Understanding Debt and Liabilities in Financial Statements

Debt and liabilities are core components of financial statements, playing a fundamental role in evaluating an organization’s financial health. They represent the obligations that a company has to fulfill, whether due to external borrowing or internal accounting standards. Understanding these elements is crucial for stakeholders, including investors, creditors, and management. Analyzing debt and liabilities helps in assessing a company’s solvency, liquidity, and overall financial position. Key distinctions between different types of debts and liabilities are necessary for clarity. Short-term obligations, often termed current liabilities, are expected to be settled within a year, while long-term liabilities extend beyond one year. Investors and analysts focus on these classifications to get a clearer picture of financial risks and needs. It is essential to carefully evaluate each component and understand its implications on the company’s financial stability and future strategies. By doing so, stakeholders can make informed decisions and develop effective plans to address potential financial challenges. Investing in knowledge about debts and liabilities fosters a deeper understanding of financial statements, enhancing their utility for various financial decisions.

In the realm of financial statements, debts can be broadly classified into several types. Generally, there are secured and unsecured debts, both of which hold distinct implications for a company’s balance sheet. Secured debt refers to obligations backed by collateral, which offers creditors a layer of protection in case of default. Examples include mortgages and loans secured by specific assets, such as equipment or real estate. On the other hand, unsecured debt does not involve collateral, placing creditors at higher risk if the borrower fails to repay. This type includes credit card debt and many personal loans. Another critical classification arises from the nature of liabilities, namely operating liabilities versus financing liabilities. Operating liabilities are directly tied to the core business operations and day-to-day activities, while financing liabilities relate to funds raised through loans or credit. A careful classification and understanding of these debts is vital in elucidating how they impact financial stability and growth potential.

Evaluating Debt Levels

Evaluating debt levels is essential for understanding financial leverage and risk. Companies often use ratios, such as the debt-to-equity ratio, to measure their leverage. This ratio compares total debt to shareholders’ equity, providing insights into how much of the business is financed through debt versus equity investments. A higher ratio indicates increased reliance on debt, which may signal higher risk, especially during economic downturns. Investors closely examine these ratios to assess risk levels and make informed investment choices. Likewise, the interest coverage ratio is vital for evaluating a company’s ability to meet interest obligations. This ratio measures earnings before interest and taxes (EBIT) against interest expenses, highlighting how comfortably a company can handle its debt servicing. Moreover, cash flow statements oftentimes provide a clearer view of a company’s capacity to cover its obligations over time. Evaluating debt levels through these metrics enables stakeholders to gain a comprehensive understanding of financial health, aiding in identifying potential issues before they escalate significantly, thereby promoting proactive financial management.

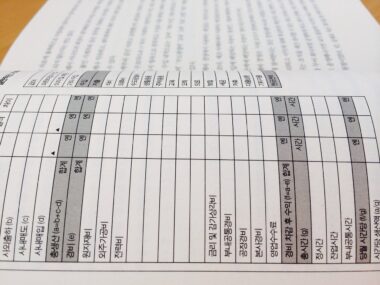

The classification of liabilities into current and long-term is essential for effective financial planning. Current liabilities are the debts due within the fiscal year, while long-term liabilities extend past this timeframe. Analyzing these categories gives stakeholders insight into an organization’s short-term versus long-term financial commitments. The ability to pay off current liabilities is crucial for assessing liquidity and operational efficiency. Companies must ensure they have enough current assets to cover these obligations, as failure to do so can lead to cash flow problems and potential bankruptcy. Conversely, long-term liabilities can indicate how robust a company’s financial structure is, particularly in relation to financing growth initiatives. Companies often incur long-term liabilities to fund expansion or new projects, hoping that anticipated growth will allow them to cover these costs over time. Understanding the balance between current and long-term liabilities aids in assessing a firm’s overall risk profile and long-term strategy, allowing for better planning and execution of business objectives. Knowledge of these classifications fosters informed decision-making.

Impact on Financial Ratios

Debt and liabilities significantly influence various financial ratios, which investors and analysts scrutinize for assessment. The current ratio measures the company’s ability to pay short-term obligations by comparing current assets to current liabilities. A ratio below 1 may indicate financial distress, emphasizing the importance of maintaining adequate liquidity levels. Moreover, the quick ratio offers a more immediate view of liquidity by excluding inventory from current assets. This measure focuses on the most liquid assets available to meet current liabilities. For long-term considerations, the debt-to-assets ratio is critical, showcasing the percentage of total assets financed through debt. High values might caution stakeholders about the company’s financial stability. Similarly, the return on equity (ROE) assesses profitability by measuring net income generated relative to shareholder equity. Debt influences this ratio since it can potentially amplify returns. In summary, understanding how debts and liabilities impact these financial ratios is crucial for strategic planning and risk assessment, aiding stakeholders in making pivotal decisions and fostering financial accountability within the organization.

Another important consideration about debt and liabilities in financial statements is off-balance-sheet financing. This accounting practice allows companies to keep certain debts off their balance sheets, which can make their financial position appear stronger than it is. Typical examples include operating leases and special purpose entities (SPEs). While this can provide financial flexibility and improve key ratios temporarily, it raises concerns about transparency and the true financial risk facing the company. Investors need to be cautious regarding these hidden liabilities, as they can significantly affect overall financial assessments. Understanding the implications of off-balance-sheet financing requires careful scrutiny of notes to the financial statements, where such arrangements are often disclosed. Transparency in financial reporting is vital for making informed decisions and fostering trust among stakeholders. While off-balance-sheet items may provide short-term advantages, long-term sustainability relies on a clear understanding of all liabilities. Therefore, grasping this concept aids in developing a more holistic view of a company’s financial health, ensuring that stakeholders are well-informed about potential risks and benefits associated with debt management.

Conclusion: Debt Management Strategies

Effective debt management is essential for ensuring long-term financial viability and stability. Companies should develop strategies to optimize their capital structure by balancing debt and equity financing. Implementing strategies like debt refinancing can lower interest rates and extend repayment periods, alleviating immediate financial pressures. Furthermore, establishing clear cash flow models helps companies project future cash needs and plan for repayments accurately. Regular monitoring of debt levels relative to cash flow and earnings enables businesses to make timely adjustments, preventing overspending or excessive borrowing. Additionally, fostering strong relationships with creditors facilitates better terms and speedier negotiations for refinancing when needed. Companies should also focus on improving operational efficiencies to boost earnings potential, thereby providing more room to manage existing debts. Educational initiatives surrounding debt management can empower management teams, ensuring they understand the risks and opportunities associated with various financing options. Ultimately, it is through disciplined debt management strategies that companies can navigate financial challenges while positioning themselves for sustainable growth opportunities in an ever-evolving economic landscape.

Understanding debt and liabilities in financial statements requires continuous learning and a proactive approach to financial management. Being aware of the distinctions and impacts of various obligations enables stakeholders to engage in more informed decision-making. So, effectively applying this knowledge in practice not only aids in overall business strategy development but directly contributes to the financial health of an organization. Moreover, keeping abreast of changing regulations and market dynamics can further enhance a company’s ability to manage debt and liabilities strategically. In conclusion, comprehensive insight into debt and liabilities will allow managers, investors, and other key stakeholders to contribute positively to the financial success of their organizations while minimizing risks and exploring new opportunities for growth.