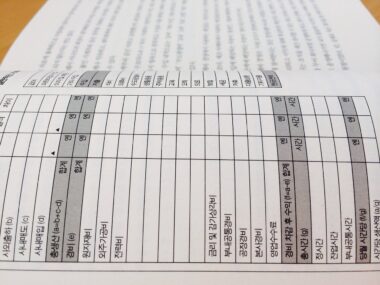

Income Statements: What You Need to Know

Income statements are essential financial documents that summarize a company’s revenues and expenditures over a specified period. This report provides crucial insights into a business’s profitability. Investors and managers can identify the company’s performance trends and understand the expense structure. Every income statement typically features several key components. These components include revenues, cost of goods sold, gross profit, operating expenses, and net income. It’s important to analyze each of these areas to assess overall financial health. When looking at revenues, one must consider how sales are evolving over periods. The cost of goods sold reflects the direct costs attributable to product creation. Understanding gross profit is critical as it indicates how efficiently a company is producing its products. Operating expenses can pinch margins significantly, which is why severe scrutiny of expense categories is necessary. Net income, the bottom line, is what shareholders ultimately want to see increase. Analysts strive to identify trends in these components to gauge future business performance accurately. Proper interpretation aids in making informed investment or management decisions. Furthermore, income statements should be compared against industry benchmarks to contextualize results.

Key Components of Income Statements

Understanding the key components of an income statement is paramount. The first significant area is revenue, which represents the total income generated from sales before any expenses are deducted. Revenue is often referred to as the “top line” for this reason. Following revenue is the cost of goods sold (COGS), which includes the direct costs tied to the production of goods sold. These costs directly impact gross profit, a critical financial metric. Gross profit indicates how much money remains from sales after subtracting the COGS. Next, we have operating expenses, which cover indirect costs like administrative salaries, rent, and marketing. Managing these expenses effectively can significantly boost profitability. After accounting for operating expenses, we arrive at earnings before interest and taxes (EBIT). This figure reveals core operational efficiency without the influence of financing or taxation. Finally, one must analyze net income, representing the total profit after all expenses, interest, and taxes have been deducted. Stakeholders closely monitor this metric to determine overall company profitability. A thorough understanding of each component enables better financial decision-making and strategy formulation.

The income statement, often combined with the balance sheet and cash flow statement, forms the core of the financial statements. Together, they provide a comprehensive overview of a company’s financial condition. Stakeholders utilize these documents to analyze performance over different periods, identify trends, and strategize for the future. Income statements can vary in format, but they generally follow the standard format prescribed by Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Adhering to these standards ensures comparability across companies. Additionally, users can find both single-step and multiple-step income statements. The multiple-step format provides greater detail by separating operational income from other income. Investors benefit from these details as they offer deeper insights into how a company generates revenue. Moreover, income statements can be valuable tools in forecasting and budgeting. They help businesses project future earnings and plan for upcoming expenses. Regularly reviewing these statements can uncover discrepancies in expected performance. Consequently, timely adjustments can be made before financial issues escalate, enhancing financial stability and performance.

The Importance of Income Statement Analysis

Income statement analysis holds significant importance for various stakeholders, including management, investors, and creditors. For management, these statements are vital tools for operational decision-making. By analyzing the income statement, managers can evaluate performance over time, making adjustments to strategies where necessary. Investors rely on this analysis to assess potential returns and understand the company’s profitability. A successful revenue-generating strategy can lead to increased shareholder value. Creditors also use the income statement to determine a company’s ability to repay debt. High profitability often indicates lower financial risk, making lending decisions more favorable. Comparing a company’s income statement against industry peers ensures a more accurate understanding of its competitive position and performance. Ratios derived from the income statement facilitate insightful analysis. Key profitability ratios, such as gross profit margin and net profit margin, help gauge operational efficiency and overall performance. Regular monitoring of these ratios allows stakeholders to detect any negative trends promptly. Therefore, the income statement is not just an accounting requirement; it serves as a critical instrument for business evaluation and financial strategy formulation.

Moreover, trends reflected in the income statement can reveal much about a company’s operational strengths or weaknesses. For example, a consistent increase in revenues paired with rising costs might indicate inefficiencies that management must address swiftly. On the other hand, if revenues are increasing while COGS remain stable, this reflects strong market demand and operational efficiency. Analyzing changes in net income over time is also essential; significant fluctuations can signal underlying operational issues or market challenges. By consistently reviewing income statements, investors can follow earnings trends and adjust their investments accordingly. In today’s data-driven world, financial modeling tools have simplified income statement projections. These tools can help prepare forecasts that consider historical performance while factoring in market dynamics. Building flexible models allows for scenario analysis, enabling better strategic planning. Moreover, companies often disclose their future outlooks in these statements, an essential piece of information for all stakeholders. By understanding the trends depicted in an income statement, stakeholders can make smarter decisions regarding both daily operations and long-term financial goals.

Common Mistakes in Income Statement Interpretation

Despite the clarity that income statements provide, common mistakes can lead to misinterpretation. One frequent error is overlooking context; analyzing financial statements without considering industry benchmarks or historical performance can yield misleading conclusions. Additionally, stakeholders might focus solely on net income while neglecting other critical components. Doing so ignores operational efficiency signs hidden in gross profit and operating expenses. Investors may also overlook seasonal variations affecting revenues, which may mislead quarterly comparisons. Another mistake is failing to consider accounting policies, as methods like accrual accounting can significantly impact displayed revenues and expenses. Reviewing footnotes and accounting principles is crucial for a thorough understanding of the reported figures. Furthermore, it’s essential to understand the distinction between cash and accrual accounting. Cash flow may differ significantly from net income, making it crucial to analyze both statements in conjunction. Lastly, comparing figures without calculating relevant ratios may obscure performance insights. Ratios such as earnings before interest, tax depreciation, and amortization (EBITDA) can provide more depth and clarity to the analysis. Recognizing these common mistakes is the first step toward effective financial analysis.

In summary, income statements offer a wealth of insights into a company’s financial performance. The various components, including revenues, expenses, and net income, collectively tell a story about how a business has performed over a specified time. Understanding how to interpret these statements accurately is vital for stakeholders, as they provide critical information necessary for informed decision-making. Continuous monitoring of income statements can be beneficial for anticipating future success. Stakeholders can notice trends as revenue patterns become clear through consistent reviews. Additionally, understanding the relationship between various components is key to analyzing operational efficiency. Engaging in regular income statement analysis also fosters proactive management strategies, allowing companies to address potential issues before they affect profitability. Furthermore, being aware of common pitfalls in interpretation can enhance the accuracy of financial assessments. Properly interpreted income statements enable stakeholders to draw meaningful conclusions regarding a business’s performance. This ability not only aids in investment decisions but also supports managers in making operational improvements. Mastering these financial essentials positions both new and seasoned investors alike for long-term success.

As one continues to grow in understanding financial reporting, the role of income statements becomes clearer. They are not just a yearly summary; they represent invaluable indicators of financial health. With evolving market conditions, it is imperative to adapt how these statements are viewed. Each analyst should keep abreast of changes in accounting standards or industry norms that affect the presentation of financial data. Future investors or company stakeholders should become adept at reading between the lines of the income statement. This ensures they capture the nuances of a company’s overall financial picture. Even seasoned professionals need reminder of the importance of continual learning. Engaging with accounting resources, workshops, or financial courses will enhance comprehension. Staying informed allows one to leverage industry developments, equipping investors to act wisely during uncertain times. By refining analytical skills, stakeholders can effectively use income statements for informed decision-making. Keeping financial objectives aligned with comprehensive income statement analysis can lead to sustained company growth. A focus on financial reporting literacy is essential for anyone keen on understanding the investment landscape. Exploring additional educational resources can only benefit one’s financial journey ahead, ultimately driving smarter financial strategies.