assisting borrowers in understanding the implications of their financial decisions. By providing resources and guidance, ethical lenders promote informed borrowing behaviors. Many ethical lenders also integrate social responsibility into their practices, supporting community development initiatives. This could range from providing loans for small businesses in underserved neighborhoods to investing in community educational programs. Ethical lending fosters relationships, builds trust between lenders and borrowers, and encourages a more sustainable approach to financial services. As a result, heightened ethical standards can lead to increased customer loyalty and positive customer experiences in the lending market.

The effects of ethical lending practices on financial inclusion can be profound and far-reaching. By adhering to ethical standards, lenders can pave the way for financial accessibility, particularly in marginalized communities. Financial inclusion is about more than just access to credit; it’s about providing the right tools for individuals to uplift themselves economically. Ethical lending enables borrowers to realize their potential by offering credit products that match their needs without exploiting their vulnerabilities. This can mean lower interest rates, less predatory terms, and customizable repayment options. Lenders who adopt ethical practices also contribute to building community resilience. Individuals are empowered when they receive fair treatment in the lending process, enabling them to invest in personal and community growth initiatives. This can lead to improved living conditions, educational opportunities, and entrepreneurial endeavors. Notably, the shift towards ethical lending cultivates a culture of responsibility among financial institutions. Responsible financial practices not only help borrowers but can also lead to a more stable financial system overall. Increased financial stability among consumers translates into broader economic benefits and long-term growth.

Challenges Facing Ethical Lending

While ethical lending practices hold great promise for enhancing financial inclusion, they also face several challenges. One significant hurdle is the prevalence of traditional lending models, which often prioritize profit over ethical considerations. Many lenders continue to rely on rigid lending criteria, making it difficult for ethical models to gain traction in competitive markets. Furthermore, the lack of awareness about ethical lending among potential borrowers can inhibit growth in this sector. Many may not trust alternative lending solutions or may be unfamiliar with available options, limiting their ability to access credit. Additionally, the regulatory environment surrounding lending practices can pose challenges. Often, regulations do not reflect the needs of ethical lenders or take into account the unique contexts from which borrowers come. This can create barriers that ethical lenders must navigate in their efforts to promote inclusion. Despite these challenges, grassroots movements and advocacy groups are working to promote ethical lending. They aim to raise awareness about ethical borrowing and challenge traditional models. By fostering dialogues about lending practices, these groups play a crucial role in reshaping the lending landscape.

Examples of ethical lending initiatives highlight various models contributing to financial inclusion. Microfinance institutions (MFIs) exemplify ethical lending by providing small loans to low-income borrowers who lack access to conventional banking. They often focus on women entrepreneurs, who are statistically more likely to repay loans but face significant barriers in accessing credit. These institutions emphasize not just lending but also empowering borrowers with skills and resources to manage their finances effectively. Another growing example is community development financial institutions (CDFIs), which aim to revitalize communities by providing equitable access to financing. These organizations typically allocate funds to underserved markets, promoting economic development through local businesses and initiatives. Peer-to-peer lending platforms also present unique ethical alternatives, connecting individual lenders with borrowers directly. By eliminating intermediaries and emphasizing transparency, these platforms can create more competitive rates for borrowers. Each of these models seeks to reimagine credit for consumers through an ethical lens, proving that sustainable lending can coexist with profitability. Ethical lending examples present viable pathways toward creating equitable economic opportunities for all.

The Future of Ethical Lending

The future of ethical lending appears promising, with an increasing awareness of its importance in fostering financial inclusion. As more consumers demand fairness and accountability in financial transactions, lenders are likely to shift their practices. This shift will be driven by the recognition that ethical lending can enhance brand loyalty and customer satisfaction. Financial institutions embracing ethical standards may gain a competitive edge in a market increasingly driven by consumers’ values. Moreover, advancements in technology are paving the way for transparency and efficiency in lending processes. Innovative fintech solutions are helping ethical lenders leverage data analytics to make informed lending decisions that consider borrowers’ unique circumstances. There is also a growing movement toward incorporating social responsibility within the core operations of financial institutions. As emphasis on sustainable development increases, ethical lending practices can exist side by side with profitability. The commitment to financial inclusion will likely gain traction as governments and regulators acknowledge its potential economic benefits. The future landscape of lending holds incredible potential, with ethical lending recognized as a catalyst for inclusivity and empowerment within society.

In conclusion, ethical lending practices offer essential roles in promoting financial inclusion. By focusing on fairness, transparency, and borrower welfare, ethical lenders can create meaningful impacts within underserved communities. These practices not only provide underserved individuals access to credit but also empower them with the knowledge and resources needed to navigate their financial journeys successfully. As communities benefit from ethical lending, broader economic growth can ensue, aligning financial institutions’ objectives with social goals. Overcoming challenges and leveraging innovative practices will be crucial to sustaining this momentum for ethical lending. With ongoing awareness and advocacy, the movement toward ethical lending will likely continue to flourish. Both borrowers and lenders stand to gain from a system characterized by accountability and care, ensuring that financial services are accessible to all. The evolution of ethical lending demonstrates a collective commitment to shaping a more inclusive financial landscape. It offers hope for those seeking economic participation that transcends traditional barriers. In this way, the influence of ethical lending on financial inclusion represents a pivotal change in the course of financial practices globally.