Navigating Charitable Giving Limits and Regulations in Retirement

Charitable giving in retirement is not only a noble endeavor but can also have significant tax implications. Engaging in philanthropy allows retirees to support causes they care about while potentially easing their tax burden. It is essential to understand the various limits and regulations governing charitable contributions to optimize these benefits. Different types of giving, such as cash donations, appreciated assets, and charitable remainder trusts (CRTs), have distinct tax treatment under the Internal Revenue Code. Knowing these differences enables retirees to make informed decisions about their financial strategies. Prioritizing donations to qualifying charities will ensure that the desired tax deductions are realized while providing support to important initiatives. Furthermore, retirees should remain aware of annual contribution limits and the long-term benefits of individual retirement accounts (IRAs) that can facilitate their charitable endeavors. Understanding these mechanisms empowers individuals to plan appropriately, ensuring their philanthropic efforts align with their financial goals. In the following sections, we will explore various options for giving, including how to strategically leverage their retirement accounts and how these donations influence their financial landscape.

Types of Charitable Contributions

There are several types of charitable contributions available to retirees that can impact their tax situations differently. Cash donations are the most straightforward, allowing for immediate tax deductions within prescribed limits. Appreciated assets, such as stocks or mutual funds, donate capital gains tax-free, maximizing the gift’s value to the charity. Donors must ensure that the charity is qualified under IRS regulations to claim these deductions. Additionally, retirees may explore donor-advised funds (DAFs), which offer a way to donate while retaining some control over the distribution of funds. These funds allow individuals to make larger deductions upfront, while the actual donations can be made over time. Charitable remainder trusts (CRTs) provide a unique option where retirees can receive income for a specified period before assets are donated, providing income and tax benefits. When engaging in charitable giving, it’s imperative to maintain accurate records. Documentation will affirm that contributions are indeed tax-deductible and to comply with IRS requirements. Retirees should consult tax advisers to ensure they navigate these options effectively and strategically.

Tax Planning Strategies for Charitable Giving

Effective tax planning is crucial in maximizing the benefits of charitable giving during retirement. Retirees should consider spreading out contributions over multiple years to minimize the tax impact in any single year while still meeting the annual contribution limits. Bunching donations into a specific year allows them to itemize deductions in that year, potentially increasing their tax benefits. Moreover, retirees can also benefit from using their required minimum distributions (RMDs) from IRAs to make direct charitable contributions, known as qualified charitable distributions (QCDs). QCDs allow individuals aged 70½ and older to transfer up to $100,000 directly to a charity without it being counted as taxable income. This strategy also helps satisfy the RMD requirement, providing a double benefit. Furthermore, planning their estate to reflect charitable intentions could enable retirees to leave a legacy while benefiting from potential estate tax deductions. Engaging a financial planner specialized in retirement and charitable planning will help to navigate those strategies effectively, tailoring them to individual circumstances and ensuring compliance with applicable laws.

Understanding Charitable Organization Classification

When engaging in charitable giving, understanding the classification of organizations is essential. Not all charities qualify for tax-deductible donations; thus, retirees must ensure that the organizations they support meet IRS criteria. 501(c)(3) organizations, which include many nonprofit entities, provide eligible donors with tax-deductible contributions. However, other classifications exist with different rules regarding deductibility. For instance, donations made to political organizations or for the purpose of lobbying are generally not eligible for deduction. This nuanced understanding is paramount when retirees plan their charitable contributions. Conducting due diligence, such as verifying an organization’s status through the IRS’s online database, ensures compliance. Awareness of potential changes in laws and regulations affecting charitable giving will also inform retirees’ decisions, as these can impact deductions and overall charitable contribution limits. As philanthropic efforts are closely tied to personal values, ensuring each contribution aligns with both ethical beliefs and legal standards will enhance the impact of charitable giving, providing tangible help to chosen causes while optimizing financial benefits.

Charitable Giving and Estate Planning Synergy

Integrating charitable giving into estate planning can yield substantial benefits for retirees. This approach allows individuals to align their philanthropic goals with their overall financial strategy. Establishing a charitable remainder trust not only facilitates ongoing income during retirement but also saves tax liabilities when the remaining assets are eventually given to designated charities. Moreover, incorporating charitable bequests into wills enables retirees to leave a meaningful legacy while benefiting from potential estate tax deductions. This synergy between charitable giving and estate planning cultivates a comprehensive strategy that maximizes advantages for both heirs and charitable organizations. It’s essential for retirees to regularly review their estate plans in light of charitable intentions and tax law changes. Consulting with estate planning attorneys who are knowledgeable about the intricacies of charitable giving will ensure that individuals create effective strategies tailored to their unique circumstances. By planning ahead, retirees gain peace of mind, knowing their financial contributions will create lasting impacts on community causes and uphold personal values long after they are gone. Understanding this intersection is vital for effective retirement financial planning.

Documenting Charitable Contributions

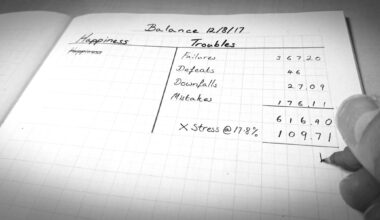

Documentation is the backbone of ensuring compliance and securing tax deductions for charitable contributions in retirement. Retirees must keep meticulous records of all donations, including receipts, bank statements, and written acknowledgments from charities. The IRS requires donors to have substantiation for contributions, especially for amounts exceeding $250. Charitable organizations should provide confirmations detailing the date of the contribution and the value of the gift. Additionally, retirees should note any conditions tied to their donations, such as service requirements or intent for specific project funding. Maintaining organized records will streamline the preparation of tax returns and assist in responding to potential inquiries from tax authorities. Furthermore, retirees should assess their total contributions annually to evaluate if adjustments are needed to optimize deductions effectively. Consulting tax professionals can provide additional insights into proper documentation practices tailored to individual situations. Well-documented charitable contributions not only shine a light on the retiree’s generosity but also serve as essential records, verifying compliance with applicable regulations and ensuring a smooth filing process during tax season.

Conclusion: The Importance of Charitable Giving in Retirement

In conclusion, charitable giving during retirement serves as an effective means of contributing positively while enhancing one’s financial strategy. Engaging in philanthropy can lead to reduced tax liabilities, fostering a stronger financial outlook for the future. As retirees embrace the opportunities available through various charitable contributions, understanding the nuances surrounding limits and regulations becomes crucial. By assessing their personal values alongside their financial planning strategies, individuals can find a harmonious balance that not only benefits chosen causes but also aligns with their long-term goals. Philanthropy enriches lives and communities; thus, retirees should view these contributions as more than mere financial transactions. Investing in causes they care about is a way to leave a lasting impact, ultimately ensuring that their retirement years are not just about accumulation but about meaningful legacy creation as well. Moreover, the journey through retirement can be enhanced with the fulfillment that comes from actively giving back, complementing the overall retirement experience. Seeking advice from financial and tax professionals is recommended to navigate the best path forward.

Navigating Charitable Giving Limits and Regulations in Retirement

Charitable giving in retirement is not only a noble endeavor but can also have significant tax implications. Engaging in philanthropy allows retirees to support causes they care about while potentially easing their tax burden. It is essential to understand the various limits and regulations governing charitable contributions to optimize these benefits. Different types of giving, such as cash donations, appreciated assets, and charitable remainder trusts (CRTs), have distinct tax treatment under the Internal Revenue Code. Knowing these differences enables retirees to make informed decisions about their financial strategies. Prioritizing donations to qualifying charities will ensure that the desired tax deductions are realized while providing support to important initiatives. Furthermore, retirees should remain aware of annual contribution limits and the long-term benefits of individual retirement accounts (IRAs) that can facilitate their charitable endeavors. Understanding these mechanisms empowers individuals to plan appropriately, ensuring their philanthropic efforts align with their financial goals. In the following sections, we will explore various options for giving, including how to strategically leverage their retirement accounts and how these donations influence their financial landscape.