Understanding the Elasticity of Labor Supply to Tax Changes

Fiscal policy plays a crucial role in shaping tax policy and labor market dynamics. One vital concept in this discourse is the elasticity of labor supply concerning tax changes. Elasticity refers to how responsive the quantity of labor supplied is to changes in tax rates. When tax rates increase, some employees may reduce their work hours or even exit the workforce. This reaction leads to a change in the total tax revenue generated by the government, making it essential to comprehend how labor supply reacts to various tax policies. Higher taxes can diminish the incentive to work, especially for lower-income earners. Understanding this relationship helps policymakers forecast revenue implications and economic behavior better. It also provides insight to businesses about potential labor costs. Research indicates that labor supply elasticity can vary significantly based on factors like age, gender, education, and industry. Hence, diverse populations may respond differently to tax changes, highlighting the importance of tailored tax strategies. Ultimately, understanding elasticity is paramount for formulating effective tax policies that do not discourage labor participation or economic growth, which benefits the economy.

Theoretical Foundations of Labor Supply Elasticity

The theoretical foundation of labor supply elasticity draws significantly from neoclassical economics. According to traditional models, individuals make labor supply decisions based on the trade-off between leisure and income potential. When taxes rise, the effective wage rate decreases, leading individuals to potentially supply less labor. The income and substitution effects illustrate this behavior. The substitution effect suggests that as the after-tax wages decline, the opportunity cost of leisure diminishes, making individuals less likely to work more hours. Conversely, the income effect posits that higher taxes reduce disposable income, prompting individuals to work more to maintain their lifestyle. Disentangling these effects can be challenging since they operate simultaneously. Moreover, different demographics react differently to these changes; for example, single parents may have a different elasticity than dual-income households. Data on labor market participation often reflects these nuances, showing that some groups adapt more readily to tax changes. Understanding these theoretical layers is essential for policymakers. If policymakers can accurately gauge labor supply elasticity through these fundamental principles, they can predict more effectively how tax changes will impact overall employment and economic activity.

One significant empirical method to measure labor supply elasticity is by examining historical data. This data provides crucial insights into how labor participation rates have reacted to past tax changes. Economists often analyze labor supply responses to shifts in taxation across different states and countries. By implementing models that account for various variables, researchers can isolate the effects of tax changes on labor supply. Recent studies have employed quasi-experimental designs to assess elasticity, focusing on natural experiments where tax policies varied significantly. Findings have shown wide-ranging elasticities, with some populations displaying highly elastic responses while others are relatively inelastic. For instance, studies indicate that younger workers may exhibit higher elasticity compared to older workers who may have fixed commitments. Moreover, this data allows for adjustments in tax policy that align better with labor market realities. Policymakers can use this information to enhance social welfare programs designed to buffer the impacts of tax changes. Adopting a data-driven approach to understanding labor supply enhances the potential for crafting effective low-impact tax strategies that consider real-world employment behaviors and trends.

Factors Influencing Labor Supply Elasticity

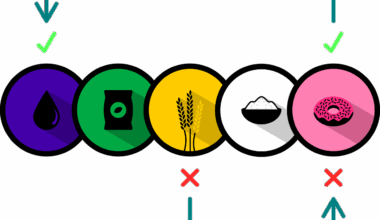

Various factors influence the elasticity of labor supply, such as age, education level, and economic conditions. Age plays a significant role, as younger workers are often more adaptable to changing job markets and may shift their work patterns in response to tax incentives. For instance, older workers approaching retirement may be less responsive to tax changes, as they focus on maintaining their existing benefits and may prioritize leisure over labor. Moreover, education level significantly affects labor supply elasticity; higher education often results in greater skill levels and the ability to navigate job markets effectively, leading to varied labor responses. Additionally, economic conditions such as unemployment rates influence how workers perceive labor markets and tax structures. During economic downturns, individuals may become more elastic as the need for income outweighs the preferences for leisure. Conversely, in booming economies, individuals might resist altering their work habits, indicating inelasticity. Recognizing these influential factors is vital for creating responsive tax policies that address the needs of diverse labor market participants and cater to economic cycles, ensuring labor market efficiency.

Another dimension to consider in labor supply elasticity is the impact of social benefits and welfare programs. The existing relationship between taxation and social welfare can influence labor decisions significantly. For instance, higher taxes might deter work effort, but if they simultaneously fund valuable social programs, the effects may be offset. These benefits can create a safety net, encouraging individuals to pursue jobs, knowing they have financial support during adverse conditions. Welfare programs often interact with labor supply by modifying individual perceptions of working versus receiving benefits. If benefits are substantial, they could provide disincentives to work altogether, particularly in low-income households. This dynamic highlights a complex interplay where enhancing welfare can lead to lower labor supply elasticity. On the other hand, appropriately structured benefits can incentivize work by boosting disposable income. Comprehensive tax and welfare reform would emphasize this balance. It becomes crucial to explore this interaction when establishing policies since misalignment may lead to reduced workforce participation rates. It’s essential for lawmakers to navigate these complex interactions carefully, aiming for frameworks that can stimulate labor supply rather than dissuade it.

Policy Implications of Labor Supply Elasticity

Understanding labor supply elasticity becomes critical for effective fiscal policy implementation. Policymakers need to recognize how labor supply responses influence broad economic outcomes. For instance, if labor supply is elastic, tax increases could lead to significant reductions in overall tax revenue, as workers may reduce hours or withdraw from the labor market. Conversely, if elasticity is low, tax increases might have minimal consequences on overall labor participation, thereby sustaining revenue flows. Policymakers can leverage this understanding to shape tax strategies that minimize adverse labor market impacts. Additionally, taxes must be balanced with incentives, ensuring fairness and encouraging participation. If taxes on higher income brackets are perceived as punitive, skilled labor may opt to relocate to regions with friendlier tax environments, leading to a talent drain. Conversely, reasonable taxation levels can foster an atmosphere conducive to business growth and labor expansion. Thus, creating an attractive economic ecosystem relies on understanding these dynamics. Introducing progressive tax systems that align with labor supply characteristics and crafting tax credits targeting essential demographics ensures economic vitality while promoting an inclusive labor market with high-wage opportunities.

The accumulated understanding of labor supply elasticity also leads to evaluations of long-term economic health. Policymakers must focus on the strategic importance of fostering a responsive labor market in the face of continual tax law revisions. A labor market characterized by fluidity adapts better during economic shocks and shifts, creating resilience against recessions. Therefore, tax policies should seek to harmonize economic stability and labor supply responsiveness. Additionally, ensuring that tax structures remain equitable is vital in preserving social harmony. Studies have shown that equitable tax systems can enhance trust in government and ensure public buy-in for economic initiatives. Conversely, perceived unfair burdens can lead to discontent and increased tax evasion. Thus, a careful balancing act between revenue generation and maintaining incentivized labor supply is necessary. It becomes pertinent to continually assess how labor dynamics respond to fiscal decisions and utilize such insights to inform ongoing reforms. The goal is to create a sustainable economic framework that supports high-quality labor participation, an essential factor for long-term prosperity, ultimately benefitting society overall.

The final consideration in grasping labor supply elasticity’s implications revolves around the importance of continuous research and monitoring. Economic environments evolve, influenced by global events, technological advances, and societal changes. Ongoing research efforts must adapt to these shifts, ensuring that tax policies remain aligned with contemporary labor market behaviors. Utilizing econometric models, researchers and policymakers can simulate various scenarios, emphasizing how labor supply might respond under different tax regimes. This adaptability not only enhances policy relevance but also fortifies the economic landscape against changing tides. Moreover, public sentiments regarding taxation can fluctuate, dictating labor participation trends. Engaging in regular public consultations provides insight to policymakers, ensuring their actions resonate with constituents. Consequently, a robust feedback loop between labor market outcomes and fiscal policy unduly becomes essential. In conclusion, understanding labor supply elasticity regarding tax changes offers invaluable insights into shaping a responsive fiscal framework. This understanding influences labor participation rates, revenue generation, and economic stability, guiding policymakers in executing strategies that consider diverse labor market interests, leading ultimately to a healthier and more resilient economy.