Swing Trading Forex with Trendlines and Channels

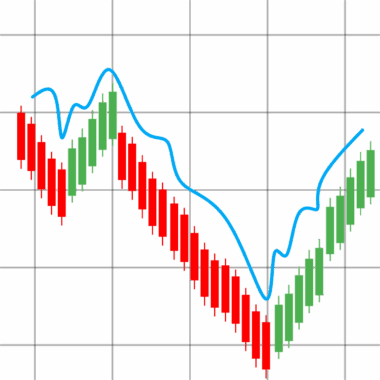

Swing trading in Forex is an approach that allows traders to capture short- to medium-term gains. It relies significantly on analyzing price movements through trendlines and channels. Trendlines provide support or resistance levels, which help traders identify potential areas for entry and exit. When used effectively, these tools enhance decision-making by offering visual cues of market behavior. A trader can draw trendlines by connecting significant highs or lows, establishing a directional bias. Channels, formed by drawing parallel lines above and below trendlines, illustrate price boundaries. These boundaries mark the potential selling and buying opportunities within the established trend. Swing trading thus becomes a strategy that combines analytical skills with an understanding of market momentum. Traders must be patient and disciplined, watching for the right setups before acting. In essence, mastering swing trading involves identifying these patterns, predicting possible market directions, and efficiently managing risks. Ultimately, successful swing trading in Forex can lead to consistent returns over time if executed correctly. Therefore, knowledge and practice are key to developing effective strategies and making informed trading decisions based on market trends.

Developing a strategy for swing trading in Forex involves meticulous planning and analysis. First, traders need to establish a clear understanding of market trends by analyzing historical price action. This helps in determining where price has moved in the past, providing insights into potential future movements. After identifying a trend, traders can then use various indicators like moving averages or RSI alongside trendlines and channels. These indicators assist in confirming entries or exits for trades. Setting proper stop-loss and take-profit levels is crucial to protect investments from significant losses. Additionally, maintaining a trading journal to document trades can provide invaluable insights into what works and what doesn’t. This method fosters continuous improvement and strategy refinement over time. Swing traders must also remain informed about fundamental factors influencing the Forex market, such as economic releases and geopolitical events. Such factors may greatly impact currency movements and should not be overlooked. By combining technical and fundamental analysis, traders gain a comprehensive view of the market, enhancing their trading effectiveness. Thus, a well-rounded approach allows swing traders to better navigate the complexities of the Forex market.

Using Trendlines Effectively

Trendlines are a fundamental tool for swing traders focusing on Forex. They allow traders to visualize the direction of price movements while also pinpointing potential reversal zones. To draw a good trendline, it’s essential first to identify at least two significant points where the price has either peaked or dipped. The more points connected to the drawn trendline, the more reliable it becomes. Traders should consider that trendlines can be dynamic; they may need adjustments as new price data emerges. A break of a trendline can indicate a potential reversal or continuation of the trend, prompting traders to reassess their positions. However, false breakouts can occur and are a common pitfall, emphasizing the importance of additional confirmation through other indicators. Swing traders often look for confluence, where trendlines align with various support and resistance levels to reinforce their trading decisions. Additionally, using trendlines in conjunction with channels can further strengthen a trader’s strategy. The combination of these tools enhances the probability of successful trades while minimizing the risk due to clearer visual guidelines in navigating the Forex market.

Channels add another layer of sophistication to swing trading strategies in Forex. They help traders identify trending markets more effectively by providing key levels to watch for possible reversals or continuations. Channels are created by drawing two parallel lines, one above and one below the trendline. This method effectively captures price ranges within which the asset is expected to move. A price bouncing between the upper and lower channel lines suggests a valid trading range, providing short-term opportunities for swing traders. As with trendlines, the reliability of channel boundaries increases with the number of times price interacts with the channel. Traders should also consider volume as a factor when engaging with channels; significant price moves often occur with increased volume, signaling strong market conviction. Recognizing when price approaches channel boundaries can facilitate thoughtful trading decisions, such as placing buy orders near lower channels or sell orders near upper channels. However, traders must remain vigilant for potential channel breakouts, which may indicate significant trend reversals. Overall, channels when combined with trendlines, present swing traders with a robust framework for analyzing and reacting to market conditions.

Risk Management in Swing Trading

For swing traders, efficient risk management is a crucial component to long-term success. The Forex market can be volatile, thus posing various risks to traders, particularly in the swing trading methodology. Establishing a risk-reward ratio is essential before entering a trade; typically, a 1:2 ratio is advisable. This means for every dollar risked, the potential profit should be at least double. Implementing stop-loss orders is a critical tactic for protecting capital and limiting losses should the market move against a trader’s position. Trailing stops can also be used to lock in profits as the trade moves in a favorable direction while minimizing downside risk. Additionally, diversifying trades across multiple currency pairs can help protect against adverse movements in a single market. This strategy involves not putting all capital into one trade, thereby smoothing out performance over time. As with any trading strategy, continuously reviewing and adjusting risk management approaches is vital. Consequently, by maintaining a disciplined approach towards managing risk, swing traders can enhance their chances of navigating the Forex landscape successfully.

Psychological discipline is another vital aspect of successful swing trading in Forex. Traders must cultivate a mindset that enables them to remain objective and unemotional during trades. This quality helps individuals avoid impulsive decisions driven by fear or greed, which can lead to significant losses. Understanding one’s emotional triggers and biases can greatly improve trading discipline. Creating a predefined trading plan, which includes entry and exit strategies, helps in maintaining focus on broader objectives rather than on immediate market fluctuations. Backtesting trading strategies can also bolster confidence and emotional resilience during live trading. This practice involves reviewing past trades to evaluate the effectiveness of strategies and making any necessary adjustments based on real outcomes. Additionally, setting realistic expectations for trading performance is essential. Recognizing that not every trade will be a winner prevents traders from falling into the trap of revenge trading. Finally, commitment to continuous education about market conditions enhances adaptability and improves overall performance. By cultivating strong psychological discipline, swing traders can better cope with market uncertainties, thus making more informed and rational decisions.

Conclusion

In conclusion, mastering swing trading in Forex requires a blend of technical skills, psychological discipline, and continuous improvement. Utilizing trendlines and channels effectively enables traders to identify potential entry and exit points, optimizing their trading strategies. Risk management emerges as a cornerstone of success, helping traders safeguard investments and minimize losses. Employing a proper risk-reward ratio along with strategic stop-loss placements can significantly enhance trading outcomes. Likewise, recognizing the importance of psychological factors emphasizes the ongoing journey of emotional mastery within trading. Traders who remain disciplined and committed to their strategies are more likely to succeed while navigating the complexities of the Forex market. Continuous education plays a crucial role in adapting to ever-changing market conditions, ensuring a thorough understanding of the forces driving currency movements. Therefore, aspiring traders should invest time and effort into sharpening their skills while maintaining flexibility in their approaches. By embracing both the analytical and psychological facets of trading, swing traders can enjoy improved consistency and profitability over time, fostering a rewarding trading experience in the dynamic world of Forex.