The Role of Base and Quote Currency Explained

Understanding currency pairs is crucial for successful forex trading. In forex, every transaction involves exchanging one currency for another. Currencies are traded in pairs, making the concept of base and quote currencies essential. The base currency is the first currency in a pair, representing how much of it is needed to purchase the second currency, known as the quote currency. For example, in the pair EUR/USD, the Euro is the base currency, while the US Dollar is the quote. If the EUR/USD rate is 1.20, it means one Euro can buy 1.20 US Dollars. Traders must analyze the economic indicators of both currencies in a pair to forecast price movements accurately. Factors such as interest rates, inflation, and political stability significantly influence currency values. By understanding these dynamics, traders can make better decisions. Moreover, the interplay between base and quote currencies helps in developing trading strategies. It’s not just about knowing what each currency represents; it’s also about mastering their relationships in the volatile forex market. This knowledge lays the foundation for strategic trading and risk management.

In forex trading, the impact of base and quote currencies on market dynamics cannot be overstated. A trader buys a currency based on observations regarding its relative strength compared to another currency. When choosing a currency pair, it is essential to evaluate both currencies’ performance against a wider economic background. For instance, a trader who believes that the Euro will strengthen relative to the US Dollar will consider buying the EUR/USD pair. The strength of a currency is not static; it fluctuates continuously due to numerous variables. These can include geopolitical events, economic reports, and market sentiment. As traders navigate the market, they must remain abreast of global news to anticipate changes in currency strength. Additionally, the choice of base and quote currency can influence a trader’s profitability and risk exposure. Leveraging knowledge of these relationships can lead to more informed trading decisions. Understanding pips— the smallest price change measures— is also crucial in forex trading. Traders often employ technical analysis in conjunction with these currency principles to identify trends and entry points.

The Significance of Exchange Rates

Exchange rates are key to understanding the profitability of currency pairs. These rates determine how much one currency is worth relative to another and can fluctuate based on various factors related to both economies involved. Changes in exchange rates can greatly impact international trade and investments. For example, if the USD strengthens against the JPY, American goods become more expensive for Japanese consumers, potentially reducing demand. Conversely, a weaker USD could result in increased exports, strengthening the US economy. Traders must examine these exchange rates closely, as they influence transaction costs and potential profit margins. Additionally, both central bank policies and interest rate differentials affect exchange rates. High-interest rates often attract foreign capital, which can increase demand for a currency, leading to appreciation. Traders who understand these concepts are better positioned to capitalize on market fluctuations. Being aware of central banks’ decisions can offer insights into future currency movements and trends. Implementing such strategies informed by fundamental and technical analysis will equip traders to navigate the intricacies of the forex market successfully.

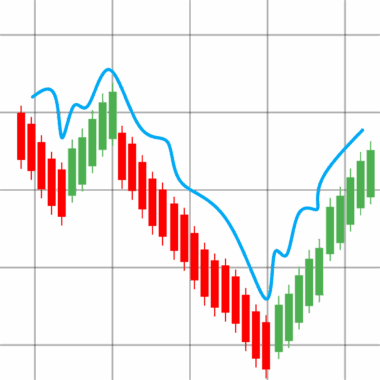

Technical analysis is a vital tool for successful trading, particularly when analyzing base and quote currencies. Traders utilize charting tools to identify historic price patterns and trends. These patterns often repeat, allowing traders to predict future price movements based on past behavior. Indicators such as moving averages, RSI, and MACD serve to provide clarity and help traders make informed decisions. In conjunction with understanding fundamental economic factors, this dual approach allows traders to refine their strategies. Establishing a coherent trading plan that incorporates both analysis techniques can drastically improve a trader’s edge in the market. Additionally, leveraging key supports and resistances assists traders in determining potential entry and exit points. This method emphasizes the importance of risk management and disciplined execution. Successful traders do not rely solely on intuition or sentiment; rather, they develop robust frameworks that account for both fundamental and technical indicators. Moreover, backtesting strategies ensures their effectiveness before employing them with real capital. By blending these analytical methods, traders can achieve a comprehensive insight into the currency markets, enhancing overall trading effectiveness.

Understanding Market Sentiment

Market sentiment plays a significant role in forex trading, particularly concerning base and quote currencies. Sentiment refers to the overall attitude of traders toward a specific currency or economic condition. Traders often rely on sentiment analysis to gauge potential price movements. Positive sentiment can lead to increased confidence in a currency, resulting in higher prices. Conversely, negative sentiment can lead to a decline in value as traders sell off their holdings. News releases, economic indicators, and geopolitical events heavily influence market sentiment. For example, positive employment reports in the United States may boost confidence in the US Dollar, strengthening its position against other currencies. Sentiment indicators such as the Commitment of Traders (COT) report can provide insights into consolidations or shifts on the horizon. Furthermore, social media has increasingly become a platform for traders to express opinions, which can also influence sentiment. Trading strategies that factor in sentiment can be especially powerful, often leading to opportunities that traditional indicators may overlook. By honing in on market sentiment, traders stand to gain a more nuanced understanding of currency strengths and potential price movements.

Traders must not overlook the importance of liquidity in the forex market when examining currency pairs. Liquidity refers to the ease of buying and selling a currency without causing a significant price change. High liquidity often leads to tighter spreads, enhancing trading opportunities. Conversely, low liquidity can result in wider spreads and increased costs for traders. Major currency pairs such as EUR/USD and USD/JPY are highly liquid due to extensive trading volumes. On the other hand, exotic currency pairs may lack the same level of liquidity, introducing additional risks for traders. Understanding liquidity is essential for executing trades effectively, as it directly impacts order execution. Illiquid markets may leave traders unable to exit positions when desired, leading to potential losses. It is crucial for traders to monitor the liquidity conditions when selecting currency pairs for trading. Additionally, utilizing stop-loss orders can help safeguard against unfavorable price movements in illiquid markets. Recognizing the significance of liquidity, traders can optimize their execution strategies and minimize risks. This knowledge ensures informed trading decisions tailored to market conditions.

Concluding Thoughts on Currency Pairs

In summary, grasping the concept of base and quote currencies is fundamental in forex trading. The interplay between these currencies, alongside understanding their relationships with macroeconomic factors, equips traders with the knowledge needed for strategic investing. Thoroughly analyzing currency pairs can generate insights on price movements, allowing traders to identify opportunities within the market. It’s paramount for traders to incorporate both fundamental and technical analysis into their strategy, considering market sentiment and liquidity conditions. By honing these skills, traders position themselves advantageously in an ever-evolving trading landscape. Moreover, staying informed about global economic developments and trends will provide traders with a competitive edge. Emphasizing continuous learning and adaptive strategies is vital for long-term success in forex trading. Building a robust understanding of these concepts fosters confidence when making trading decisions. Ultimately, consistent practice and adherence to a well-structured trading plan contribute to a sustainable trading career. As the forex market continues to grow, traders who master these principles will stand out amidst the competition.

In conclusion, the relationship between base and quote currencies is the core of forex trading knowledge. The insights gained from understanding currency pairs are invaluable for informed decision-making, risk management, and trading strategy development. Equipped with this knowledge, traders can navigate the complexities of the forex market more effectively. By regularly reviewing market trends and adjusting their strategies based on economic indicators, traders can enhance their chances of success. Ultimately, the forex market’s dynamic nature offers both challenges and opportunities for those willing to invest the time and effort into mastering it. With strong commitment and well-thought-out planning, traders can achieve their financial goals in this exciting arena.