The History and Evolution of Currency Pair Trading

The practice of currency pair trading originates from the ancient trade routes, where commercial transactions necessitated the exchange of different local currencies. As global trade expanded, it became evident that a structured system for currency exchange was needed. In the early days, exchange rates were arbitrary and typically set by individual merchants, leading to inconsistency and confusion. With the advent of currency trading, a more standardized approach was developed. This laid the foundation for modern forex trading, where traders began to understand the significance of currency pairs. By the 1970s, the floating exchange rate system was introduced, further facilitating currency conversion based on market demand. This innovation allowed traders to speculate on price movements, capitalizing on fluctuations in currencies like the USD, EUR, and JPY. As technology progressed, electronic trading emerged, empowering retail traders to participate in the currency market. Today, there are hundreds of currency pairs available for trading, catering to the needs of various traders and investors worldwide. Understanding the historical context of currency pair trading helps traders make informed decisions in the ever-evolving forex market.

Currency pairs serve as the backbone of the forex market, firmly establishing the relationship between two different currencies. Each pair consists of a base currency and a quote currency, with the value of the base currency represented in terms of the quote currency. This dynamic allows traders to engage in speculative activities, betting on whether one currency will strengthen or weaken against another. Forex trading takes place in numerous pairs, which can be categorized into major, minor, and exotic pairs. Major pairs include the most commonly traded currencies, such as the Euro and the US Dollar. Minor pairs consist of currencies that are less frequently traded but still hold significant liquidity. Exotic pairs typically involve one major currency and a currency from a developing economy. The classification of currency pairs plays a crucial role in determining trading strategies and risk management techniques. Traders often rely on technical and fundamental analysis to formulate their strategies based on market trends. Additionally, currency pairs can be affected by geopolitical events, economic data releases, and central bank policies, making it essential for traders to stay informed and proactive in their approach.

The Growth of Forex Trading

The globalization of financial markets has led to the exponential growth of forex trading over recent decades. This transformation can be largely attributed to the increasing need for businesses to conduct international transactions. As the world became more interconnected, and with advancements in technology, forex trading evolved from specialized institutions to a more accessible platform for retail traders. The introduction of online trading platforms revolutionized how currency trading was conducted, allowing individuals to trade from anywhere at any time. Moreover, the rise of mobile trading applications has enabled on-the-go trading, contributing to the industry’s growth. Forex trading is now accessible to both institutional investors and individual traders, creating a more competitive landscape. The combined effects of deregulation and the emergence of electronic trading platforms have lowered entry barriers for new traders. As a result, the forex market has become the largest and most liquid market in the world, generating trillions of dollars in daily trading volume. It is vital for new traders to familiarize themselves with the evolving nature of forex trading to identify lucrative opportunities and navigate potential risks successfully.

The role of technology in currency pair trading cannot be overstated, as it has fundamentally changed how traders interact with the forex market. The introduction of automated trading systems and algorithmic trading has accelerated the speed at which trades are executed. These technologies utilize advanced algorithms to analyze vast amounts of market data, allowing traders to make quicker decisions based on real-time analysis. Additionally, the advent of artificial intelligence has introduced new methodologies in trading strategies, as AI can identify patterns that are often missed by human traders. Ripples from these technological advancements extend to risk management practices, enabling traders to configure their strategies more efficiently. Benefits such as reduced trading costs and improved efficiency have attracted more participants into the forex market. Furthermore, traders now have access to comprehensive market analyses and forecasts due to the availability of financial content online. As technology continues to advance, it will undoubtedly reshape the landscape of currency pair trading, driving innovation and offering traders new tools to enhance their trading experiences in this dynamic market.

Understanding Currency Pair Mechanics

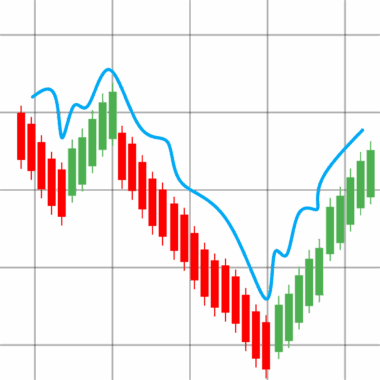

To effectively engage in currency pair trading, it is essential to grasp the mechanics behind how currency pairs function. Each currency pair features a unique exchange rate, reflecting the relative value between the two currencies. A trader buying a currency pair anticipates that the base currency will appreciate relative to the quote currency. Conversely, selling a pair suggests a belief that the base currency will depreciate. The exchange rate movements are influenced by multiple factors, such as economic indicators, political stability, and market sentiment. Traders often utilize tools like charts and indicators to analyze these movements, seeking to identify trends and reversal patterns. An integral part of currency trading is recognizing what affects these movements, including news releases, which can provide insights into possible price shifts. Furthermore, the liquidity and volatility of specific currency pairs can impact trading strategies. Major pairs often exhibit high liquidity, ensuring tighter spreads and reduced transaction costs. Understanding the interplay between liquidity, volatility, and market forces allows traders to develop effective strategies, maximizing their chances of success in the competitive forex market.

Effective risk management is pivotal in currency pair trading, as it helps mitigate potential losses and protect trading capital. Traders should establish a clear risk-reward ratio before entering a trade, defining the potential profit in relation to the acceptable level of risk. It’s common for successful traders to utilize stop-loss orders to limit downside exposure. Additionally, maintaining a diversified portfolio can reduce risks associated with market swings. By trading multiple currency pairs with distinct factors driving price movements, traders can spread their risk more evenly. Developing a sound trading plan that incorporates rules for entering and exiting trades, as well as risk tolerance levels, is essential for long-term success. Moreover, understanding the psychological aspects of trading is crucial, as emotions can lead to irrational decision-making. Many traders adopt strategies to keep their emotions in check, allowing them to adhere to their predefined trading plans. As the forex landscape continues to shift, maintaining a disciplined approach remains vital for navigating the complexities of currency pair trading and achieving consistent results in an ever-evolving market.

The Future of Currency Pair Trading

Looking ahead, currency pair trading is poised for further transformation driven by technology and changing market dynamics. As globalization and digitalization continue unabated, the forex market will likely experience an influx of new participants, from institutional investors to savvy retail traders. Cryptocurrencies have emerged as an influential factor, creating new currency pairs that traders can capitalize on. The ability to trade pairs that include digital currencies is increasingly becoming a prominent feature of forex trading platforms. Furthermore, innovations in blockchain technology promise to revolutionize transaction speed and security within the forex domain. As regulations evolve, the possibilities for more sophisticated trading instruments, including CFDs and options, are also expanding. With artificial intelligence and big data analytics shaping market strategies, traders must adapt and evolve their approaches to stay competitive. The educational resources available today can help both novice and experienced traders understand these changes and seize opportunities as they arise. Navigating the future of currency pair trading will require agility, continuous learning, and the ability to adapt to the ever-changing forex landscape, ensuring sustained growth and profitability in a global market.

In conclusion, currency pair trading has a rich history and a bright future, fueled by technological innovation and market evolution. For anyone engaged in forex trading, an appreciation of currency pairs and their mechanics is invaluable. Understanding historical trends, the impact of technology, and effective risk management will ultimately empower traders to make informed decisions. As the market continues to evolve, staying informed about upcoming trends will be crucial for maintaining a competitive edge. The growing significance of educational resources further enhances prospects for traders entering this dynamic arena. By embracing new tools and techniques, traders can leverage their knowledge of currency pairs to capitalize on potential opportunities. Continuous analysis and experimentation will be essential for navigating the complexities of currency trading successfully. In this volatile environment, only those who remain agile and informed will thrive. As the forex trading landscape evolves, emerging wallet technologies or trading methodologies can reshape the way traders operate. Being adaptable to these changes fosters resilience in pursuing trading success. Ultimately, the art of currency pair trading encompasses both historical understanding and a proactive approach to ongoing learning and strategy development.