Stress Scenarios in Liquidity Planning and Management

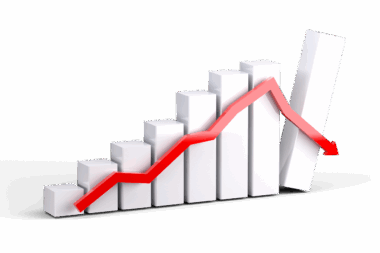

In today’s volatile market environment, liquidity management is crucial for financial institutions. These institutions must develop robust liquidity strategies to mitigate risks associated with market fluctuations. Stress scenarios play a vital role in liquidity planning. By simulating adverse conditions, such as economic downturns or liquidity crises, firms can evaluate their financial resilience. Creating these scenarios involves analyzing historical data to predict potential impacts on liquidity. Various factors like market volatility, customer behavior, and funding costs need assessment. Effectively managing liquidity under stress ensures firms can meet their obligations during turbulent times. This proactive approach helps avoid liquidity shortfalls that could jeopardize financial stability. The integration of stress testing into liquidity management frameworks is essential. Regulatory requirements often mandate that institutions perform these tests regularly. As new regulations emerge, staying compliant while ensuring liquidity sufficiency becomes a balancing act. Additionally, communication with stakeholders is vital throughout this process. By providing transparent information regarding liquidity positions, organizations can maintain trust and minimize panic during crises. In conclusion, stress scenarios significantly enhance liquidity management strategies and improve preparedness for unexpected market changes.

One of the most important aspects of liquidity management involves understanding the impact of market volatility. Financial markets can experience sudden shifts, leading to drastic changes in liquidity conditions. These shifts prompt firms to be diligent in their liquidity forecasting. The application of sophisticated predictive models is crucial in anticipating liquidity needs. Models must incorporate a variety of stress scenarios to capture the diverse possibilities. The efficacy of these models depends largely on the quality of input data and the appropriateness of the underlying assumptions. Organizations must also consider external factors, including macroeconomic indicators and geopolitical events. Maintaining communication and collaboration among departments such as treasury, risk management, and compliance enhances the accuracy of liquidity assessments. Doing so aligns the entire organization towards a common liquidity strategy. Training and awareness programs can further empower employees to understand liquidity dynamics better. By establishing a culture of vigilance regarding liquidity management, firms can respond swiftly when unexpected events arise. Furthermore, scenario testing should not be a one-time exercise but a continuous practice that evolves with changing market conditions. Ultimately, vivid insights gained from stress scenarios can inform better liquidity management decisions and strategies.

Strategic Responses to Stress Scenarios

Organizations can employ various strategic responses to effectively manage liquidity under stress. First, firms should prioritize the development of contingency funding plans. These plans outline specific actions to be taken during liquidity crises, ensuring access to financial resources when needed. Additionally, maintaining a diverse funding base is essential. Relying solely on one source of funding poses risks that can exacerbate liquidity challenges. Diversifying funding sources, such as interbank loans, issuance of bonds, or equity sales, can provide a buffer in times of distress. Financial institutions should also consider implementing liquidity buffers, consisting of high-quality liquid assets. These buffers can be crucial during periods of market instability, allowing firms to meet obligations without panic. Regular communication with stakeholders, including investors and regulators, enhances transparency. This is vital to maintain confidence during times of uncertainty. Furthermore, organizations should continuously monitor market conditions and adjust their liquidity strategies accordingly. Finally, firms should foster a culture of risk awareness and communication across teams to ensure a unified response during liquidity challenges. By adopting these strategic responses, organizations can enhance their resilience and agility in navigating stress scenarios.

Moreover, the role of technology in liquidity management cannot be overlooked. Advanced technological solutions can significantly improve the accuracy and efficiency of liquidity forecasting. Organizations increasingly incorporate big data analytics to process vast amounts of information from multiple sources. These tools can identify patterns and trends in customer behavior and market dynamics. By utilizing machine learning algorithms, firms enhance their ability to predict liquidity needs, adjusting strategies in real-time. Cloud-based platforms also offer scalability, allowing organizations to respond quickly to fluctuations in liquidity demands. Implementing effective data visualization tools aids decision-makers in understanding complex scenarios effortlessly. These technologies provide insights that can lead to timely interventions, maintaining market confidence. Furthermore, integrating artificial intelligence allows for enhanced risk assessments by simulating various market conditions and their effects on liquidity. Building a tech-savvy culture within financial institutions fosters innovation, ensuring teams are equipped to tackle future challenges. Training employees to effectively utilize these technologies is equally important. Ultimately, leveraging technological advancements serves as a catalyst for more effective liquidity management practices, ensuring organizations remain resilient against market volatility.

Regulatory Considerations in Liquidity Management

Regulatory frameworks play a crucial role in shaping liquidity management practices for financial institutions. Compliance with established regulations is essential for maintaining operational integrity and trust. Regulatory bodies, such as the Basel Committee, outline guidelines that necessitate the assessment of liquidity risks. Implementing these regulations requires a comprehensive understanding of the organization’s liquidity position under varying stress conditions. Regular reporting to regulatory authorities ensures transparency and accountability, fostering a culture of compliance. Moreover, institutions must prepare for periodic examinations by regulators, demonstrating adherence to liquidity requirements. Engaging in proactive dialogue with regulators can improve understanding and support compliance efforts. Additionally, the volatility of financial markets may prompt regulators to adapt their requirements, posing challenges for institutions. Organizations must remain vigilant, adjusting liquidity strategies to align with any changes. Effective governance frameworks enable institutions to maintain strong compliance oversight while adapting to new regulations. This adaptability is essential for long-term success in managing liquidity. By fostering a strong partnership with regulatory bodies, firms can navigate the complexities of compliance while enhancing their overall liquidity management capabilities.

Furthermore, integrating stress scenario analysis into the corporate governance framework is vital. This integration should not be an isolated effort but rather part of a broader risk management strategy. Senior management and boards must advocate for liquidity considerations in strategic planning processes. Regular assessments of liquidity risk enable organizations to identify weaknesses and develop action plans promptly. Communication lines between risk management and operational teams should facilitate real-time information sharing. By ensuring that stress scenarios are included in business continuity plans, firms can proactively prepare for disruptions. Simulation exercises can also help organizations practice their responses to liquidity crises. These exercises can promote collaboration among departments and highlight potential obstacles. Furthermore, revisiting and revising stress scenarios should occur regularly to reflect evolving market conditions and internal changes. Adopting a dynamic approach to stress testing ensures firms remain prepared for any eventuality. Encouraging a culture of continuous improvement through learning and adaptation can drive better outcomes in liquidity management. In conclusion, integrating stress scenario analysis into governance enhances overall resilience and aligns strategies towards effective liquidity management.

Future Trends in Liquidity Management

Looking ahead, several trends are set to shape the landscape of liquidity management in an increasingly complex environment. Firstly, the expansion of digital currencies and payment systems will impact liquidity dynamics. Financial institutions must adapt to the evolving landscape posed by innovations like blockchain technology. The rise of DeFi (Decentralized Finance) platforms will also alter traditional liquidity management paradigms. As these platforms grow, the interconnectedness of various markets poses both challenges and opportunities for liquidity managers. Additionally, the emphasis on sustainability will prompt firms to consider the environmental impacts of their liquidity strategies. Aligning liquidity management with sustainable finance principles is expected to gain traction among organizations. Furthermore, as regulatory scrutiny increases, firms will need to adopt more sophisticated technologies for compliance monitoring and reporting. Financial institutions may also leverage artificial intelligence to automate liquidity risk assessments, improving efficiency. Embracing advanced analytics and machine learning will empower firms to make data-driven decisions. Developing a more agile approach to liquidity management, aligned with future trends, is essential for firms to thrive amidst uncertainties. Ultimately, the evolution of liquidity management practices will reflect market developments and the growing importance of innovation and responsiveness.

In conclusion, understanding stress scenarios in liquidity planning and management is imperative for firms seeking to navigate today’s unpredictable market landscape. The integration of thorough stress testing, technological innovations, regulatory compliance, and effective governance structures can significantly enhance liquidity resilience. Financial organizations must remain proactive and adaptive to mitigate potential risks associated with market volatility. By fostering a culture of compliance and vigilance, and utilizing strategic responses, firms can strengthen their liquidity positions. Continued collaboration across departments will enhance insights into liquidity dynamics and enable organizations to respond efficiently during crises. Moreover, leveraging technology will not only improve forecasting accuracy but also provide real-time data to inform decisions. Emphasizing sustainable practices within liquidity strategies aligns with emerging trends toward responsible finance. As financial landscapes evolve, so too must approaches to managing liquidity. Institutions that invest in strengthening their liquidity management capabilities will be best positioned to withstand future challenges. Ultimately, embracing a dynamic and multifaceted approach will set organizations apart, ensuring their operational stability in the face of uncertainty.