Compliance Strategies for New Liquidity Requirements

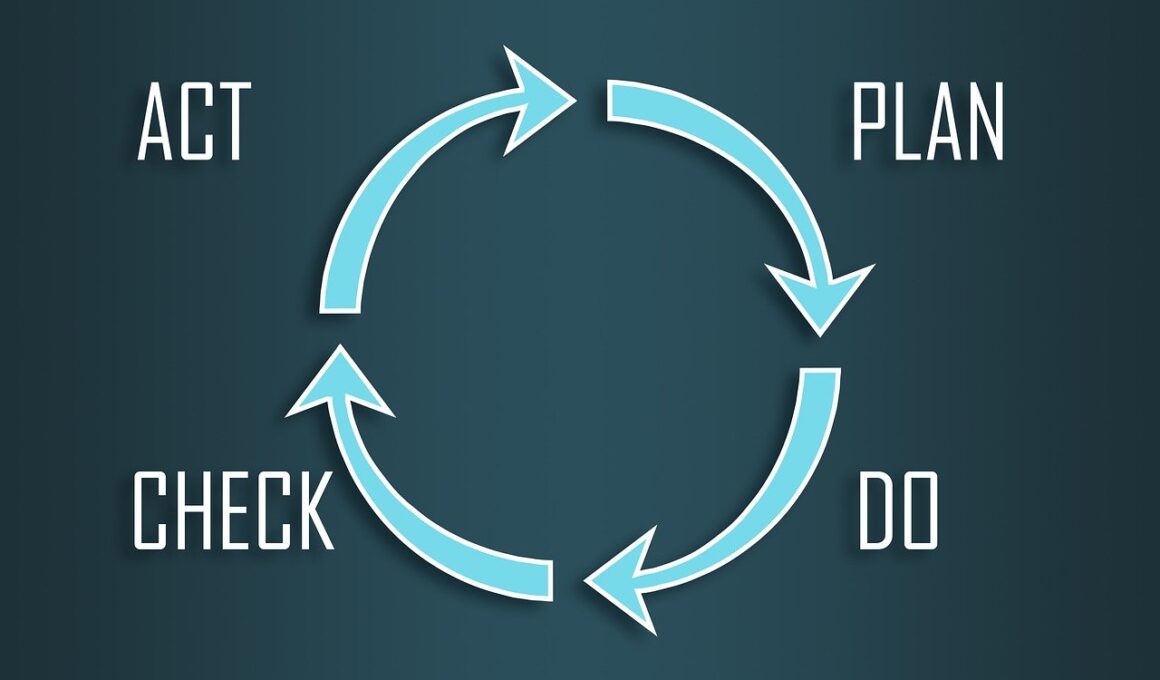

Managing liquidity effectively has become an essential component of financial stability in the current economic landscape. Financial institutions must rapidly adapt to the evolving regulatory requirements for liquidity management. Understanding these requirements is crucial for compliance and risk mitigation. Organizations should develop robust liquidity risk frameworks that not only comply with regulations but also enhance operational efficiency. Key components of these frameworks often include improved data management systems, stress testing methodologies, and effective resource allocation strategies. These elements ensure proper tracking and monitoring of liquidity positions and help in understanding potential shortfalls. Additionally, fostering a culture that emphasizes proactive liquidity management is vital. It encourages teams across various units to engage in planning and anticipatory actions. Establishing a clear governance structure is also imperative, as it delineates roles and responsibilities pertaining to liquidity management. Training employees to be well-versed in regulatory updates will empower them to make informed decisions. Organizations need to leverage technological advancements such as automated reporting tools that provide real-time insights into liquidity positions. By implementing these strategies, organizations can achieve compliance while ensuring their liquidity remains resilient.

To effectively approach the regulatory landscape, organizations must prioritize their liquidity management planning initiatives. Analyzing existing practices can yield insights into gaps and areas for improvement. The adoption of comprehensive liquidity measurement tools is essential for assessing liquidity risks accurately. These tools can range from sophisticated software solutions to basic spreadsheets, depending on organizational size and complexity. However, more widespread use of stress testing can reveal vulnerabilities under various scenarios. Regulatory bodies often provide guidelines for stress testing methodologies that can enhance overall risk awareness. By rigorously testing against adverse conditions, organizations can prepare for uncertainties that could impact their liquidity positions. It is also prudent to establish early warning indicators. Such indicators notify financial institutions when liquidity metrics deviate from acceptable thresholds. This enables immediate action to mitigate risks before potential issues escalate. Governance must extend beyond upper management, incorporating insights from various departments for a holistic strategy. Compliance teams should collaborate closely with treasury and financial planning teams. In doing so, they can ensure cohesive efforts. This will fortify the organization against disparate liquidity challenges arising from regulatory shifts or market fluctuations.

Enhancing Reporting Mechanisms

Regulatory compliance demands a proactive reporting framework that captures the nuances of liquidity management. Organizations must implement real-time monitoring systems to provide accurate, comprehensive liquidity data. Transparency in reporting is vital since regulators require timely information to make informed decisions. Automated reporting processes streamline data collection, reduce errors, and enhance accuracy. Integrating robust reporting frameworks often involves a multi-faceted approach, combining qualitative and quantitative data assessment. Additionally, a clear understanding of regulatory requirements will shape the reporting strategy effectively. Institutions should familiarize themselves with local and international regulatory expectations to align reports accordingly. Adequate systems must exist for capturing, storing, and analyzing these data efficiently. Regular audits of reporting processes help to ensure ongoing compliance and adaptability to new regulatory changes. The importance of a flexible reporting structure cannot be overstated. Changes in business operations or external market factors demand reporting adaptability. Cross-functional teams can support this need, providing varied perspectives that enhance the comprehensiveness of reports. Organizations should prioritize continuous training sessions that ensure staff members remain current with all regulations, which in turn strengthens reporting capabilities.

Setting liquidity targets is another critical strategy for compliance with liquidity regulations. Organizations should define specific, measurable targets for liquidity ratios, ensuring they meet or exceed regulatory requirements. Defining these targets often involves rigorous statistical analysis and forecasting based on historical performance data. Utilizing scenario analysis will help identify how different business cycles affect liquidity. Exploring and establishing liquidity thresholds considering both regulatory requirements and organizational risk appetite is crucial. Furthermore, organizations should adopt a multi-currency liquidity framework that acknowledges global operations and their impacts on liquidity management. This is particularly important for organizations operating in international markets. Ensuring adequate liquidity across multiple currencies can mitigate currency risk. Collaborating with external advisors can also provide valuable insights for setting realistic and achievable liquidity objectives. Establishing contingency funding plans can enhance overall liquidity risk management practices. These plans deal with potential liquidity shortfalls and outline the steps the organization will take to access additional funds when needed. By planning for contingencies, organizations can maintain stability during unpredictable times. Implementing a comprehensive strategy ensures a more resilient liquidity posture that complies with regulatory requirements.

The Role of Governance in Compliance

The governance structure of liquidity management is paramount to achieving compliance with regulatory requirements. Strong policies and procedures lay the foundation for effective liquidity management practices. Organizations should establish clear roles and responsibilities within the governance structure. This creates accountability and ensures adherence to established guidelines and best practices. Furthermore, engagement from the top management is critical in signaling the importance of liquidity management across the organization. Leadership should actively promote a culture of accountability and transparency. Regular meetings, briefings, and workshops can foster open discussions on liquidity issues and strategies. Additionally, boards of directors must assure regular assessments of the organization’s liquidity position and risk exposure. This involvement reinforces the message that liquidity management is a priority. It is also essential to incorporate comprehensive reporting mechanisms into governance. By aligning liquidity management with the overarching strategic goals of the organization, compliance becomes a shared responsibility. Educating board members about liquidity risks and regulations empowers them to make informed decisions. This holistic approach ensures all levels of the organization understand their role in achieving compliance.

Incorporating technology into liquidity management strategies can lead to significant advancements in compliance efforts. Today’s digital landscape offers numerous tools to monitor liquidity positions in real-time. Leveraging data analytics helps organizations predict cash flow patterns and assess liquidity needs more effectively. Machine learning algorithms can also analyze vast data sets to identify trends and alert institutions to possible discrepancies. Implementing these technologies can drive efficiency and contribute to a proactive regulatory approach. Moreover, organizations are encouraged to invest in integrated financial platforms that bridge gaps between different systems. These platforms provide a unified view of the organization’s liquidity status across various departments. In turn, this promotes a collaborative atmosphere where teams work together to enhance compliance standards. Establishing continuous feedback loops within the technology framework will also drive improvements and facilitate timely updates. Ensuring close alignment between IT and finance departments is essential for successful implementation of these technologies. While technology alone cannot guarantee compliance, it forms a vital part of a comprehensive strategy that enables organizations to navigate regulatory complexities effectively.

Concluding Strategies for Compliance

In conclusion, addressing regulatory requirements for liquidity involves multifaceted strategies that demand comprehensive planning. Financial institutions must actively engage with evolving regulations and prioritize their liquidity management infrastructure. Establishing a robust governance framework that promotes cross-departmental collaboration will enhance compliance. This includes accessible reporting mechanisms, well-defined liquidity targets, and technology implementation. Moreover, continuous education and training for staff members cultivate a culture of awareness around liquidity management. Keeping abreast of regulatory changes and understanding their implications will position organizations effectively in the marketplace. Engaging in regular scenario analysis further equips institutions to anticipate challenges before they arise. A strong focus on compliance not only helps in mitigating risks but also reinforces stakeholder confidence. Organizations that excel in liquidity management can better navigate uncertainties and strengthen their market positions. By prioritizing compliance, they create resilient systems capable of withstanding economic fluctuations. As the regulatory landscape continues to evolve, remaining adaptable is crucial. Effective liquidity management will always be key for fostering long-term growth and stability. Through strategic efforts, organizations can align their liquidity practices with both current and forthcoming regulations.

As liquidity management regulations evolve, organizations must continually reassess their strategic initiatives. Adapting to new compliance requirements effectively requires a proactive mindset, backed by robust processes and technologies. These adjustments enhance operational excellence while ensuring adherence to regulations. Research indicates that organizations prioritizing compliance achieve greater long-term viability and market competitiveness. For financial institutions, staying ahead of regulatory mandates is not just a challenge but an opportunity to innovate. By fostering a culture of compliance, organizations can identify and harness new strengths within their operations. This creates a formidable foundation for ongoing success while effectively managing liquidity risks. Ultimately, a commitment to compliance reflects an organization’s dedication to both shareholders and clients. In the ever-changing landscape of finance, those who prioritize regulatory adherence will often enjoy a competitive edge. Together, strategic planning, technological applications, and agile governance foster a resilient business model capable of navigating any liquidity challenge. The road ahead may be complex, but organizations willing to invest in their liquidity frameworks will likely emerge as leaders in their respective markets.