How Financial Statements Reflect Business Risks and Opportunities

Financial statements serve as essential tools for evaluating a company’s economic health. These documents, which include balance sheets, income statements, and cash flow statements, provide critical insights. Investors and stakeholders analyze these financial indicators to gauge potential risks and opportunities. Understanding the figures meticulously outlined in these statements is crucial. They not only showcase profitability but also offer a glimpse into operational efficiency and cash management practices. For businesses, these reports highlight areas needing improvement and signify opportune moments for investment. While analyzing financial statements, it is important to note trends, ratios, and red flags indicating potential troubles. A changing pattern in debt ratios or declining revenues may signal financial instability. Conversely, improving profitability ratios may suggest effective management strategies and potential for growth. Besides, situational context adds vital nuance. For instance, external economic factors and competitive positioning come into play, influencing interpretations of data. Therefore, accurate assessments emerge from a holistic approach. Investors must consider both quantitative data and qualitative factors to form a comprehensive viewpoint on financial performance.

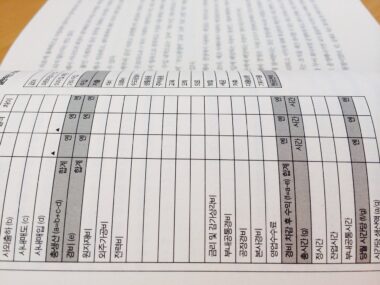

The balance sheet remains pivotal in understanding a company’s financial position at a specific time. It details assets, liabilities, and shareholders’ equity. This fundamental structure reflects how resources are allocated and financed through debts or equity. Notably, the balance sheet acts as a snapshot, presenting vital information necessary for evaluating business risks. For instance, a high debt-to-equity ratio might indicate financial over-leverage, implying higher risks should market conditions shift unfavorably. Moreover, analyzing asset composition offers insights into operational efficiency. Companies holding more liquid assets can effectively manage day-to-day operations and unexpected expenses. Evaluating long-term assets appears equally vital; these indicate future economic benefits. When scrutinizing intangible assets, such as goodwill or patents, understanding their value versus book value can signal overvaluation or underutilization. A disparity here may present opportunities or risks related to future revenues. Stakeholders must comprehend that decisions based solely on the balance sheet data may overlook dynamic market aspects. Thus, integrating balance sheet analysis with broader economic understands fosters informed strategic decisions, balancing opportunities for growth against identifiable business risks.

Income Statements: The Profitability Indicator

The income statement serves as a cornerstone of financial analysis, revealing profitability over time. By documenting revenues and expenses, this statement portrays operating performance and the company’s ability to generate profit. Investors closely examine this report to identify trends in net income. Fluctuations may signify shifting market conditions or operational inefficiencies. While revenues show overall sales growth, elevated expenses could diminish profitability. For instance, a consistently increasing cost of goods sold may hint at pricing pressures or escalating raw material costs. Additionally, analyzing gross profit margin helps assess operational efficiency; a decline may indicate unfavorable sales conditions or increased competition. Variations in non-operating income also require scrutiny, as they affect net income relative to core business shifts. Furthermore, periodic review against industry benchmarks and historical performance contextualizes results. Such comparisons yield insights revealing competitive positioning or market opportunities. A company with increasing profitability relative to peers may signify efficient management and strategic advantages, enticing investors. Thus, the income statement not only highlights risks associated with declining profitability but also underscores potential growth avenues through consistent financial monitoring and strategic adaptations.

Cash flow statements provide invaluable insights into a company’s liquidity and cash management practices. This report categorizes cash sources and uses, facilitating analysis of operational, investment, and financing activities. Understanding cash flow dynamics allows stakeholders to discern the sustainability of operations amidst external challenges. Positive cash flow indicates that a company can meet its obligations and invest in growth opportunities. An investor observing recurrent negative cash flow, however, should consider potential risks associated with liquidity constraints. Analyzing operational cash flow ratios provides clarity on cash generated from core activities. Moreover, sustained negative cash flows could signify underlying operational inefficiencies or reduced market demand. Additionally, considerably high levels of capital expenditures could indicate a focus on growth, but also warn about potential strains on liquidity. The cyclical nature of many industries can impact cash flow as well. Hence, deepening the analysis towards seasonal cash variations explicates further risks or opportunities arising from operational cash performance. In summary, the cash flow statement reflects not just a reality check on solvency but a way to identify strategic investment possibilities that leverage cash efficiently, thereby fostering future growth.

The Role of Financial Ratios in Risk Assessment

Financial ratios emerge as critical analytical tools in evaluating business performance and risks. Ratios derived from financial statements, including profitability, liquidity, and solvency ratios, enhance understanding of a company’s health. Investors employ these ratios for comparative analysis, continuously gauging performance against industry benchmarks. For instance, the current ratio indicates a company’s ability to meet short-term obligations, while a high quick ratio underscores effective cash management. Conversely, a low current ratio could indicate potential cash flow issues affecting operational stability. Profitability ratios, such as return on equity, reveal how effectively a company utilizes equity to generate profits. Examining trends in ratios over time significantly informs risk management, signifying areas needing improvement. Moreover, debt ratios expose leverage levels, allowing investors to ascertain the financial risk tied to capital structure. High leverage ratios can raise red flags about solvency risks, especially during periods of economic downturns. Therefore, when assessing financial ratios, context matters. A comprehensive analysis of these ratios assists in discerning operational efficiencies and financial health, ultimately guiding staking decisions towards identifying promising opportunities and exposures.

Investor sentiment greatly influences the perception of financial statements, especially concerning market risks and opportunities. Behavioral finance illustrates how emotions and biases can impact decisions based on financial reports. Misinterpretation of quarterly earnings or cash flow fluctuations may fuel panic selling or encourage hasty investment decisions. As emotions distort rational evaluations, it is crucial for stakeholders to maintain objectivity when analyzing data. Understanding macroeconomic factors—such as interest rates, inflation, and market conditions—offers important contexts to help interpret financial figures. For example, during recessionary periods, even strong earnings may be viewed skeptically, leading to declining share prices despite solid fundamentals. Investors need a balanced outlook to discern genuine opportunities amid market reactions driven by sentiment. Thus, aligning analysis of financial statements with situational awareness fosters a comprehensive evaluation. By acknowledging the psychological dimensions influencing marketplace behavior, an investor better anticipates reactions and adapts strategies accordingly. Ultimately, pursuing strategic decision-making based on well-rounded assessments of financials and surrounding factors helps organizations navigate both risks and opportunities effectively, promoting resilience in fluctuating economic climates.

Conclusion: Navigating Risks and Opportunities

Understanding how financial statements reflect business risks and opportunities is imperative for effective financial management. Each statement—the balance sheet, income statement, and cash flow statement—offers unique insights into different dimensions of financial health. By scrutinizing these reports extensively, stakeholders can identify trends and issues requiring action. Financial ratios provide quantitative lenses that enhance analysis, offering comparisons across time periods or against industry standards. Furthermore, recognizing emotional and behavioral influences on investment decisions helps mitigate risks stemming from subjective interpretations. The interplay between finance and psychology is vital; stakeholders need a solid foundation based on data tempered with contextual insights. The ability to navigate emerging challenges and seize opportunities hinges on this blend of analytical rigor and strategic foresight. As businesses evolve amid changing economic conditions, knowledge and adaptability become indispensable. Organizations that embrace comprehensive financial analysis can anticipate shifts and make informed decisions to thrive. To sum up, leveraging financial statements effectively equips investors and managers to not only recognize potential risks but also take proactive steps towards capitalizing on opportunities, fostering sustainable growth.

Furthermore, staying updated with changes in accounting standards and regulations is critical. These amendments could alter how business performance is represented in financial statements. Knowledge of such shifts ensures accurate interpretation of financial results. Engaging in continuous education surrounding financial analysis elevates stakeholders’ understanding and evaluation techniques. Networking with finance professionals and attending workshops contribute valuable insights and best practices. Moreover, utilizing advanced financial modeling techniques can enhance forecasting accuracy, enabling organizations to strategize based on anticipated scenarios. Businesses leveraging technology, like financial analytics software, gain real-time access to data, fostering timely decisions. The integration of predictive analytics further amplifies understanding, unveiling trends not immediately visible through traditional analysis. As financial landscapes evolve, adopting a proactive approach to monitoring and understanding the implications of financial statements ensures sustained competitive advantages. Ultimately, these combined strategies contribute to better risk assessment and more informed opportunities. Cultivating an environment conducive to financial literacy enables businesses not only to thrive but indeed flourish in competitive and evolving markets. Through robust financial understanding and strategic insights, organizations mitigate risks while actively pursuing growth and innovation opportunities.