Tax Implications of Hybrid Mutual Funds

Hybrid mutual funds are investment vehicles that combine the characteristics of both equity and debt funds, offering investors a diversified portfolio. One of the essential aspects to consider when investing in hybrid mutual funds is the tax implications. Understanding how gains are taxed can significantly impact your overall returns. Hybrid funds generally invest in various assets, allowing for potential growth and risk management. Investors must know the holding period for these funds, as it determines whether long-term or short-term capital gains tax will apply. Short-term capital gains are levied at the investor’s tax slab rate, while long-term gains over the specified limit of one lakh are taxed at 10%. The blending of these two components makes hybrid funds an attractive option for many investors seeking a balanced approach to returns. Knowing the differences in taxation based on holding periods is vital for maximizing tax efficiency while investing in these financial instruments. Notably, the taxation policies can alter, making it essential to stay updated on current regulations and their impacts on hybrid mutual funds.

Investors in hybrid mutual funds should understand the two key components of taxation: capital gains tax and dividend distribution tax (DDT). Capital gains arise when you sell your investment for a profit, while DDT is applicable to the dividends received from these funds. Depending on your investment horizon, tax implications can vary dramatically, particularly concerning short vs. long-term capital gains. If you hold your hybrid mutual fund investment for one year or longer, it qualifies for long-term capital gains tax. The tax rate is significantly lower, sitting at 10%, provided the gains exceed INR 1 lakh in a financial year. Alternatively, selling before one year triggers short-term capital gains tax, incurring charges at the investor’s personal income tax slab rate. On the other hand, dividends are subject to a DDT, which is deducted at a rate of 10% before distribution. Understanding both of these taxes is critical for any hybrid mutual fund investor, as it influences not just net returns but also the strategy around when to sell or hold these assets.

Impact of Hybrid Fund Type on Taxation

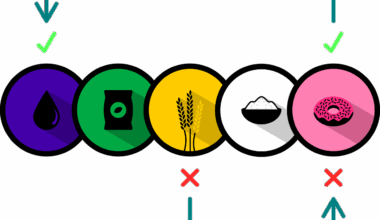

Various types of hybrid funds exist, including aggressive, balanced, and conservative hybrids. Each type can carry different implications for tax that investors must consider before diving in. For aggressive hybrid funds primarily investing in equities, higher volatility is expected, leading to potentially greater returns. However, the tax implications in the event of profit realization will reflect that volatility. For balanced hybrids, which have equal investments in equity and debt, the taxation on gains and dividends may balance out. Conservative hybrid funds lower risk by allocating most of their investments into debt instruments causing lower returns but predictable taxation implications. As different fund types possess unique risk-return profiles, the impact on taxes can affect your overall annual investment strategy and net returns. Therefore, knowing how each type operates is vital for informed decision-making regarding investment and tax planning. Researching fund performance, historical returns, and tax efficiency might guide investors in selecting a hybrid fund that aligns with their financial goals, risk appetite, and tax considerations.

Another significant consideration involves the tax implications tied to systematic investment plans (SIPs) in hybrid mutual funds. SIPs allow investors to contribute a fixed sum periodically, rather than a lump sum upfront, making it easier to navigate market fluctuations. While SIPs may provide disciplined investing, they also create multiple purchase dates in a single investment. Consequently, this affects the calculation of capital gains. For each SIP installment, the holding period is calculated separately. This means that if you redeem your investment, the different parts of your investment could be subject to varying capital gain tax rates. For example, if some installments have been held short-term and others long-term, the taxation applied would differ significantly. Therefore, it becomes vital for investors to maintain accurate records of their SIP transactions. Additionally, investors should stay informed about law changes affecting SIPs in hybrid funds. Proactive record-keeping and a solid understanding of taxation can maximize the benefits of SIPs while minimizing tax liabilities and reinforcing investment strategies.

Fee Structure and Associated Tax Benefits

The fee structure associated with hybrid mutual funds can also influence net returns and the overall tax burden. Different mutual funds charge varying fees, including expense ratios, which represent the annual costs of managing the fund. While these fees do not directly affect tax liability, they can lower net gains, thus indirectly impacting the amount of tax owed when the fund is sold. Moreover, some funds may offer tax benefits under sections of the Income Tax Act in certain regions. Investors might find that specific types of hybrid funds qualify for tax deductions if the investment stays within the prescribed limits and qualifies under the relevant sections. Thoroughly researching a hybrid fund’s fee structure and potential tax benefits can help investors make more informed decisions, ultimately affecting their financial outcomes. The long-term nature of mutual funds means every detail from fees to tax benefits accumulates over time, warranting attention during initial fund selection and subsequent investments.

Tax-loss harvesting is another strategy hybrid mutual fund investors can use to optimize tax efficiency. In a year where investments incur losses, such losses can be used to offset taxable gains realized from other investments. This strategy enables investors to reduce their total tax liability significantly. However, utilizing such a strategy requires a comprehensive understanding of your investment performance across all assets, including hybrid funds. Investors must identify which of their investments might produce losses and strategically sell them to offset gains realized earlier in the year. Furthermore, recognizing specific tax laws affecting hybrid mutual funds and their nuances is crucial in navigating these waters successfully. This proactive approach can create a comprehensive tax strategy that enhances the overall investment outcome while managing risks. Therefore, tax-loss harvesting has become an invaluable tool for savvy investors aiming to minimize taxes and maximize their retained earnings through careful planning and analysis concerning their hybrid mutual funds.

Conclusion: Strategic Impact of Taxes on Investments

Ultimately, understanding the tax implications of hybrid mutual funds is vital for optimizing investment strategies. As these vehicles blend equity and debt investments, they present unique challenges and opportunities in the tax landscape. Investors must navigate varying capital gains taxes, dividend distribution taxes, and the impact of their investment type on overall tax liabilities. Additionally, considering factors like SIPs and fee structures is crucial, as they can affect net returns and tax outcomes. Proactively using strategies like tax-loss harvesting can further enhance tax efficiency. As investment strategies evolve and tax regulations change, staying informed becomes paramount in making educated choices. Moreover, the interlinked nature of investment decisions makes it essential to view these taxes through the lens of one’s overall financial goals. Every detail counts, from the types of funds chosen to the timings of transactions. Therefore, seeking professional tax advice, when appropriate, can facilitate better planning and decision-making across hybrid mutual funds, ultimately driving success and growth for investors over time.

Investing in hybrid mutual funds provides an excellent opportunity for individuals seeking a balanced risk-reward ratio. As the economic landscape evolves, the tax implications associated with such investments will remain central to strategic financial planning. Emphasizing awareness of taxation and strategic approaches can lead to more favorable outcomes and enhanced financial security. Careful assessments and adaptations to tax changes are necessary for every investor eager to maximize their returns while managing tax liabilities effectively.