How to Communicate Financial Forecasts Effectively

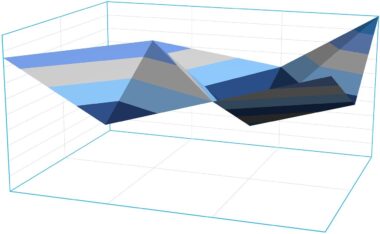

Successful communication of financial forecasts is crucial for any organization aiming to make informed decisions. First, clarity must reign supreme. Utilize straightforward language that conveys the essence of your financial outlook without jargon. Second, employ visual aids such as charts and graphs. Visuals enhance understanding through representations of data trends and relationships. Additionally, focus on tailoring your message to your audience. Different stakeholders may have varying levels of financial acumen, so customize your presentation accordingly. Moreover, provide context for your forecasts. For instance, explain the assumptions and methodologies behind financial projections, which may involve industry trends, economic factors, and historical data analyses. This background enriches stakeholder comprehension and trust. Another key aspect is to encourage engagement during discussions about forecasts. Invite questions and address concerns proactively, creating an open dialogue. Finally, ensure your communication is timely. Present forecasts regularly and have follow-up discussions that incorporate revised numbers as necessary. In summary, effective communication hinges on clarity, visualizations, audience adaptation, contextual explanations, engagement, and timeliness. Mastering these elements will significantly enhance stakeholder confidence in your financial forecasts.

One effective strategy for presenting financial forecasts is by using storytelling techniques. Transform numerical data into narratives that demonstrate the relevance and implications of the forecast. Storytelling captures attention, making your financial outlook more relatable. For example, share a case study that illustrates how similar projections have unfolded in the past. This approach grounds projections in reality and offers tangible examples for stakeholders. Additionally, consider differentiating between optimistic and pessimistic scenarios. Present a range of possible outcomes to show the potential variability in your forecasts. This practice equips stakeholders with a more comprehensive understanding of risks and opportunities. Furthermore, leverage technology to aid communication; tools like presentation software and interactive dashboards ensure that financial data is visually compelling and accessible. Incorporating real-time data updates into your presentations can also keep your forecasts relevant and demonstrate a commitment to transparency. As you refine your forecast communication, gather feedback from stakeholders. Their insights will further enhance your presentation style and content. Ultimately, marrying storytelling with technology and stakeholder engagement can transform the way financial forecasts are perceived and understood by various audiences.

Another important aspect of communicating financial forecasts effectively is establishing credibility. Building trust with your audience is essential, especially when discussing money. Align your forecasts with reputable sources, showcasing data from recognized financial institutions or industry analysts. Demonstrating alignment with expert opinions adds weight to your projections. In addition, highlight the expertise of your forecasting team. Make sure to communicate the qualifications and experience of those involved in creating the forecasts. This connection can help to reassure stakeholders about the competence behind the projections. Furthermore, don’t shy away from discussing limitations and uncertainties related to your forecasts. Acknowledging potential risks rather than glossing over them shows transparency and confidence in your team’s assessments. You may also want to include regular updates as new data becomes available. Frequent communication about the forecast’s status illustrates a commitment to keeping stakeholders informed. In doing so, you invite scrutiny, which can further validate your forecasts. By prioritizing credibility, transparency, and regular updates, you will enhance the overall effectiveness of your communication regarding financial forecasts. This solidifies stakeholder trust and engagement with your predictions over time.

The Importance of Consistency

Consistency in financial reporting and forecasting cannot be overstated. When communicating forecasts, ensure that the format and structure are uniform. Consistent presentation allows stakeholders to quickly locate pertinent information and comprehend trends more easily. Use the same time periods, currencies, and methodologies across all reports; this aids in comparison and analysis. Additionally, maintain regular communication intervals when updating stakeholders on financial forecasts. Whether quarterly or monthly, a predictable schedule enhances stakeholder engagement and expectation management. Furthermore, consider creating a dedicated section in your financial reports just for forecasts. This focused approach allows your audience to concentrate directly on the financial projections, avoiding distractions. The clarity given by a consistently formatted section contributes to better stakeholder understanding. Moreover, encourage your team to utilize the same language and terminology when discussing financial forecasts. Familiarity with terms ensures that everyone uses the same understanding of key concepts, which minimizes miscommunication. In summary, cultivating consistency in format, timing, and language in financial forecasts enhances clarity and trustworthiness. This structured approach leads to better outcomes and collaborative efforts in decision-making for organizations.

In addition to the practices already discussed, utilizing feedback loops is crucial for refining your forecast communication. Establish channels for stakeholders to provide their opinions and insights on the presentation of financial forecasts. Understanding their preferences allows you to adapt your approach over time, making the information more relevant and engaging. Conduct surveys or informal discussions after forecasts are presented to gather valuable perspectives. Engaging with stakeholders in this manner enhances their commitment and cooperation, as they feel their input is taken seriously. When implementing feedback, make necessary adjustments that resonate with your audience’s needs. For instance, if you discover that stakeholders prefer graphical data representations over written explanations, consider adapting your communication style. Regularly revisit your financial forecasts and communication strategies to ensure they reflect stakeholder expectations and remain contemporary with industry best practices. Furthermore, consider holding workshops or training sessions for stakeholders to enhance their financial literacy. Educated stakeholders can better understand and engage with your forecasts, paving the way for more productive discussions. Ultimately, creating feedback loops and fostering education can significantly uplift the performance of financial forecasts and their communication within your organization.

The Role of Technology

Technology plays a pivotal role in enhancing the communication of financial forecasts, facilitating clearer understanding and engagement. Employing sophisticated software tools for data visualization can transform complex datasets into intuitive graphs and dashboards. These tools make financial information easier to absorb and interpret for your audience. Some popular options include Tableau, Microsoft Power BI, and Excel for basic charting. Integration of real-time data can also provide stakeholders with current insights that are crucial for informed decision-making. This feature ensures that forecasts remain dynamic rather than static, adapting to market changes. Moreover, when disseminating forecasts, utilize online platforms like cloud-based services for sharing documents collaboratively. Stakeholders can then access or comment on forecasts from anywhere at any time, promoting a more participative approach. Webinars to present forecasts also allow for interactive discussions where stakeholders can pose questions immediately. Additionally, consider utilizing project management tools to track forecast outcomes and analytical tools for predictive analytics, which improve forecast accuracy. Overall, technology fosters better engagement and increased transparency, significantly enhancing the overall communication of financial forecasts with stakeholders.

To conclude, effective communication of financial forecasts is a multifaceted process, demanding attention to various crucial factors. Clarity remains the most important principle to uphold. Presenting information in a simple, straightforward manner ensures that stakeholders grasp the essence of your projections. Utilizing visuals can significantly enhance understanding and retention, coupled with storytelling techniques that make forecasts relatable. Building credibility is equally vital, achieved by leveraging reputable sources, demonstrating expertise, and maintaining transparency. Consistency in reporting formats cultivates trust while regular updates and feedback loops refine communication over time. Harnessing technology enables engagement improvements, with tools that facilitate collaborative efforts and enhance data accessibility. Finally, don’t forget the importance of tailoring your communication to your audience, recognizing the varying levels of understanding among stakeholders. Each of these components contributes to a robust financial forecasting communications strategy that optimizes stakeholder understanding and involvement. By implementing these principles, you will foster a disciplined approach that resonates with stakeholders, ensuring that financial forecasts serve their intended purpose of guiding decision-making and strategic planning for your organization.