Analyzing Currency Pair Trends and Patterns

In the world of Forex trading, understanding currency pairs is essential for success. A currency pair consists of two currencies that are traded against each other. The first currency is known as the base currency, while the second is the quote currency. For example, in the EUR/USD pair, the Euro is the base currency, and the US Dollar is the quote currency. Currency pairs can be categorized into three main categories: major pairs, minor pairs, and exotic pairs. Major pairs include the most traded currencies, such as the Euro, US Dollar, and Japanese Yen. Minor pairs consist of currencies that are not frequently traded, while exotic pairs involve a major currency paired with a currency from a developing economy. When analyzing currency pairs, traders typically look at various factors, including economic indicators, interest rates, and geopolitical events. Understanding these elements helps traders make informed decisions and identify potential trading opportunities.

Factors Influencing Currency Pair Prices

Numerous factors influence the pricing of currency pairs, making it crucial for Forex traders to stay informed. Economic indicators, such as GDP, unemployment rates, and inflation, provide valuable insights into a country’s economic health. Interest rates set by central banks also play a pivotal role in determining a currency’s strength against another. Higher interest rates generally attract foreign capital, increasing demand for that currency. Geopolitical events, including elections, trade agreements, and conflicts, can create volatility in the forex market; thus, traders must monitor news releases and social developments closely. Sentiment analysis is another essential tool, as it gauges the mood of market participants towards specific currencies. Additionally, supply and demand dynamics affect currency values; if demand for a currency rises, its price increases relative to others. To navigate the complexities of currency pair trading, traders utilize various analysis techniques, such as technical analysis and fundamental analysis, allowing them to anticipate price movements and make strategic trading choices.

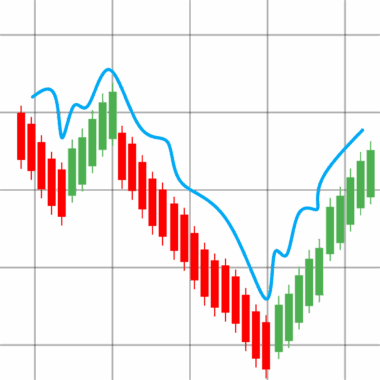

Technical analysis is a popular trading method that involves analyzing historical price data to predict future movements. Traders use charts, indicators, and key levels to identify trends and patterns in currency prices. Commonly employed tools include moving averages, RSI, and MACD, each serving unique purposes in assessing market conditions. Trendlines help traders determine the overall direction of the market, while support and resistance levels indicate possible price reversal points. By recognizing chart patterns such as head and shoulders, flags, and triangles, traders can better anticipate future price behavior. Moreover, trading volume is analyzed in conjunction with price movements to confirm trends. Combining these technical tools with fundamental analysis creates a comprehensive trading strategy. This allows traders to capitalize on both market sentiment and underlying economic factors. Analyzing chart patterns and combining them with sound economic data equips traders with an effective approach to making informed trading decisions.

Another essential aspect of currency trading is understanding the interrelationships between different currency pairs. Correlation indicators help traders identify whether two currency pairs move in the same direction (positive correlation) or in opposite directions (negative correlation). For instance, if two pairs show a strong positive correlation, traders can use this information to hedge their positions or diversify their portfolios effectively. Conversely, if they exhibit a negative correlation, it could present opportunities to capitalize on price discrepancies. Monitoring correlations also allows traders to adjust their strategies based on market fluctuations. It’s crucial for traders to regularly analyze correlation metrics, as they may vary over time due to changing market conditions and economic factors. Utilizing correlation effectively can enhance risk management and optimize trade execution strategies. In addition to correlations, considering how global events impact various currencies is vital for forex success. By staying updated on economic news and reports, traders can anticipate how changes will affect their chosen currency pairs.

Common Currency Trading Strategies

Many traders employ specific strategies to maximize their success in currency trading. Some of the most popular strategies include scalping, day trading, swing trading, and position trading. Scalping involves making quick trades to capture small price movements, often holding positions for just a few seconds to minutes. Day trading, on the other hand, requires traders to open and close positions within the same trading day, capitalizing on intraday price fluctuations. Swing trading focuses on capturing price swings over several days, utilizing technical analysis to identify optimal entry and exit points. Finally, position trading is a long-term strategy where traders hold currency pairs for weeks or months based on fundamental analysis. Each strategy has unique benefits and risks, and traders must select the one that aligns with their trading style, risk tolerance, and market outlook. Additionally, creating a well-defined trading plan is essential, as it helps traders maintain discipline and focus amid market noise.

Risk management is vital for any currency trader, as the Forex market can be highly volatile. To protect trading capital, setting stop-loss and take-profit orders can help manage risk and secure profits. Stop-loss orders automatically close positions at predetermined price levels, limiting potential losses. Meanwhile, take-profit orders lock in profits once a currency pair reaches a specified price target. Additionally, maintaining a proper risk-to-reward ratio is essential; traders should aim for a favorable ratio to ensure long-term profitability. Diversification across multiple currency pairs can minimize risk by reducing reliance on a single trade. Moreover, traders should regularly evaluate their trading performance and adjust their strategies as needed. This continuous self-assessment aids in identifying weaknesses and improving overall trading effectiveness. Incorporating technology, such as trading platforms and tools, enhances analysis capabilities and provides real-time market data. Emphasizing sound risk management practices alongside a disciplined trading approach ultimately contributes to a trader’s success in navigating the complex Forex market.

Conclusion and Future Perspectives

In conclusion, mastering currency pairs is integral to success in Forex trading. Traders must understand the various elements that influence currency prices and how to analyze trends and patterns effectively. By leveraging technical and fundamental analysis, traders can develop robust strategies that align with personal trading styles and risk appetites. Additionally, staying informed about global economic developments and using risk management techniques can protect capital and enhance profitability. The Forex market continues to evolve, influenced by advances in technology, changes in economic policies, and shifts in geopolitical dynamics. As these factors affect currency pair movements, traders must adapt their strategies to stay ahead of the curve. Embracing continuous learning and honing analytical skills is essential for thriving in this competitive landscape. As the financial world grows increasingly interconnected, understanding the nuances of currency pairs will become even more critical for achieving trading success. With dedication and a proactive approach to analysis, traders can confidently navigate the Forex market’s complexities.

As you embark on your Forex trading journey, remember that success doesn’t come overnight. Continuous education, practice, and discipline are essential components of becoming a proficient trader in the currency market. Utilizing resources such as online courses, webinars, and trading communities can significantly enhance your understanding of currency pairs and market behavior. Engaging with fellow traders allows you to share insights and strategies, fostering a supportive environment for growth. Moreover, consider utilizing demo accounts to practice trading without risking real capital. This hands-on experience enables you to apply theoretical knowledge in real-time market conditions, boosting your confidence when you decide to trade with actual funds. As the Forex market is constantly changing, maintaining an adaptable mindset will serve you well. Regularly reviewing and refining your trading strategies will help you stay aligned with market trends. Remember, successful trading is a journey requiring commitment, patience, and a willingness to learn from both successes and setbacks. By embracing these principles, you will position yourself to navigate the complex landscape of Forex trading with increased confidence and effectiveness.