How to Prepare Financial Statements under IFRS Standards

Preparing financial statements under IFRS standards involves several critical stages and requirements. It’s vital to ensure compliance with the International Financial Reporting Standards as they provide a globally recognized framework. The first step involves identifying the applicable standards relevant to the organization’s operations. These standards will serve as guidelines throughout the financial statement preparation process. In addition, it is essential to gather all necessary financial data and documentation, which includes records of assets, liabilities, revenues, and expenses. This data will be the foundation upon which financial statements are constructed. Financial statements primarily include the statement of financial position, statement of comprehensive income, and statement of cash flows. Each of these components holds specific information on the financial health of a business and must comply with the disclosure requirements highlighted in the standards. Moreover, it’s important to maintain transparency and accuracy throughout the process to uphold the credibility of the statements. A review of prior accounting policies may also be necessary to ensure conformity with the IFRS approach and practices. Finally, consultation with financial professionals is recommended to navigate complexities effectively.

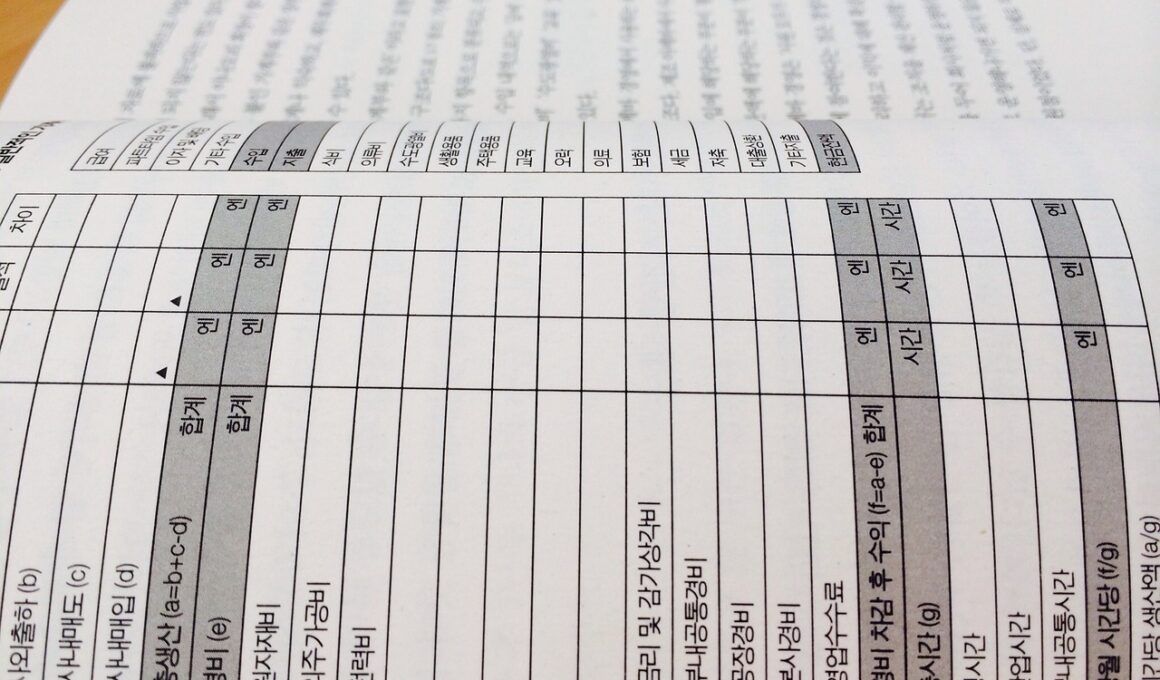

Once the relevant data is gathered and organized, the process of drafting the financial statements can begin. Each statement must reflect the true and fair view of the financial situation of the company. One of the critical aspects of constructing the statement of financial position is determining asset categories. IFRS classifications divide assets into current and non-current categories, which offer insights into liquidity and operational efficiency. Current assets typically include cash, inventories, and receivables, while non-current assets encompass property, plant, and equipment. For liabilities, current liabilities must be distinguished from long-term liabilities, which is essential for understanding the financial obligations of the business. After drafting these statements, the statement of comprehensive income needs attention where income, expenses, and profits must be accurately calculated and represented. Emphasis should be placed on whether the statements highlight gross profit and operating profit to ensure stakeholders are aware of profitability trends. This attention to detail enables stakeholders and management alike to make informed decisions based on transparent financial data.

Disclosures and Notes

Another important aspect of IFRS compliance is the accompanying disclosures and notes that provide additional context to the financial statements. These notes play a crucial role as they offer valuable insights into accounting policies, significant judgments, and estimates made by management during the preparation of the financial statements. Further detailing can include explanations of financial instruments, accounting for taxes, and commitments or contingencies faced by the company. Properly preparing these notes ensures a full understanding of the financial statements and adheres to IFRS requirement for completeness. The notes must be relevant, clear, and concise to avoid any confusion. Therefore, companies should invest adequate time in reviewing these disclosures for accuracy and compliance. Additionally, organizations must be transparent about their financial dealings to foster trust among investors and regulators. It is also wise to perform a thorough check across all documents to ensure consistency and clarity in disclosures. Organizations may consider employing specialists or auditors to aid in preparing these notes to achieve IFRS compliance efficiently while maintaining high standards of excellence.

Once the financial statements and accompanying disclosures have been finalized, the next step is the approval process. It is a best practice to have the statements reviewed by the management team and an audit committee, if one exists. This oversight is essential to ensure all statements are accurate, compliant, and free from material misstatements. After internal review, seeking external auditing services can provide an additional layer of credibility. Auditors will evaluate the financial statements against IFRS standards, verifying the figures and compliance with required practices. Post-audit findings may lead to further revisions, hence fostering accuracy and trust within the documentation. Upon receiving the auditor’s approval, companies must file and publish their financial statements as mandated. Furthermore, certain industries may have specific filing deadlines, thus requiring timely submissions to avoid penalties. Publicly traded companies, particularly, must adhere strictly to regulatory requirements regarding the release of their financial statements. Finally, ensuring robust internal controls is essential to support ongoing compliance throughout the financial year and mitigate any potential future discrepancies.

Emphasis on Continuous Compliance

Continuing compliance with IFRS standards should not be a one-off task, but rather an ongoing practice throughout the financial year. Companies must stay updated with any modifications to the IFRS framework as these can affect reporting requirements and financial statement presentation. Engaging in continuous professional development through workshops or training for accounting staff can significantly help in adapting to such changes over time. Additionally, periodic reviews of internal processes and accounting policies can help ensure they remain aligned with IFRS updates, ultimately fostering a culture of compliance within the organization. Regular consultations with financial advisors can provide organizations with insights into best practices and emerging trends within the financial reporting landscape. They may also assist organizations in navigating complex scenarios or unique transactions that necessitate tailored accounting treatments under IFRS. Moreover, industries that are significantly impacted by international trade should also anticipate additional complexities and prepare accordingly. Overall, committing to a culture of compliance is not only beneficial for meeting IFRS requirements but also for improving overall financial health and performance.

Effective communication around financial reporting is essential, especially in multinational corporations that operate under different regulatory environments. Communication facilitates transparent discussions about the financial health and performance of the organization among various stakeholders including investors, regulatory bodies, and employees. For companies engaging in international business, consistency in financial reporting across jurisdictions is crucial. It assures stakeholders that the organization adheres to uniform codes and standards, thus fostering trust and support. Furthermore, having a clear financial reporting strategy that focuses on making complex financial data accessible will enhance stakeholder engagement. Utilizing technology and data management solutions can also aid in improving the presentation and clarity of financial data. For instance, integrated software solutions can streamline the financial reporting process, generate automated disclosures, and enhance data accuracy. Utilizing visual aids, such as graphs and charts, can also make complex information easily digestible. By leveraging available technology, organizations can ensure they meet both communication and compliance expectations under IFRS regulations. Ultimately, embracing a proactive approach to financial reporting can lead to improved stakeholder trust while promoting organizational success.

Conclusion and Future Considerations

In conclusion, preparing financial statements under IFRS standards involves a meticulous approach, with an emphasis on adherence to guidelines and accuracy. Organizations are encouraged to engage in continuous education and professional development to keep abreast of changes in IFRS. Companies must also implement robust internal controls to foster a culture of transparency and reliability in financial reporting. These measures will ultimately contribute to the company’s success and credibility in the marketplace. Additionally, as financial landscapes evolve, organizations should remain adaptive and flexible to new requirements or guidelines that could arise from global financial trends. Leveraging technology to enhance the financial reporting process can also prove beneficial, offering efficiencies and improved reporting accuracy. Lastly, building and maintaining strong communication channels with stakeholders will ensure that all parties remain informed and engaged. Organizations that prioritize these considerations will be better positioned to navigate the complexities of IFRS compliance. By rigorously adhering to these principles, businesses not only meet compliance standards but build a foundation for sustainable financial health and stakeholder confidence over time.