Understanding the Moral Risks of Complex Financial Products

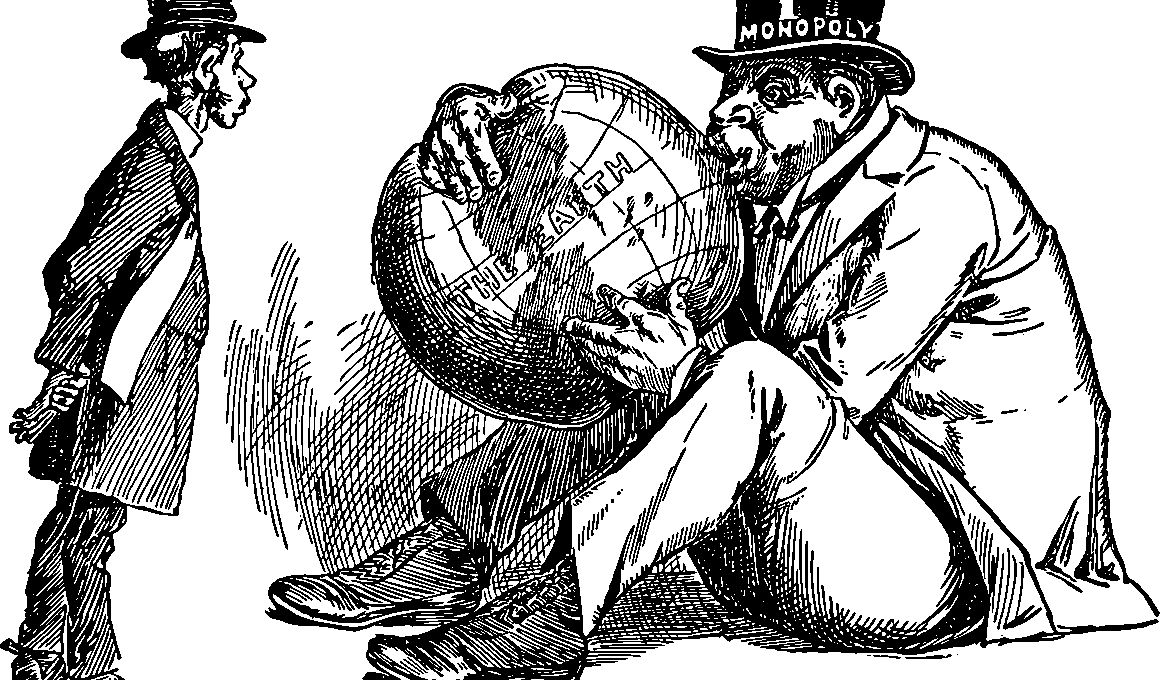

Complex financial products such as derivatives pose significant moral risks that can complicate ethical decision-making. These products, which include options and futures, are designed to help institutions manage risk but can lead to unforeseen consequences. Financial professionals often grapple with moral dilemmas when wielding these powerful tools. A trader might prioritize profit over ethical considerations, potentially leading to exploitation. Furthermore, the opacity of these products can result in a lack of understanding among stakeholders, including consumers. This ignorance invites manipulation and unethical practices, resulting in financial crises that impact society. Regulation often lags behind innovation in this area, allowing dubious practices to flourish unchecked. Ethical education and culture within financial institutions can mitigate these risks by promoting transparency and accountability among practitioners. Additionally, stakeholders must remain vigilant about the implications of using such products. Investors need to demand clarity, while professionals should advocate for responsible practices. Implementing robust ethical standards can safeguard against the darker aspects of financial innovation, ensuring that risk management does not come at the expense of moral integrity or societal well-being. Only through growing awareness can we navigate the complexities involved responsibly.

The ethical implications of derivatives extend beyond individual institutions to the broader financial ecosystem. Investors, regulators, and consumers all play key roles in shaping the moral landscape of these complex products. This interdependence creates a web of responsibilities that can complicate ethical practices further. When ethics are overlooked for short-term gains, consequences can reverberate throughout the markets. For instance, the 2008 financial crisis serves as a stark reminder of how derivatives can wreak havoc when mismanaged. Entities that used these products irresponsibly severely impacted their own organizations and caused cascading failures affecting millions of individuals worldwide. This scenario highlights the imperative for comprehensive ethical guidelines and robust regulatory frameworks to prevent a repeat of such tragedies. Market participants must understand their ethical obligations when engaging with derivatives. Consequently, developing a strong ethical foundation requires educational reforms in finance curriculums and ongoing training in corporate environments. Discussions around risk management and ethical practices must be integral to financial analysis and strategy formulation. Institutions should actively promote ethical behavior among employees, ensuring that all stakeholders prioritize ethical considerations when engaging with derivatives to foster a more stable and trustworthy financial landscape.

Case Studies of Ethical Failures

Examining real-world examples of ethical failures in the realm of derivatives provides insights into the moral risks involved. The collapse of Lehman Brothers in 2008 exemplifies how complex financial products can lead to catastrophic outcomes. Lehman leveraged excessive amounts of derivatives, exacerbating its risk profile significantly. When the housing bubble burst, the firm could not sustain its obligations, resulting in massive financial losses. Beyond the immediate financial ramifications, the fallout led to widespread job losses and economic instability. Another illustrative case is that of the London Whale incident, where a trader’s reckless behavior, involving complex derivatives trading, resulted in substantial losses for JPMorgan Chase. This incident raised questions about internal controls, company culture, and accountability in financial institutions, highlighting the importance of ethical oversight. These cases underline that robust risk management must incorporate ethical considerations to protect not just organizations but the entire financial ecosystem. As such, a serious commitment to regulating practices surrounding complex financial products is vital to safeguarding stakeholders and promoting long-term stability in the financial system. Ultimately, developing sound ethical guidelines can help mitigate moral hazards in financial services.

A critical aspect of managing the ethics of derivatives involves understanding the influence of financial incentives on behavior. In many cases, employee compensation structures favor short-term results or profits, which can lead to unethical practices. When traders are rewarded primarily for performance, the temptation to cut corners or engage in risky behavior increases. This environment fosters a culture where profits overshadow ethical considerations. To combat this, organizations must reevaluate compensation models, integrating long-term performance indicators that account for ethical behavior and risk management. Incentivizing ethical decision-making can shift the focus from immediate gains to sustainable practices, promoting accountability and integrity. Furthermore, fostering an organizational culture that emphasizes ethical values can empower employees to voice concerns and prioritize ethical practices over mere financial performance. Creating a whistleblower policy can also help in reporting unethical conduct without fear of repercussions. Such measures can enhance moral accountability within financial institutions, ensuring that ethical standards guide decision-making processes. By aligning financial incentives with ethical behavior, organizations can contribute to a healthier financial landscape that values responsibility alongside profitability, ensuring that all stakeholders benefit equitably in the long run.

The Role of Regulation

Regulatory measures play an essential role in safeguarding against the moral perils associated with complex financial products. Governments and regulatory bodies have the responsibility to create frameworks that ensure transparency and ethical practices in the derivatives market. Effective regulation can help mitigate abuse and promote accountability among market participants. The Dodd-Frank Act, implemented in response to the financial crisis, aimed to regulate derivative trading and prevent risky behaviors. While progress has been made, the ever-evolving nature of financial products poses continual challenges for regulators. As innovations emerge, regulators must remain proactive in updating rules and frameworks to ensure ethical practices are maintained. However, enforcing regulations is only part of the solution; it is essential for financial professionals to adhere to these guidelines and to recognize their moral obligations. Collaboration between regulators and industry participants can foster a culture of ethics and responsibility. Additionally, ongoing dialogue within the financial community can help address emerging ethical challenges associated with complex financial products. Ultimately, a regulatory environment that prioritizes ethical behavior can help create a more stable and trustworthy financial market for all stakeholders involved.

Furthermore, financial education plays a pivotal role in addressing the ethical dilemmas posed by derivatives. Educating market participants about the implications and potential risks of complex financial products is essential for responsible decision-making. Academic institutions, industry organizations, and regulatory bodies must collaborate to enhance financial literacy, ensuring that individuals comprehend the moral dimensions of their choices. This education should extend beyond theoretical learning to include practical insights into ethical dilemmas, case studies, and real-life scenarios involving complex financial products. By equipping future finance professionals with the tools to evaluate their ethical responsibilities, the industry can cultivate a generation of practitioners who prioritize moral considerations in their work. Additionally, continued professional development for existing employees can help reinforce ethical principles in practice. Workshops, seminars, and discussions about ethical behavior in finance should be regularly included in training programs. Ultimately, a commitment to ongoing education about the ethical aspects of derivatives will promote a culture of integrity and accountability. As participants become more informed, ethical practices will naturally emerge, leading to a more responsible financial landscape, where derivatives are utilized thoughtfully and judiciously.

Conclusion: Path Forward

In conclusion, navigating the moral risks of complex financial products requires a multifaceted approach involving both ethical practices and effective regulation. Stakeholders must recognize their responsibilities and embrace transparency and accountability when dealing with derivatives. Financial institutions and professionals should prioritize ethical standards, ensuring that risk management does not erode their moral obligations. Education is also crucial, as financial literacy can empower individuals to make informed decisions about their engagements with such products. By fostering a culture that emphasizes ethical learning and practices, the financial sector can move towards a healthier and more trustworthy system. Regulatory measures must evolve alongside the products themselves, ensuring that potential abuses are checked and prevented. Ultimately, a collective commitment to ethical conduct, continuous education, and robust regulation will pave the way for a financial ecosystem that not only thrives economically but also upholds the values of integrity and responsibility across its spectrum. In doing so, the industry can restore public trust and support sustainable financial progression that benefits all engaged parties, ensuring that ethical principles are at the forefront of complex financial product usage.

By understanding the moral risks associated with derivatives and implementing comprehensive strategies to mitigate these risks, the financial industry can pick forward toward a brighter future. This effort begins with acknowledging the intricate interplay between ethics and finance, especially as global markets become increasingly interconnected. Stakeholders must remain vigilant, proactive, and engaged in their pursuit of ethical financial practices. Moreover, drawing insights from past mistakes can provide valuable lessons in developing better safeguards to prevent similar occurrences. The lessons learned from previous financial crises highlight the need for deeper ethical considerations in decision-making processes. As complex financial products continue to evolve, so too must our understanding of their ethical implications. The future of ethical finance relies on the collective responsibility individuals take today to reform their approach to risk, responsibility, and accountability. Only through dedicated efforts can we ensure that the financial space does not repeat the mistakes of the past. Together, regulators, professionals, and investors can cultivate a financial environment where ethics thrive alongside innovation, creating a sustainable ecosystem that respects both profitability and moral integrity.