Maximizing Tax Benefits Through Charitable Donations

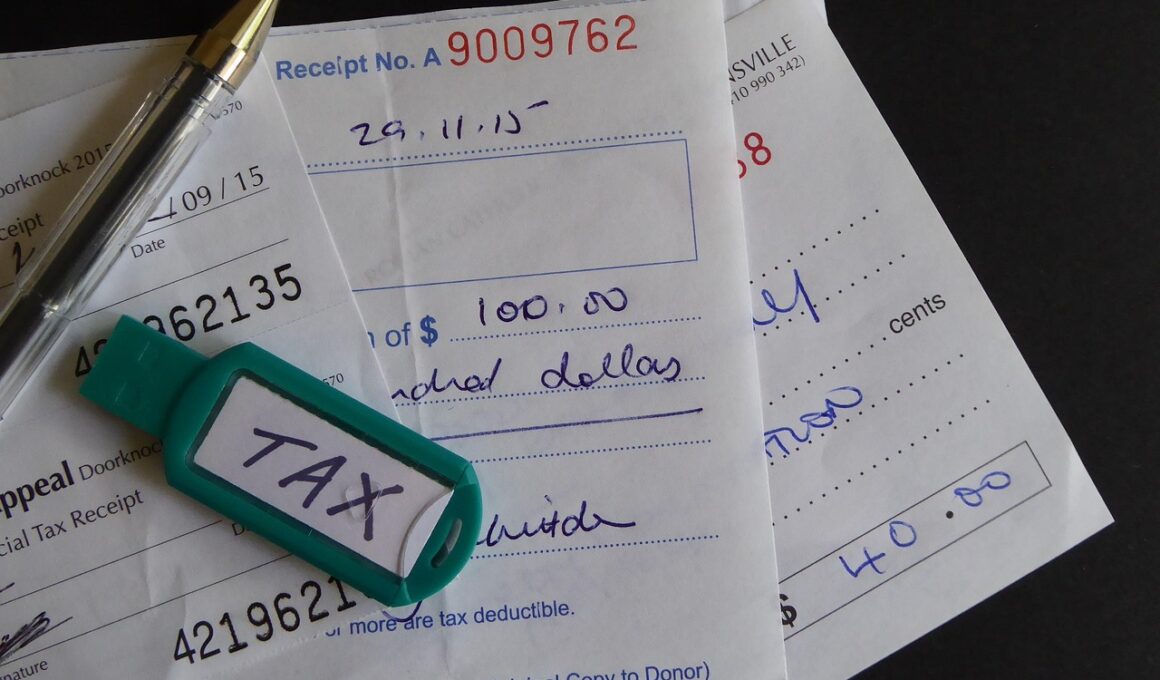

Charitable giving serves as both a generous act of kindness and an effective financial strategy, particularly when considering tax implications. When you donate, you may be eligible for various tax deductions that significantly reduce your taxable income. This can lead to substantial savings at tax time, enabling you to contribute more generously to causes that matter to you. It is essential to understand the rules governing charitable donations to optimize your tax benefits. For instance, donations to recognized charities typically attract qualifying tax deductions, while contributions made to individuals usually do not. Additionally, the IRS has specific guidelines surrounding the limits on charitable deductions, which often depend on your income level and the type of donation you make. You should keep comprehensive records of your charitable contributions, including receipts and acknowledgment letters from the organizations. Overall, understanding the mechanics of charitable giving allows you to maximize your tax benefits effectively while also making a positive impact on your community and causes valued most highly. Knowing these details can enhance your overall financial planning and philanthropic efforts in achieving your personal and financial goals effectively.

One of the best strategies for maximizing the tax benefits of charitable giving is to make donations directly from your retirement accounts, specifically your IRA. The IRS permits individuals aged seventy and a half or older to transfer funds directly to qualified charities without incurring income taxes. This approach can present significant tax advantages and reduce your taxable income. Moreover, the transfer counts toward your annual required minimum distribution (RMD), further enhancing its tax efficiency. Utilizing this strategy allows you to support your favorite charitable organizations while simultaneously managing your tax liabilities. It’s important, however, to note that not all donations are eligible for this treatment, so verifying with your financial advisor is crucial for ensuring compliance with the relevant laws. In many cases, donors find that this method of giving works in harmony with their overall estate planning strategies. By considering direct distributions from your IRA, you maximize both your charitable impact and your financial advantages, elevating the importance of integrating charitable strategies with overall wealth management. This method aligns financial and charitable objectives, leading to a win-win scenario for you and your chosen charities.

Understanding Deductible Donations

Understanding what qualifies as a deductible donation can significantly enhance the tax benefits associated with charitable contributions. Generally, contributions made to IRS-qualified nonprofit organizations are eligible for tax deductions. These typically include various entities such as charities, educational institutions, and religious organizations. However, it’s crucial to be aware that not every donation qualifies. For example, contributions made to individuals or non-qualifying organizations will not provide any tax benefits. Additionally, donations of goods and property have different valuation methods in terms of deduction eligibility. The IRS provides guidelines on valuing these assets correctly, which can sometimes require appraisals. Some types of donations may even offer unique benefits or stipulations, such as the donation of appreciated assets, which could yield additional tax advantages. Always consult with a tax professional to ensure that your charitable giving aligns with IRS rules. By understanding these concepts thoroughly, you can strategically plan your charitable contributions to maximize your deductions while still supporting the causes you care about. This knowledge is imperative not only for tax planning purposes but also for fulfilling your philanthropic goals effectively.

Incorporating charitable giving into your overall financial plan requires effective strategy and foresight. By identifying your philanthropic objectives and aligning them with sound financial practices, you can significantly enhance the overall benefits of your charitable contributions. Many individuals choose to automate their giving to simplify the process and ensure ongoing support for their selected charities. This method not only provides convenience but also allows for better budgeting and financial management. Another effective strategy is to involve your family in your charitable decisions, fostering a sense of shared purpose and community spirit. Involving your children or relatives can help instill values of generosity and social responsibility, creating a lasting impact beyond financial implications. Utilizing donor-advised funds (DAFs) can also be an effective way to manage charitable giving. DAFs allow you to make contributions, receive an immediate tax deduction, and retain the ability to recommend grants over time. Ultimately, an integrated approach that includes regular donations, family involvement, and creative financial strategies will maximize both the tax benefits and community impact of your charitable endeavors.

Creating a Charitable Giving Plan

Creating a well-structured charitable giving plan is paramount for maximizing both philanthropic impact and tax benefits. Start by determining the specific causes and organizations that truly resonate with your values. Next, assess your financial capacity and the frequency of your contributions to ensure sustainability. Setting a budget for charitable giving can help maintain a balanced financial portfolio while still addressing your philanthropic desires. Additionally, consider the timing of your donations as tax regulations can change year to year. Some individuals may opt to make larger donations in higher-income years to maximize deductions at tax time or carry forward excess contributions to future years. The goal is to align your charitable contributions with your tax situation strategically. Engaging with financial advisors can also provide invaluable insights into structuring your donations for optimal tax efficiency and impact. This planning process ensures that your charitable efforts are sustainable over time while also securing potential tax advantages. Ultimately, a thoughtful giving plan is beneficial for both your community contributions and overall financial management, making it an essential component of effective wealth management.

Moreover, the establishment of a family foundation can be an incredible way to enhance your charitable strategy while allowing for greater control over asset management and disbursements. By creating a foundation, families can pool resources to fund charitable initiatives and engage in philanthropy collectively. This empowers families to address multiple causes while leaving a lasting legacy that can benefit future generations. Tax advantages associated with foundations can be significant, with donors often receiving deductions that are higher than traditional giving methods. Furthermore, funds allocated to charitable foundations typically grow tax-free, providing a means to increase charitable giving potential over time. Of course, this approach comes with its complexities, including compliance with IRS regulations and the management of assets within the foundation. Seeking legal and financial advice for establishment and ongoing management is advisable. Overall, establishing a family foundation provides unique opportunities to maximize philanthropic efforts while ensuring compliance with tax regulations and maintaining control over charitable endeavors, making it a worthy consideration for those engaged in serious charitable giving.

Review and Adjust Your Giving Strategy

No charitable giving strategy can be static due to ever-evolving regulations, personal circumstances, and financial situations. Reviewing and adjusting your philanthropic efforts periodically is crucial to ensure alignment with your goals. Factors such as financial change, growth in income, or changes in your community can necessitate reevaluating your giving practices to maximize benefits. Additionally, monitoring the performance and impact of the nonprofits you support is vital for ensuring that your contributions yield meaningful results. Many charitable organizations provide annual reports detailing how funds are utilized, allowing you to make informed decisions about future donations. If certain organizations are not meeting your expectations, it may be worthwhile to redirect your resources to more effective charities. Furthermore, staying informed about current tax laws can be incredibly helpful in maximizing the benefits you reap from charitable contributions. Financial planning sessions with a professional can ensure that you remain aware of new opportunities and tax incentives. Continuous review allows for a dynamic and effective charitable giving strategy that adapts to changes while supporting the causes you hold dear in a meaningful way.

Ultimately, charitable giving should not only reflect your values but also align with your financial goals. Making donations can have a profound positive effect on society, but it can also be strategically beneficial for your personal finances. Whether you choose to give directly or through established vehicles like family foundations or DAFs, the essential component is understanding and leveraging the potential benefits. The right strategy ensures you gain tax advantages while supporting vital causes and communities. Creating stability and sustainability in giving can maximize the impact, paving the way for a legacy that transcends your lifetime. With the proper knowledge, planning, and engagement, you can cultivate a charitable giving strategy that is not just beneficial for your taxes but transformative for the communities you support. Remember that philanthropy and financial acumen can coexist beautifully, providing opportunities to create both social impact and personal benefit. Stay proactive in your charitable approach, continually educating yourself on the intricacies of tax incentives associated with charitable donations to ensure that you optimize your giving as both moral and financial endeavors seamlessly.