Differences Between Classified and Unclassified Balance Sheets

When it comes to financial reporting, understanding the distinction between classified and unclassified balance sheets is crucial. A classified balance sheet is organized into distinct categories such as current and non-current assets and liabilities. This format provides clarity, making it easier for users to analyze a company’s financial position. The current assets will hold items expected to be converted to cash, while non-current assets include long-term investments and fixed assets. Similarly, liabilities are separated into current and long-term components. Investors and management often prefer classified balance sheets since they facilitate a more straightforward evaluation of liquidity and financial health. Conversely, unclassified balance sheets do not categorize assets and liabilities, listing them in order of liquidity. From a simplicity perspective, it might appear easier. However, this lack of classification could obscure essential details, making it harder for stakeholders to quickly assess key financial metrics. Consequently, while both formats serve the fundamental purpose of balance sheets—to communicate financial standing—they cater to different needs, preferences, and levels of detail sought by analysts, investors, and decision-makers.

Importance of Balance Sheets in Financial Reporting

Balance sheets provide essential insights into a company’s financial stability, but the format chosen affects clarity. In a classified balance sheet, users can readily see how quickly assets can be turned into cash and obligations settled. This format highlights the short-term financial health and aids in assessing risk management. Moreover, having a structured presentation of financial data encourages comprehensive analysis, facilitating better decision-making. It allows stakeholders to locate relevant figures rapidly and perform comparisons with industry standards or competitors. In contrast, the unclassified format might slow down the ability to grasp this important information, requiring users to sift through items that lack categorization. As such, classified balance sheets often find greater favor among creditors and investors looking to assess creditworthiness or liquidity quickly. Furthermore, regulatory bodies also commonly require classified formats in filing and reporting due to their enhanced readability. Therefore, the importance of the balance sheet format extends beyond just preference; it shapes analyses and influences the perceptions of professionals interpreting a company’s financial standing in diverse contexts.

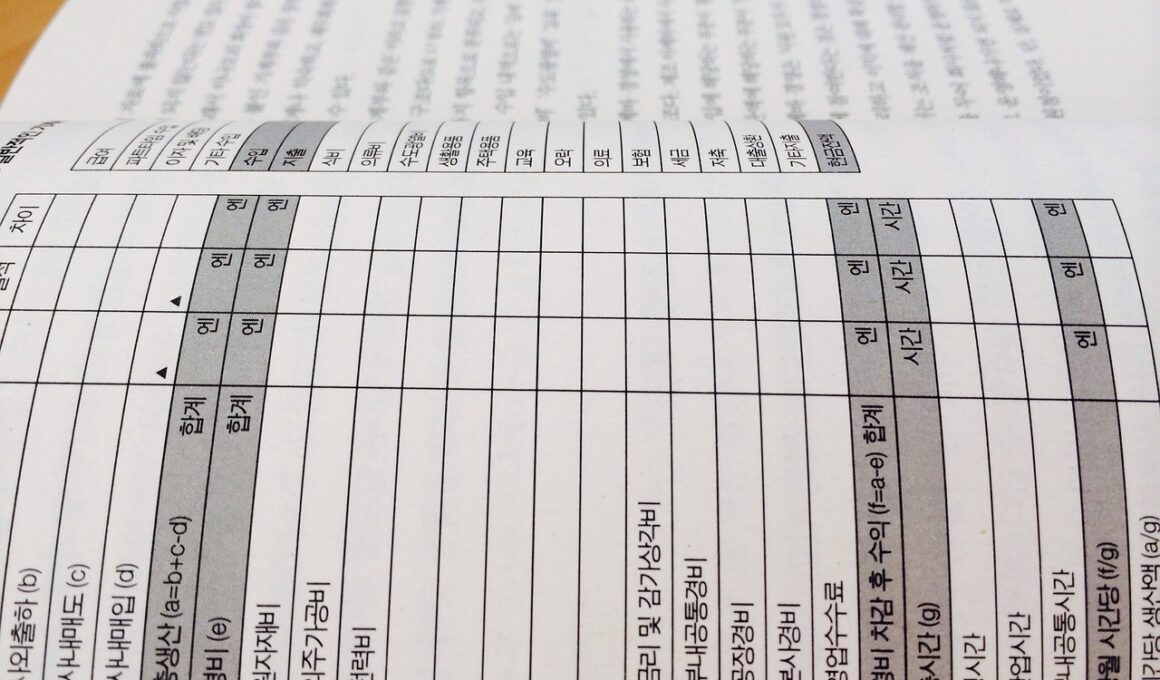

Detailed Components of Classified Balance Sheets

Classified balance sheets have various distinct components that enable enhanced insight. Key elements include current assets like cash, accounts receivable, inventory, and pre-paid expenses designed for conversion within one year. These assets are crucial for day-to-day operations, giving investors a clear view of immediate liquidity requirements. Following that, long-term assets, including land, buildings, equipment, and intangible assets, showcase the company’s capacity for generating income over extended periods. On the liabilities side, current liabilities such as accounts payable, accrued expenses, and short-term loans indicate debts due within one year. Long-term liabilities, including bonds payable and long-term loans, signify the overall long-term financial responsibilities of the enterprise. The structure culminates in shareholders’ equity, detailing investment and retained earnings. This arrangement allows stakeholders to evaluate how assets are financed, be it through debt or equity. Through this layered construction, classified balance sheets furnish a comprehensive overview of the organization’s financial activities in a manner that is easily understandable and comparable across different reporting periods.

In contrast, unclassified balance sheets lack these categories and often simply list assets and liabilities in order of liquidity. For instance, starting with cash, followed by liquid assets, and then fixed assets is common in unclassified versions. This straight listing may appear straightforward but sacrifices the benefits of classification. Investors may need to invest extra time to analyze financial data because of the absence of organization. Furthermore, the lack of categorization can hinder comprehensive discussions about financing strategies and resource allocation. Analysts prefer structured data since it leads to better interpretations; hence, unclassified balance sheets might deter quick understanding and informative analysis. While some small-scale businesses use simpler layouts, larger firms often seek more detailed reports that underscore financial nuances and operating efficiency. Unclassified formats are sometimes only suitable for internal purposes but less favorable for external financial reporting. Ultimately, the choice between classified and unclassified formats affects how businesses communicate their finances, potentially impacting investor decisions, lending, or partnerships.

Comparison of User Preferences

Considering user perspectives reveals nuanced preferences between classified and unclassified balance sheets. Financial analysts typically gravitate toward classified balance sheets for their structured approach. The clear separation of current and non-current assets helps analysts assess liquidity and operational efficiency. In high-stakes environments, where timing and understanding matter, clarity is paramount. Investors also benefit from the summarized live data that classified formats provide, creating informed decision-making opportunities. Additionally, creditors favor classified balance sheets when evaluating creditworthiness since they offer a quick breakdown of obligations and potential cash flows. On the other hand, some internal managers might appreciate unclassified versions for their flexibility and simplicity. Smaller firms or those with less complex operations opt for unclassified balance sheets, finding them more manageable. However, even among these users, there’s an increasing recognition of the value of classified structures. Therefore, while preferences vary, the inclination toward structured balance sheets continues to grow as businesses evolve in their financial reporting demands, reflecting broader trends toward transparency and detailed analysis.

Regulatory Factors Influencing Format Choice

In today’s corporate landscape, regulatory factors dictate the necessity of detailed financial reporting, influencing the choice between classified and unclassified balance sheets. Regulatory bodies often require a segmented approach to balance sheets that enhances transparency and provides valuable insights into an organization’s financial health. For instance, the Generally Accepted Accounting Principles (GAAP) mandates many companies to present classified balance sheets in their financial filings. Such regulations ensure that stakeholders, including investors and government authorities, receive vital information up front. Selected accounting standards help in ensuring consistency, comparability, and reliability of financial reports across organizations and industries. Furthermore, when preparing financial statements, compliance with the International Financial Reporting Standards (IFRS) emphasizes the need for coherent structuring of assets and liabilities. Noncompliance could lead to penalties, audit issues, or credibility losses. Thus, an understanding of these regulations leads management to prefer classified formats. Ultimately, regulatory requirements reinforce the use of classified balance sheets as the industry standard, shaping the submission of accurate and reliable financial information that stakeholders need to make sound decisions.

In light of these regulatory influences, the impact on standardization is significant. Organizations adhering to these prescribed formats often find advantages in investor relations and reporting practices. Furthermore, having a reliable distinction of financial elements simplifies dialogue between internal team members and external parties. By leveraging a classified format, businesses foster a culture of transparency that attracts investment and builds credibility. This structured approach encourages improved financial management and accountability. Companies often realize that accurately organized financial data can lead to quick insights when assessing performance metrics or fiscal health, leading to data-driven decision-making and problem-solving. Furthermore, operating within a framework of regulatory compliance emphasizes the importance of consistency, resulting in a coherent narrative for earnings reports and financial disclosures. In conclusion, while both balance sheet formats have their respective place in finance, the continuing preference for classified balance sheets reflects a broader commitment to transparency, compliance, and effective communication in financial reporting.

Conclusion

In summary, classified and unclassified balance sheets play vital roles in financial reporting. The choice of which format to use can significantly influence the understanding of a company’s financial standing. Classified balance sheets excel in providing structured and accessible data, facilitating analysis and quick insights for stakeholders. They better cater to the needs of investors, creditors, and regulatory bodies. Conversely, unclassified balance sheets may fulfill specific needs for simpler or smaller operations but risk lost clarity and insights. As businesses grow and their complexity increases, the trend toward adopting classified balance sheets will likely continue. Through enhanced segmentation and clarity, classified balance sheets enable accurate representation and informed analyses of overall financial health, supporting effective management and strategic decision-making. Ultimately, the preference for detailed classified formats indicates a commitment to transparency in financial reporting, improving trust among stakeholders. Organizations should carefully consider their audience and regulatory requirements when deciding on their balance sheet format. By doing so, they can best illustrate their financial position and facilitate informed engagements with those interested in their financial wellbeing.