Forex Trading Scams: Common Types and How to Avoid Them

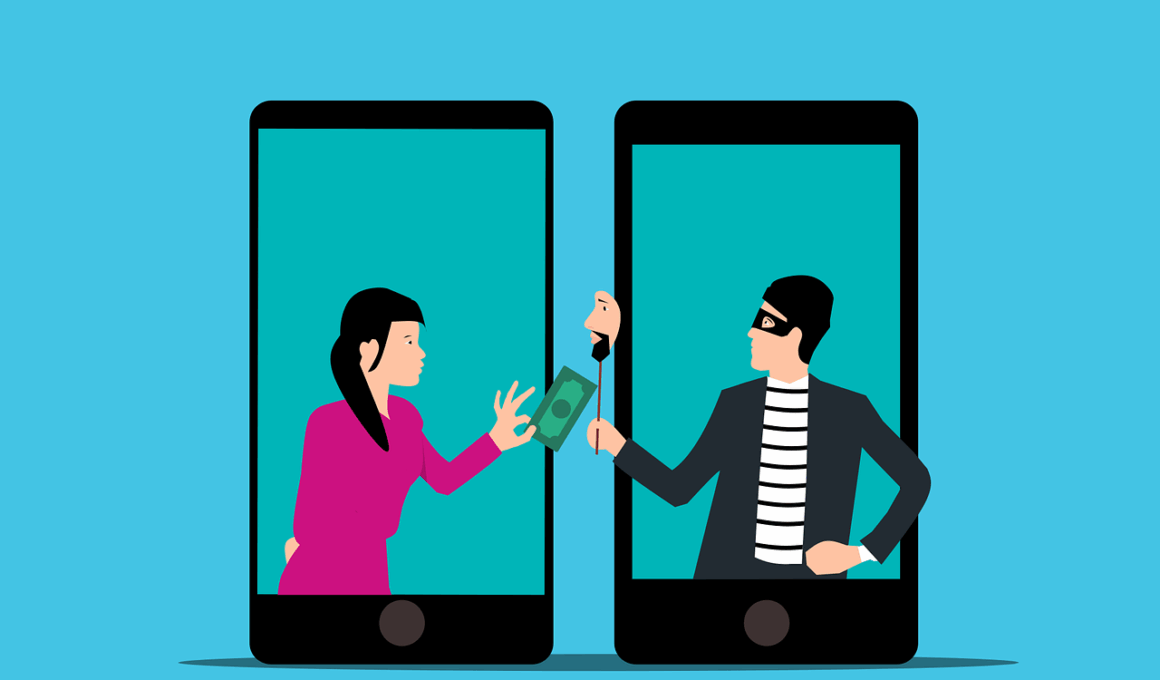

Forex trading is a rapidly growing field, but it has unfortunately attracted numerous scams that can deceive even experienced traders. Understanding the common types of forex scams is vital to avoiding them. One prevalent scam is the counterfeit broker scheme, where individuals set up faux brokerages, enticing traders with promises of high returns. They often use professional-looking websites and approaches to appear legitimate. Another common method is Ponzi schemes, where funds from new investors pay returns to earlier investors, creating a false impression of profitability. As these schemes rely on an influx of new participants, they ultimately collapse when recruitment slows. There are also signal seller scams, where firms or individuals sell false “signals” promising to guide traders to profitable trades. Traders must conduct thorough research before engaging with brokers or purchasing advice. Use regulation as a filter against scams; only trade with regulated brokers. Remember that a legitimate broker will always prioritize transparency and security. Familiarize yourself with the warning signs of scams to protect your investments and stay one step ahead of fraudsters.

Understanding the Common Types of Forex Scams

To defend against forex scams, it’s important to identify the primary types and their characteristics. A prominent form consists of high-pressure sales tactics, where individuals push traders to make quick decisions. This often encompasses promises of guaranteed profits with minimal risk, which is an immediate red flag. Another scheme involves fake investment platforms that showcase lavish lifestyles, persuading traders to part with their hard-earned money for a false paradise. Phishing scams are another prevalent technique where scammers impersonate legitimate forex firms to acquire sensitive information such as passwords or account details. This can happen through emails, websites, or fake support calls. Misleading promotions and bonuses also serve as bait for unsuspecting traders. These usually come with unreasonable conditions that are intentionally designed to trap traders in complex withdrawal processes. For anyone interested in forex trading, remaining alert and skeptical of unsolicited offers is crucial. Always verify any claims with independent sources and utilize regulatory information to assess the legitimacy of brokerage firms and their offerings. Being informed can greatly reduce the risks associated with forex trading.

Scammers often target inexperienced traders by capitalizing on their emotions and knowledge gaps. One prevalent method is the use of bogus testimonials and fabricated success stories that mislead potential investors. These testimonials often appear on websites and social media platforms, showcasing fictional trading success. They commonly utilize attractive individuals or influencers to increase their credibility. Moreover, some scams employ a personal touch by contacting traders via cold calls, presenting false investment opportunities that entice participants with low fees. Criminals are constantly evolving their tactics, making it difficult for traders to spot these scams. Furthermore, they might offer access to proprietary trading software that claims to deliver exclusive trading insights or indicators. Traders should be wary of software that appears too good to be true or does not deliver verifiable results. It is advisable to rely on recognized software providers and ensure their legitimacy through reviews and independent audits. Overall, skepticism and research play pivotal roles in safeguarding traders from fraud. An informed trader is a formidable force against scammers operating in this deceptive market.

How to Avoid Falling for Forex Scams

Successfully navigating the forex market requires vigilance against fraud. First and foremost, thoroughly research brokers before establishing accounts or investing funds. Check if they are regulated by reputable financial authorities; many countries have strict regulations governing forex trading. Always look for warnings or advisories issued by regulatory bodies about specific companies. Ensure the broker provides clear contact information, including a physical address, as legitimate firms maintain transparency. Seek independent reviews and ratings to gauge a broker’s reputation. Additionally, familiarize yourself with common warning signs of fraud, such as unsolicited calls or emails offering high returns. Take time to scrutinize the strategies employed by brokers or signal sellers. Encourage skepticism regarding unrealistic promises, as legitimate trading comes with risks. Employ a demo trading account to test platforms before committing real resources; this allows traders to assess the broker’s services without risking substantial funds. Continuously educate yourself on trading strategies and practices. Join forums and discussions to learn from the experiences of others. By arming yourself with knowledge and remaining cautious, you can enhance your protection against scams and improve your trading experience.

Many unsuspecting traders fall prey to forex scams due to a lack of understanding about the forex market dynamics. Scammers exploit this by offering a product or service that appears indispensable for success. Educating oneself about the forex market is crucial. There are various resources available, including webinars, online courses, and financial literacy websites. Well-informed traders can recognize the difference between legitimate offers and fraudulent schemes, empowering them to make educated decisions. Connecting with a community of experienced traders can also provide valuable insights and support. Additionally, understanding risk management is vital in forex trading. Genuine strategies involve understanding and managing risks rather than pursuing returns blindly. Proactive risk management measures will safeguard your investments from unregulated practices. Research the regulatory environment in your region to understand the legalities involved better. It can sometimes offer a robust framework to hold brokers accountable. Always maintain open communication with brokers and review their transparency of fees and commission structures. Clear terms are a sign of legitimacy in the forex sector. A cautious approach paired with continuous learning will safeguard your trading journey.

Recognizing Warning Signs of Forex Trading Scams

Identifying the warning signs of forex trading scams can help traders avoid significant financial losses. When surveying brokers, pay particular attention to any lack of transparency on their website regarding company details and trading conditions. If it appears difficult to access essential information, exercise caution. Be wary of brokers that do not provide clear terms of service or obscure critical fee structures within convoluted documentation. Another red flag is promises of unrealistic profits, especially in a short timespan. Scams capitalizing on the allure of easy money should be approached with skepticism. Additionally, unsolicited communication, such as unexpected emails or phone calls, is a common tactic among fraudsters. Legitimate brokers rarely engage in pushy marketing strategies, so be cautious of aggressive sales attempts. If a broker’s website contains numerous grammatical errors or seems unprofessional, this should raise alarms about their authenticity. Always review licensing information provided by the broker against reputable registries. Confirm that the firm operates within the regulations of its jurisdictions. By remaining vigilant and aware of these warning signs, traders can better protect themselves against potential scams.

In conclusion, forex trading can offer exciting opportunities but is rife with risks, particularly from scams. As the market grows, traders must remain educated and vigilant to safeguard their investments. Always conduct thorough research on brokers, understanding their regulatory status and services. Identify common schemes, focusing on the tactics employed by scammers to lure in both novice and experienced traders. Risk management is vital, and self-education on best practices in trading strategies should be a continual process. Foster relationships with other traders and learn from their experiences, leveraging community wisdom to bolster your defenses against fraud. Don’t forget to trust your instincts; if something feels off, it’s often best to walk away. Continuous learning and practicing skepticism creates a healthier trading atmosphere, ultimately enhancing your trading results. While the risks associated with forex trading cannot be eliminated entirely, immediate measures can significantly mitigate potential losses. By establishing a proactive approach and remaining aware of evolving scam tactics, traders can confidently navigate the forex landscape without falling victim to deception.

Forex Trading Scams: Common Types and How to Avoid Them

Forex trading is a valuable yet potentially risky venture, especially when it comes to scams. Understanding various types of scams that exist in the forex market is crucial to safeguard oneself against falling victim. One common type of forex scam involves fraudulent brokers posing as established firms. They entice traders with high returns and minimal risk. Traders unwary of their true intentions can lose substantial funds. Another frequent occurrence is that of Ponzi schemes which create artificial experiences of profitability. New investors pay for previous investors, giving a false sense of security. These schemes implode when new money stops flowing in. Signal sellers also promote shady advice, scamming traders of their money while providing non-existent profits. To combat these scams, always research and verify broker credentials before investing your money. Regulatory bodies often publish lists of authorized brokers to ensure your investments are secure. Moreover, never engage with brokers soliciting unsolicited investments, as these often lead to deceitful schemes. By educating yourself about forex scams and adopting a skeptic’s mindset, you can better protect your investments while trading.