The Importance of Balance Sheets in Financial Reporting

The balance sheet is a critical financial statement that provides a snapshot of a company’s financial position at a specific point in time. It summarizes the company’s assets, liabilities, and shareholders’ equity, allowing stakeholders to assess its financial stability. This document highlights what a company owns and owes, providing vital insights necessary for strategic decision-making. Investors rely on balance sheets to evaluate a company’s capital structure and overall financial health. Understanding this financial statement is key for potential investors and creditors alike. A well-prepared balance sheet can showcase a company’s liquidity, operational efficiency, and financial flexibility. It also enables stakeholders to compare financial information over time and against competitors. Analyzing the balance sheet helps in identifying trends and potential risks. For instance, a significant increase in liabilities relative to assets may raise concerns about solvency. Additionally, a balance sheet supports various regulatory and compliance requirements, ensuring transparency and trust in financial reporting. Its significance extends to management decisions, where leaders utilize its insights to guide future growth and operational strategies effectively. Thus, a balance sheet is invaluable in financial reporting.

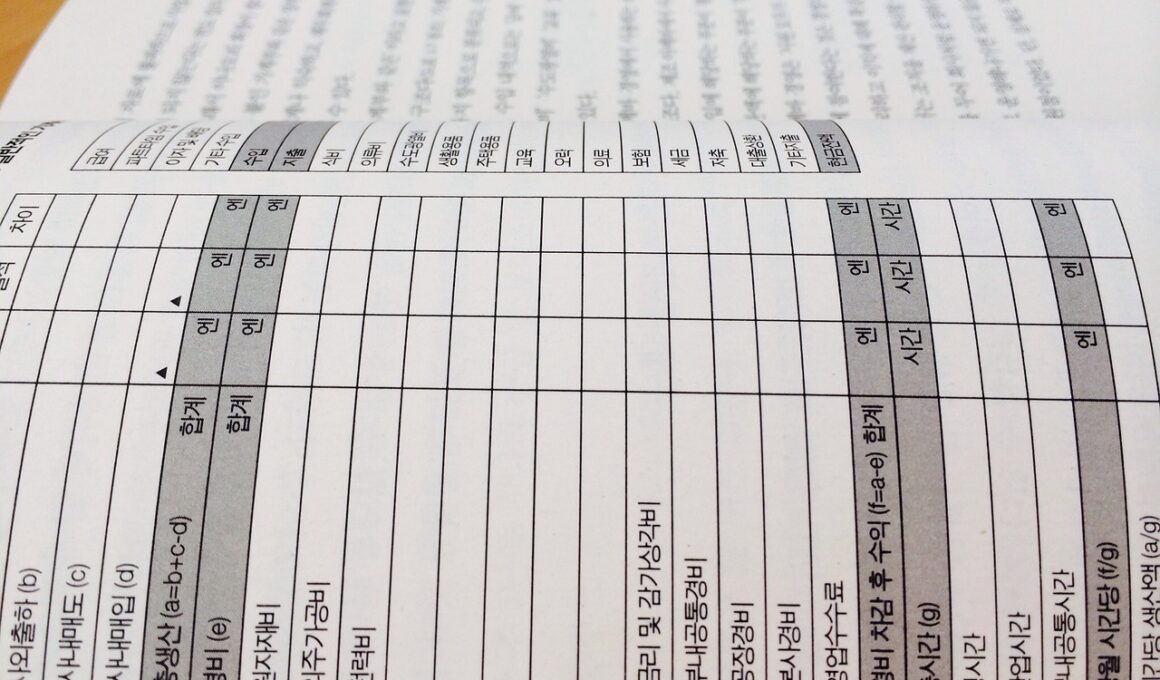

Components of a Balance Sheet

A balance sheet is divided into three primary components: assets, liabilities, and shareholders’ equity. Assets are everything a company owns, such as cash, inventory, equipment, and receivables. They are further categorized as current and non-current. Current assets are expected to be converted into cash within one year, while non-current assets have a longer lifespan. Liabilities represent what the company owes to third parties, including loans and accounts payable. They are also categorized into current and non-current liabilities. Current liabilities are obligations due within one year, while non-current liabilities extend beyond one year. Shareholders’ equity reflects the owners’ claim after liabilities have been deducted from assets. This section includes common stock, retained earnings, and additional paid-in capital. Understanding these components provides a clearer picture of a company’s financial dealings. By analyzing the relationships between these components, stakeholders can make informed predictions about future performance. Moreover, proper management of assets and liabilities is crucial for maintaining financial health and stability. Therefore, comprehending these elements is essential for anyone engaged in financial reporting.

Balance sheets play a vital role in financial analysis and decision-making. Investors and analysts scrutinize these statements for insights into a company’s financial performance and condition. Key financial ratios derived from balance sheet data, such as the debt-to-equity ratio and current ratio, provide indicators of operational efficiency and risk. These ratios help gauge a company’s ability to meet obligations and fund growth. For instance, a high debt-to-equity ratio may signal financial risk, prompting potential investors to approach with caution. Conversely, a healthy current ratio indicates liquidity, suggesting that a company can cover short-term liabilities comfortably. Furthermore, balance sheets facilitate comparisons across time periods and industry benchmarks, enabling stakeholders to identify trends and discrepancies. They serve as a foundation for other financial metrics and reports, allowing for a comprehensive evaluation of corporate performance. Accurate and timely presentation of balance sheets is essential for compliance with accounting standards and regulations. Thus, balance sheets are not merely regulatory documents but also strategic tools that shape investment and operational decisions.

Implications for Stakeholders

Stakeholders significantly benefit from understanding balance sheets as they provide essential insights into a company’s financial stability. For investors, meticulously analyzing a balance sheet allows for informed investment decisions by revealing the underlying value of a business. Analysts utilize balance sheets to adjudicate a company’s capability to generate future cash flows and to hedge risks associated with financial commitments. Creditors depend heavily on balance sheets to evaluate credit risk before extending loans or credit lines to companies. Moreover, management teams use balance sheets to refine operational strategies and make decisions about capital expenditures. This information aids leaders in setting priorities for resource allocation, ultimately enhancing productivity and profitability. Regulatory agencies also rely on balance sheets to ensure compliance with financial laws and governance standards. Furthermore, auditors review balance sheets during financial audits to verify accuracy and adherence to prescribed accounting standards. Consequently, a balance sheet serves as a focal point in high-stakes discussions among diverse parties, underscoring its functional importance in comprehensive financial reporting.

The preparation and presentation of balance sheets require adherence to established accounting principles. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) provide frameworks guiding how balance sheets should be compiled. Compliance with these standards ensures that financial statements are reliable, comparable, and consistent over time. However, organizations may apply specific accounting policies that can impact how financial information appears on the balance sheet. For instance, companies may choose different methods for inventory valuation, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), leading to varying asset values and reported profits. Transparency in these policies is crucial, as it influences stakeholders’ understanding of the balance sheet. Furthermore, maintaining updated information on balance sheets is vital, as outdated figures may mislead users about a company’s financial standing. This urgency for accuracy emphasizes the need for regular reviews and audits. Consequently, establishing effective internal controls and processes for updating balance sheets is essential to avoid discrepancies that could affect decision-making.

Technological Advancements and Balance Sheets

Recent technological advancements have profoundly impacted the way balance sheets are prepared, analyzed, and shared. Digital tools and accounting software have revolutionized the process, enabling quick data entry and automating calculations to ensure accuracy. These innovations reduce errors and improve efficiency, allowing accountants to focus on analysis rather than mere data entry. Additionally, cloud-based platforms have enhanced accessibility, enabling stakeholders to access real-time balance sheet information anytime and anywhere, increasing transparency. Companies can generate instant financial reports, making it easier to respond swiftly to financial challenges. Big data analytics further enhances balance sheet analysis by allowing organizations to sift through vast amounts of information and identify meaningful patterns and trends. Artificial intelligence (AI) is also being integrated into financial reporting, providing sophisticated analytics and assisting in predictive modeling. However, with these advancements come new challenges, such as the need for proper cybersecurity measures to protect sensitive financial data. Thus, while technology streamlines balance sheet processes, a balanced approach to innovation and security is essential.

In conclusion, balance sheets hold crucial significance in financial reporting, serving as a cornerstone for various stakeholders’ decision-making processes. These documents provide insights into a company’s financial health, highlighting the relationship between assets, liabilities, and equity. Understanding balance sheets is essential for investors, creditors, and management to make informed decisions. They facilitate transparency and compliance with legal standards, ensuring trust in corporate reporting. With the advent of technology, the preparation and analysis of balance sheets have evolved, increasing accuracy and accessibility for users. However, stakeholders must remain aware of the implications of technology, including security risks that accompany digital transactions. Moving forward, the need for precise, timely, and transparent balance sheets is more critical than ever. As companies navigate an increasingly competitive environment, mastering the balance sheet will empower stakeholders to seize opportunities effectively and mitigate risks. Therefore, investing time in understanding balance sheets can yield substantial returns for individuals and organizations, promoting sustainable financial growth and stability.