Common Mistakes to Avoid When Trading Currency Pairs

Forex trading can be a lucrative business, but many traders make mistakes that hinder their success. One common mistake is not having a well-defined trading plan. A solid trading plan outlines your strategy, goals, and risk management parameters. It helps to avoid impulsive decisions based on emotion. Another frequent error is overleveraging, which means using borrowed funds extensively. High leverage can result in significant losses in volatile markets. Additionally, many traders neglect the importance of fundamental and technical analysis. Ignoring market news and data can lead to uninformed trading decisions, jeopardizing profits. Furthermore, inadequate risk management strategies are prevalent. Not using stop-loss orders can result in substantial losses. Other mistakes include trading without a clear strategy, underestimating transaction costs, and failing to keep emotional responses in check. Successful Forex traders consistently learn from their mistakes and adapt their strategies accordingly. By avoiding these pitfalls, you position yourself better for success. Education and continuous improvement are vital for long-term profitability in Forex trading. Consider leveraging reputable online resources and trading communities for gaining insights and tips from experienced Forex traders.

Understanding Currency Pairs

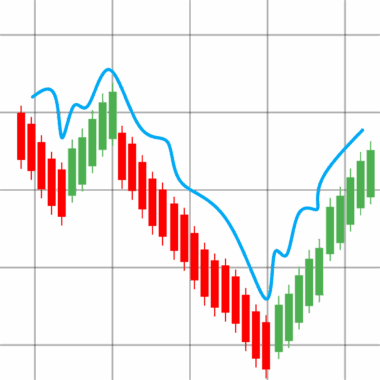

Currency pairs are essential ingredients in Forex trading. Understanding how they work is crucial to trading successfully. Currency pairs consist of two currencies: a base currency and a quote currency. The base currency is the first one listed, and the quote currency indicates how much of it is needed to buy one unit of the base currency. Mistakes often arise from misunderstanding how these pairs function. Some traders think that currency pairs move independently, but they are often influenced by various global factors, including economic indicators, interest rates, and geopolitical events. Therefore, awareness of global economic conditions becomes vital in making educated trades. Additionally, new traders might overlook important pair correlations, which can provide valuable trading opportunities. It’s essential to recognize that some pairs are more volatile than others. A common error is overtrading a single currency pair, which can lead to missed opportunities in others. Traders should diversify their investments across multiple pairs to reduce risk. Identifying the right pairs to focus on requires a combination of research, practice, and a keen understanding of market dynamics, ensuring a more balanced approach.

Another prevalent mistake involves not keeping up with economic news. The Forex market is highly sensitive to global events, and failing to monitor major economic releases—such as employment rates or GDP data—can be detrimental. For instance, unexpected news can cause sudden spikes or drops in currency values, resulting in substantial losses for unprepared traders. Moreover, emotional trading can cloud judgement. Many traders react to short-term fluctuations, leading to impulsive decisions that contradict their strategy. Emotional responses can lead to revenge trading, where losses prompt attempts to quickly recover them through risky trades. It’s essential to remain disciplined and stick to your trading plan. Additionally, neglecting ongoing education and market analysis can put traders at a disadvantage. The Forex market is continually evolving, and strategies that worked previously may not yield the same results today. Joining forums, attending webinars, and reading books on trading can improve skills. Trading psychology also plays an important role. Understanding the psychological aspects of trading—such as fear and greed—can help navigate the emotional rollercoaster of day-to-day trading realities effectively.

Risk Management Techniques

Effective risk management is critical in Forex trading. Many traders fall into the trap of focusing solely on potential gains while ignoring potential losses. A comprehensive risk management strategy protects your capital by ensuring that losses do not exceed a predetermined limit. One common mistake is risking too much on a single trade. As a rule of thumb, avoid risking more than one or two percent of your trading capital on any single position. This technique minimizes the possibility of significant losses while allowing for long-term trading success. Traders should also utilize stop-loss orders to mitigate risks inherent in currency trading. A stop-loss order allows you to set a specific price that triggers a sale when reached. This practice provides a safety net during volatile market conditions. Additionally, diversifying investments across various currency pairs helps spread risk. Relying on a single pair increases exposure to adverse moves. Finally, continuously reevaluating risk management policies is crucial. Conditions fluctuate, requiring adjustments to protect your account from unforeseen market shifts. Taking risks wisely and practicing sound risk management is essential for sustainability in this fast-paced environment.

Another mistake often overlooked involves unrealistic expectations about profits. Forex trading is often perceived as a way to quickly amass wealth. This mindset can lead traders to make rash decisions, chasing unattainable profits. In reality, currency trading requires discipline, patience, and a realistic understanding of market dynamics. Establishing attainable goals keeps your trading focused and prevents frustration. Moreover, some traders neglect the importance of journal keeping. Documenting trades provides insights into what strategies are working and which need adjustments. Analyzing past performance allows for improved decision-making in future trades. Additionally, not learning from other traders’ experiences can be detrimental. Engaging with trading communities or following expert traders’ social media can provide valuable insights. Beware of over-reliance on others, though; develop your style based on collective knowledge rather than following blindly. Furthermore, some traders forget to review their trading outcomes regularly. Reviewing gains and losses provides clarity on what worked and what didn’t. This reflection is vital for correcting course and learning from mistakes. Ultimately, trading should be approached with a balance between ambition and realistic planning to foster ongoing success.

Psychology in Forex Trading

The psychological aspect of Forex trading cannot be overstated. Many traders encounter emotional challenges that massively impact their decisions. Fear and greed are two primal emotions that frequently cause traders to make poor choices. An inexperienced trader might panic during market volatility, leading to premature sell-offs. Conversely, the desire for profit can instigate overconfidence, prompting risky trades. Developing strong psychological resilience is essential for fostering a successful trading mindset. Strategies such as mindfulness and self-reflection can aid in managing emotional reactions. Staying level-headed during market fluctuations can help with clarity when making decisions. Consistency is crucial; traders should stick to their plans. Additionally, overlooking the impact of peer pressure is another common pitfall. Traders often share and compare results with fellow traders, leading to misplaced confidence or insecurity. It’s vital to maintain focus on personal goals rather than getting swayed by comparisons with others. Finally, understanding the implications of this psychology can dramatically enhance trading. By fostering awareness of how emotions affect trading decisions, you’re better equipped to manage outcomes. Balance between emotional intelligence and trading strategy leads to better overall performance in the dynamic world of Forex.

In conclusion, avoiding common Forex trading mistakes is vital for success. By identifying and addressing problems such as insufficient planning, emotional trading, and lack of market knowledge, traders can enhance their strategies significantly. Risk management deserves special emphasis, considering the volatile nature of currency trading. It’s crucial to remember that Forex doesn’t guarantee fast wealth; consistency, education, and discipline hold the keys to long-term sustainability. Moreover, the psychological aspects influencing trading behaviors must be recognized and managed effectively. By developing emotional resilience and maintaining realistic expectations, traders are likely to flourish in a competitive environment. Learning from mistakes and trading experiences ensures continued growth. Joining trading communities also fosters idea exchange and collective learning, ultimately informing better trading decisions. Most importantly, continuous self-improvement showcases a commitment to mastery in Forex trading. Embrace the challenges, stay patient, and strive for knowledge in your trading journey. Implementing these strategies will help in building a robust approach to navigating currency pairs in Forex trading effectively.