The Role of Term Life Insurance in Debt Management

Term life insurance serves as an invaluable financial safety net, especially during times of uncertainty. Individuals typically acquire debt through mortgages, credit cards, and loans. While these debts can be manageable in good times, they can become overwhelming in the event of an untimely death. Term life insurance provides peace of mind, knowing that loved ones are protected if something unexpected occurs. The death benefit from a term life policy can be used to pay off outstanding debts, reducing the financial burden on surviving family members. This immediate infusion of funds can facilitate prompt debt settlement, helping to keep a family’s financial future intact. Additionally, as these policies are typically more affordable than other life insurance types, they provide accessibility for a vast majority of individuals. This affordability means more people can obtain sufficient coverage for their debts. Furthermore, the duration of term life insurance aligns well with major financial obligations, such as the length of a mortgage. Therefore, choosing the right term duration is essential in ensuring that debts remain covered throughout the significant financial commitments.

Besides protecting loved ones from financial distress, term life insurance offers vital support for careful debt management. When evaluating debt obligations, understanding the role of insurance in managing potential outcomes is paramount. If one happens to pass away without adequate coverage, surviving family members may face significant hardships in sustaining their lifestyle. A term life policy helps to eliminate or reduce debts, which is especially crucial for those with large financial obligations that, if unpaid, could lead to family crisis. The insurance payout can cover remaining mortgages, auto loans, and significant personal debts. Moreover, it lessens the risk of family members being forced to liquidate assets to settle those debts. Such a strategy fosters stability and provides security for the family’s financial future. The payout from the policy can empower beneficiaries to make sound financial decisions moving forward. Without adequate life insurance, families may struggle against creditors, possibly losing their homes or vehicles. Hence, wise policy selection and thorough debt assessment should go hand in hand when creating a robust financial plan.

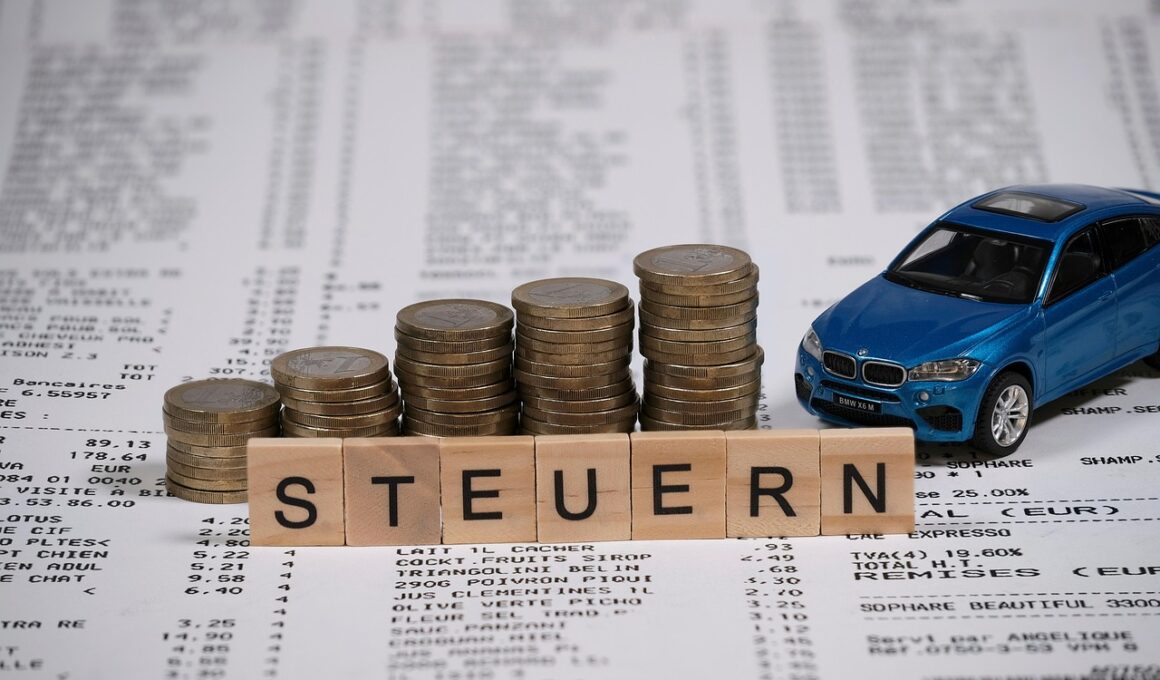

Assessing the Costs of Term Life Insurance

When considering term life insurance as a tool for managing debt, one must assess premium costs in relation to coverage needs. Price can vary significantly based on factors like age, health, and lifestyle. Higher premiums may be necessary for those presenting significant health risks. However, many find that their overall financial burden can be mitigated by securing a policy with a suitable death benefit level. Providers often use information from medical exams to determine these premiums. Therefore, it’s advantageous for potential clients to compare various insurance options. Understanding how different policies can impact one’s monthly budget is also essential. It’s important to consider that lower-cost policies may not always provide adequate coverage for hefty debts. Alternatively, pricier options might yield unnecessary expenses for those with minimal obligations. Taking time to explore multiple quotes empowers individuals to secure the necessary coverage without overspending. This diligence in shopping for a policy ultimately enhances the overall financial literacy of an individual and allows for informed decision-making regarding both debts and insurance.

Another essential consideration is the term duration of the life insurance policy. The length of the term should correspond with the lifespan of existing debts. Most debts, such as mortgages, are structured over specific periods, often 15 to 30 years. Families should align the term of their policy accordingly, ensuring that coverage lasts throughout the payment periods of these debts. If a policy expires before the debt is settled, individuals may find their families still exposed to financial risk. For instance, parents with dependent children should consider longer terms to provide ongoing protection until their children are financially stable. By maximizing the coverage duration, families can effectively navigate potential future challenges. This correlation between debt commitment duration and insurance policy term safeguards against unforeseen circumstances while also helping in debt management. Therefore, maintaining focus on policy renewal and updating coverage needs as debts diminish is crucial. Adjusting plans as life circumstances change can ensure continued protection and financial stability.

Benefits Beyond Debt Management

While the primary purpose of term life insurance often centers on protecting loved ones from debt repercussions, it also offers additional benefits. These policies can serve as a disciplined savings mechanism. Many individuals find that regular premium payments instill a measure of financial discipline. Moreover, some term policies include conversion options, allowing individuals to transition into permanent life insurance plans later. Such a strategy can be beneficial if health conditions evolve over time. Additionally, when factoring in potential income loss due to an untimely death, term life insurance provides valuable support in preserving the family’s lifestyle. It can replace lost earnings, enabling the family unit to maintain their financial commitments and debt obligations. The assurance that income continues can alleviate stress, fostering emotional well-being during tumultuous times. Forward-thinking individuals often use this protection as a proactive approach to financial planning. Properly leveraged, term life insurance strengthens overall financial health and promotes responsible debt management, serving as a critical tool in long-term financial success.

Learning how to utilize term life insurance effectively requires a thoughtful understanding of policies and financial impact. Financial advisors often recommend conducting comprehensive assessments regarding one’s debts and coverage needs. This ensures an appropriate alignment between insurance benefits and financial obligations. Additionally, clients should frequently re-evaluate personal circumstances and debt status. Growth in income or the reduction of existing liabilities may necessitate adjustments in coverage. Moreover, rigidly sticking to the initially selected policy without introspection may lead to insufficient coverage as debts fluctuate over time. It is vital that individuals maintain an adaptable mindset concerning their life insurance needs. Adaptability aids in achieving financial peace of mind while simultaneously accommodating shifts in personal or economic circumstances. Consulting experts can offer valuable insights into selecting and updating policies as necessary. Ultimately, being proactive in debt management and term life insurance planning can prevent financial pitfalls, resulting in improved family stability. This ongoing analysis will likely yield positive outcomes, reducing risk and enhancing the family’s financial legacy.

Conclusion: A Strategic Approach to Financial Security

In conclusion, term life insurance plays a crucial role in protecting families from the uncertainties of debt. By eliminating financial burdens that arise from unexpected events, these policies empower individuals to create stable and secure futures. The thoughtful selection of term duration and coverage aligns with life’s significant financial commitments, ensuring consistent protection throughout various life phases. Moreover, the secondary benefits of life insurance contribute to improved financial behaviors and peace of mind for policyholders. Transitioning mindsets toward viewing life insurance as a core component of financial planning encourages responsible debt management and fiscal prudence. Therefore, individuals seeking to optimize financial health must recognize the advantageous role of term life insurance in their overall strategy. As financial situations evolve, so too should coverage and plan specifications. By embracing a proactive stance on financial planning, individuals can avoid common pitfalls associated with unmanaged debt, creating a stronger foundation for future generations. Thus, understanding the profound impact of term life insurance should be a priority for anyone aiming to achieve lasting financial stability.

This final section encapsulates the key elements to consider when integrating term life insurance into a comprehensive debt management strategy. Individuals are encouraged to tackle these subjects proactively, drawing on both personal insights and professional advice. Comprehensive assessments of existing debts, policy comparisons, and environment adaptation are vital. Additionally, clear communication with loved ones about financial arrangements fosters trust and understanding. The peace of mind derived from knowing that debts are covered by reliable life insurance can be transformative. Families can then focus more on moving forward financially rather than being burdened by uncertainty. Thus, approaching life insurance as part of a broader financial strategy allows individuals to embrace a proactive mindset toward overall financial wellness. Through informed decision-making, individuals can ensure they are better positioned to navigate life’s intricate uncertainties. Satisfaction derived from securing financial futures and steadfast obligations remains a priority. Therefore, adopting these practices can enhance the effectiveness of term life insurance in debt management, fostering resilience during challenging times. Through these strategic considerations, securing a solid financial foundation ensures ongoing legacy for loved ones.