Systemic Risk Metrics: Concepts and Measurement Challenges

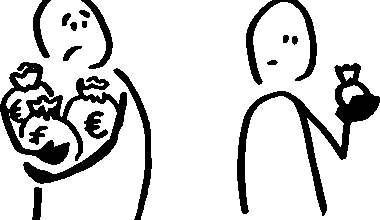

Systemic risk refers to the potential collapse of an entire financial system or market, which could occur due to systemic interdependencies among financial institutions. It is critical to understand the metrics that capture this risk effectively. Metrics for systemic risk highlight interconnectedness among banks, asset managers, and other entities, providing insight into vulnerability to crises. Commonly used metrics include Value at Risk (VaR), stress testing results, and CoVar, which assesses the risk that a firm contributes to another firm’s risk. However, measurement challenges persist, particularly across varying methodologies and data limitations. Granular data and comprehensive modeling strategies remain essential for effectively assessing systemic risk. Moreover, incorporating macroeconomic factors is vital, as they often influence risk exposure in substantial ways. This makes it imperative for financial institutions to standardize metrics and methodologies to ensure comparability and transparency. In addressing these challenges, regulators can enhance resilience across the financial system. Understanding systemic risk more comprehensively helps mitigate potential crises, providing a more stable financial landscape for future operations and ensuring economic stability.

One of the primary challenges in systemic risk measurement is the development of models that accurately capture the complex interconnections between financial institutions. Traditional risk measurement methods often fail to account for the cascading effects of one institution’s failure on others. For example, during the 2008 financial crisis, it became evident that interconnectedness was a significant factor exacerbating the crisis. The limitations of existing methodologies necessitate the adoption of more sophisticated models that incorporate network theory and stress-testing scenarios. Metrics need to reflect how contagion can escalate, affecting liquidity and solvency throughout financial networks. Consequently, institutions should leverage enhanced data analytics, machine learning, and network analysis to facilitate better risk measurement. Moreover, regulators must encourage collaborative approaches in risk assessment that emphasize information sharing between covered entities. Incorporating stress testing and scenario analysis into regular risk management practices can provide valuable insights into vulnerabilities. Ultimately, improving the understanding of systemic risk metrics is essential for preventing events that can disrupt markets and lead to economic decline, compelling industry players to remain vigilant in their risk management endeavors.

The Role of Data in Risk Metrics

Data quality is paramount in measuring systemic risk effectively. Incomplete or inaccurate data can lead to misguided conclusions about the actual level of risk facing financial institutions. Accurate data collection should encompass a vast array of qualitative and quantitative metrics, which include interconnections, exposures, and potential loss scenarios. Furthermore, data governance practices must be strengthened to address inconsistencies and ensure that robust datasets are maintained. Without a solid foundation of reliable data, any calculations regarding systemic risk may be compromised, leading to poor decision-making and exposed vulnerabilities. Advanced data aggregation and processing techniques can drastically improve the timeline for risk assessment while offering better insights into potential systemic threats. Implementing real-time data analytics will allow institutions to capture evolving risk profiles more dynamically. Moreover, collaboration between data providers, regulators, and financial institutions is critical in establishing a standardized framework for data sharing. This collaborative approach can enhance collective understanding and responsiveness regarding systemic risk, making institutions more resilient in the face of unforeseen challenges and shocks within the market.

Another important aspect of systemic risk metrics involves the regulatory landscape governing financial institutions. Regulatory bodies worldwide aim to foster stability by implementing stress tests and capital requirements designed to improve the resilience of financial systems. Consequently, effective systemic risk measurement must align with evolving regulations, necessitating updated methodologies that remain relevant to current market conditions. Frameworks such as the Basel III accord have introduced stricter capital requirements, emphasizing liquidity and risk management practices in banks. Monitoring compliance with these regulations helps mitigate systemic risk across financial sectors. However, there is a significant burden on institutions to ensure their methodologies for measuring risk are not only robust but also compliant with these regulatory expectations. As regulatory focus intensifies, financial institutions must prioritize integrating their risk assessment practices with regulatory requirements while exploring alternative metrics that capture systemic risk more accurately. This alignment can help institutions avoid regulatory penalties while ensuring they remain agile in adapting to changes in the financial environment. Adapting rapidly to evolving metrics will better position these entities to prevent future crises and safeguard against systemic threats.

Integration of Macroprudential Policies

The integration of macroprudential policies into systemic risk metrics is essential in fostering a resilient financial system. These policies provide a framework for identifying and mitigating systemic risks that transcend individual institutions. By focusing on the overall health of financial markets rather than on single entities, macroprudential policies ensure that systemic risk is addressed comprehensively. Key tools in this realm include countercyclical capital buffers, loan-to-value ratios for mortgages, and stress-testing scenarios that evaluate systemic interlinkages. Moreover, adopting macroprudential policies can help regulators identify potential systemic threats before they escalate into crises, providing a proactive approach to risk management. By aligning metrics with macroprudential objectives, financial institutions can incorporate broader economic factors into their risk assessments, enhancing the overall understanding of interconnectedness within financial systems. This approach encourages stakeholders to focus on the stability of the entire financial landscape rather than just individual performances. Ultimately, robust and interconnected macroprudential frameworks, when integrated into standard practices, can create more resilient banks and secure financial stability for communities and economies worldwide.

Furthermore, ongoing education and collaboration among stakeholders play a crucial role in improving systemic risk measurement. Financial institutions, regulators, and researchers must engage in open dialogues about challenges, innovations, and best practices in risk management. This collaboration not only enables the sharing of knowledge and expertise, but also fosters an environment where systemic risks can be assessed effectively. Ideally, periodic workshops and conferences can serve as platforms for discussing emerging trends in systemic risk metrics and measurement methodologies. Such interactions can foster collaboration towards the development of universal standards targeted at systemic risk identification and minimal thresholds that institutions should adopt. Moreover, educational initiatives could enhance practitioners’ understanding of systemic risk characteristics and promote best practices for risk assessment. A well-informed ecosystem ensures that financial players are equipped to navigate the complexities of systemic risk, thereby contributing to greater collective stability. Education and awareness are instrumental in shaping an adaptive financial landscape where individual entities appreciate their roles within the larger economic fabric and prioritize accurate risk measurement.

Future Directions in Systemic Risk Measurement

Looking ahead, advancements in technology, particularly in big data analytics and artificial intelligence, will transform the way systemic risk is measured. The potential for harnessing vast datasets presents opportunities to develop more sophisticated risk models that incorporate real-time data. As machine learning algorithms become more adept at recognizing patterns and anomalies, they may significantly enhance the prediction of systemic risks, allowing institutions to respond promptly to emerging threats. Additionally, the use of decentralized finance (DeFi) and blockchain technology could reshape financial interconnections, motivating institutions to adapt their methods of measuring systemic risk accordingly. As these new financial technologies proliferate, it is imperative that both regulators and institutions remain vigilant in evaluating their implications on systemic risk measurement. Collaborating on developing metrics that align with emerging technologies will ensure that risk assessments are comprehensive in their coverage. Ultimately, embracing innovative approaches to systemic risk measurement will better equip financial institutions and regulators to safeguard markets against future crises. An adaptive and forward-thinking approach will pave the way for resilience in an ever-evolving financial landscape.

In conclusion, addressing the challenges of measuring systemic risk requires a multi-faceted approach that incorporates advanced methodologies, meaningful data governance, regulatory alignment, macroprudential policies, stakeholder collaboration, and technological advancement. The complexity of systemic interactions within financial systems necessitates continued evolution in risk metrics that can accurately reflect these dynamics. Financial institutions must recognize their responsibility to not only manage their risk exposure but also contribute to the overall stability of the financial system. Furthermore, regulatory bodies should continue refining guidelines to facilitate effective systemic risk measurement through collaboration with industry participants. The financial landscape will continue to evolve, characterized by new technologies and economic unpredictabilities. Consequently, a proactive approach to systemic risk assessment is essential in addressing future challenges. Institutions need to invest in their capabilities to measure and manage systemic risks effectively. By doing so, they can contribute meaningfully to a resilient financial ecosystem that prioritizes long-term sustainability and economic stability. Performance in the face of systemic risks will ultimately depend on the commitment of institutions to adapt and innovate, ensuring preparedness for potential crises.