Impact of Ethical Lapses on Audit Quality

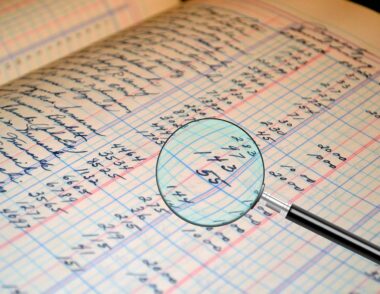

The quality of audits is significantly influenced by the ethical behavior of auditors. Ethical lapses can lead to questionable practices, thus undermining the reliability of audit processes. When auditors prioritize personal gain, corporate interests, or pressures rather than their ethical obligations, the quality of audits diminishes. The public trust in audits and the financial reporting systems relies heavily on the integrity of the professionals involved. Instances of compromised ethics can result in severe consequences, not only for the auditors but also for the companies they serve and the market as a whole. For example, when auditors knowingly ignore or conceal material weaknesses, their decisions lead to misleading financial statements. These lapses can ultimately affect investors, creditors, and stakeholders who depend on accurate financial disclosures. Furthermore, the fallout from ethical breaches often translates into legal ramifications and damage to reputations. Organizations may find themselves facing lawsuits or regulatory scrutiny, which only exacerbates financial instability. For sustaining quality, organizations must cultivate an ethical culture, ensuring all auditors adhere to industry standards and regulations. This commitment is vital to upholding public interest and maintaining the reliability of the auditing profession as a whole.

In addition to reputational damage, ethical breaches in auditing can lead to significant financial repercussions. Organizations that fail to maintain high ethical standards often face loss of investor confidence. Investors who realize they have been misled by inaccurate financial reporting are likely to withdraw their investments, leading to fluctuations in stock prices. When audits lack credibility due to ethical issues, it can trigger a broader financial crisis within industries. Such scenarios result in increased costs as companies may need to re-engage auditors and rectify previous financial reports. This loss of trust can also lead to stricter regulatory scrutiny, resulting in further compliance costs. Additionally, ethical lapses can create a toxic work environment within auditing firms, leading to low morale among employees. When ethical behavior is not emphasized or is actively ignored, talented professionals may leave in search of firms that uphold integrity. Furthermore, competition for quality auditors intensifies, forcing companies to invest heavily in attracting and retaining them. The implications of unethical auditing extend beyond monetary penalties, drastically affecting firm culture, employee satisfaction, and overall business sustainability in the long run.

Regulatory Responses to Ethical Lapses

Regulatory bodies worldwide have recognized the critical need to address ethical issues in auditing. Institutions like the International Federation of Accountants (IFAC) and the American Institute of Certified Public Accountants (AICPA) continually evolve standards to enhance auditor accountability. These organizations emphasize the development of ethical guidelines that specifically address potential conflicts of interest. In response to high-profile auditing failures, governments have enacted stricter regulations and frameworks to safeguard financial reporting integrity. The implementation of laws, such as the Sarbanes-Oxley Act in the United States, underscores the seriousness of ethical practices in auditing. These laws mandate regular training and compliance measures for auditors to enhance their ethical decision-making and awareness. Furthermore, regulatory responses encourage transparency in audit procedures and reporting, helping to restore trust. Stakeholders are increasingly lobbying for better governance and ethical compliance in financial practices. Regulatory oversight not only serves as a deterrent against unethical behavior but also as a framework that promotes ethical culture within organizations. By fostering a commitment to ethical standards, audit quality can be improved, which is essential for safeguarding public interest and financial integrity.

Ethical issues in auditing are closely linked to the broader implications of corporate governance. Strong governance structures foster ethical behavior and accountability among auditors and management alike. When organizations focus on building robust governance approaches, they engage more transparently with stakeholders. Clear communication channels and defined responsibilities encourage auditors to express concerns without fear of reprisal. As a result, ethical dilemmas can often be addressed before escalating into significant issues that compromise audit quality. Board oversight also plays a crucial role, as independent directors can provide essential guidance and maintain the ethical integrity of the auditing function. Furthermore, fostering a culture of ethical awareness and continuous evaluation can strengthen adherence to ethical practices. Companies can promote workshops and training sessions on ethical dilemmas specific to auditing to prepare their personnel better. Engaging employees at every level ensures that ethical considerations remain at the forefront of decision-making processes. Ultimately, the collective responsibility of management, auditors, and stakeholders contributes to a company’s overall ethical landscape, reinforcing the importance of ensuring audit quality through shared ethical commitments across all organizational levels.

Consequences for Stakeholders

The impact of ethical lapses in auditing reverberates beyond the auditing firms themselves, affecting various stakeholders involved. Investors, who rely on accurate financial information to make informed decisions, face financial losses due to misleading audits. Inaccurate financial disclosures can lead to uninformed investing behaviors, causing investor trust to erode over time. Financial institutions also become vulnerable as they base lending decisions and credit ratings on flawed audits. The repercussions are not limited to just monetary aspects; reputational damage can hinder future fundraising efforts for affected companies. Additionally, customers can suffer from the fallout of unethical audits as companies may raise prices to cover losses incurred from previous failures. Employees might experience job insecurity or layoffs in organizations facing legal consequences or budget constraints because of their ethical failures. Furthermore, the public perception of the auditing profession suffers, as ethical breaches erode confidence in auditors who are meant to be unbiased financial watchdogs. This collective impact on stakeholders emphasizes the far-reaching consequences of ethical lapses, highlighting the importance of safeguarding integrity and transparency in the auditing process.

Ethics training is essential for maintaining high standards in auditing. Continuous professional development ensures auditors are equipped with the latest knowledge regarding ethical expectations and challenges. Organizations must invest in structured ethics training programs that emphasize the importance of ethical behavior and its implications for audit quality. These training sessions should focus on real-life ethical dilemmas that auditors might face, encouraging critical thinking and problem-solving skills. Additionally, mentorship programs can pair seasoned auditors with junior staff to reinforce the importance of ethical practices in daily operations. The role of leadership in promoting ethical culture cannot be understated, as leading by example can inspire commitment among staff. Allowing open dialogue about ethics fosters a supportive environment where auditors feel empowered to voice concerns. By integrating ethics training into the organizational culture, auditing firms can cultivate a strong ethical foundation that prioritizes quality. As these principles become embedded in business practices, not only do the auditors thrive, but the overall trust in the profession strengthens. Ultimately, proactive measures in ethics education can significantly mitigate the risk of ethical lapses and enhance audit quality across the industry.

Conclusion

The role of ethics in auditing is fundamental to ensuring the quality and integrity of financial reporting. Ethical lapses have far-reaching consequences that not only undermine public trust but also create a ripple effect affecting various stakeholders. It is essential for organizations to prioritize ethical standards through rigorous training, clear governance structures, and supportive corporate cultures. Regulatory responses further contribute to promoting ethical practices within the auditing profession, emphasizing the importance of accountability and transparency. As the influence of ethical behavior on audit quality becomes increasingly evident, companies must realize that their commitment to integrity directly correlates with their success. The sustainability of audit quality hinges on collective efforts from all stakeholders, including auditors, management, and regulatory bodies. Ultimately, establishing and maintaining a robust ethical framework can help avert crises stemming from unethical practices. Auditors must recognize their role as guardians of financial integrity, navigating the complexities of their profession with the utmost ethical considerations in mind. By fostering a strong culture of ethics, the auditing industry can set a precedent for accountability, trust, and excellence in serving the public interest.