Loan Default: Consequences and How to Prevent It

Loan default occurs when a borrower fails to meet the legal obligations of their loan agreement, failing to make required payments on schedule. The implications of default are severe and can severely affect a person’s financial health. Defaulting on a loan not only impacts your credit score but also places you in a position of financial distress, making it difficult to secure future loans. When a loan is defaulted, the lender may take legal action to recover the owed amount. Creditors often initiate collections, which can lead to increased fees, wage garnishments, or even asset repossession. Understanding your loan terms and conditions is essential to avoid default and its repercussions. Knowledge about interest rates, payment schedules, and penalty clauses can aid significantly in looms that might loom over a default scenario. Ensuring timely payments requires proactive management of your finances and budget allocation. If ever in a position to default, communication with lenders can often lead to possible adjustments, such as extended payment terms. Taking preventive measures is the best strategy to avoid the negative consequences associated with loan defaults.

The impact of loan default extends beyond immediate financial penalties. Besides affecting your credit score, defaulting can hamper your ability to acquire other forms of credit. This inability can create a detrimental cycle of financial instability where recent defaults contribute to increased repayments on new loans, leading to difficulties in securing better terms. Such hurdles can lead to a diminished capacity to make any significant purchases, like a home or car, creating long-term consequences. It’s essential to be aware of your options to manage and prioritize any outstanding debt. Setting up monthly reminders or using financial tools can help maintain a structured repayment plan. Negotiating loan terms with lenders for more favorable conditions can also be beneficial. Options such as deferment or forbearance may be available if you’re struggling financially, allowing you to manage your payments better. Ignoring the problem can lead to a snowball effect, culminating in additional stress and further financial deterioration. Engaging in proactive communication with lenders is key to finding viable solutions before reaching the state of default. Always keep an open line of communication and remain proactive about your financial obligations.

The role of budgeting cannot be overstated when it comes to managing loans. Creating and maintaining an effective budget helps track income, expenses, and loan repayments. A well-structured budget will prioritize essential needs, helping allocate resources to prevent any missed payments. Consider utilizing budgeting apps or spreadsheets to keep the financial overview clear and manageable. Regular evaluations of one’s budget can reveal areas of excess spending that, when adjusted, can free up funds for necessary loan payments. Additionally, understanding your total debt-to-income ratio can offer insights into your financial health and identify at-risk situations before they escalate. Early recognition of potential issues allows you to make informed decisions about your finances, keeping you ahead of payments. Another helpful strategy may include setting up automatic payments. This method ensures that payments are made on time and can also help in avoiding penalties and late fees, which significantly contribute to loan burden. Always remember to account for unexpected expenses by incorporating a safety buffer into your budget, facilitating smoother transactions and arrangements even during financially tight periods.

Understanding Your Loan Agreement

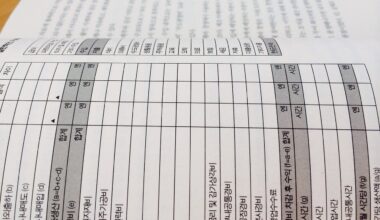

A thorough understanding of your loan agreement is crucial in loan management. Every loan agreement carries specific terms and conditions that detail repayment schedules, interest rates, and potential penalties for late payments. Ignoring these details can lead to unforeseen complications resulting in default. Ensure you read the entire document carefully and ask questions if you encounter jargon or clauses that are confusing. Many lenders also provide resources or customer service support to clarify any uncertainties. It’s wise to keep a copy of your agreement for future reference, making it easier to identify your obligations. Moreover, some agreements may have options for loan modifications under specific circumstances. Documenting your payment history can be advantageous, especially if disputes arise regarding missed payments. Regular reviews of your agreement in relation to your financial situation may reveal opportunities for refinancing, which can potentially save you money in the long run. Keeping abreast of the terms allows for better preparation against default conditions, ensuring you remain compliant with the agreed-upon conditions. Comprehensive knowledge of your loan details aids in maintaining a healthy financial outlook.

When default appears imminent, proactive measures are essential to mitigate risks and potential damages. Firstly, establish direct communication with your lender. Most lenders prefer to work with you rather than going down the default route, as it serves their interests too. They may offer alternative payment plans or solutions tailored to your situation, which can lessen the impact of a possible default. Creating a personal repayment plan based on your available budget can also assist in preventing defaults. This plan should prioritize high-interest debts or payments that would significantly impact your life if left unpaid. If necessary, do not hesitate to seek advice from a financial counselor who can provide personalized assistance and additional resources to help you navigate your financial situation. Don’t allow shame or fear to stop you; it is crucial to acknowledge the problem and seek support as early as possible. Remember that compound interest can lead to escalating debt quickly, thus prompt action and awareness of your obligations can save you from the distress of default. Remind yourself that financial challenges can be overcome with the right strategies in place.

Repercussions of Defaulting

The repercussions of defaulting on a loan can be devastating and widespread. Aside from creating a poor credit score, which can remain on your report for years, it can lead to legal ramifications such as wage garnishments, making it challenging to recover financially. Lenders may reach out to collections agencies to recoup their losses, further complicating your financial picture and potentially leading to bankruptcy. The emotional toll associated with default can manifest in stress, anxiety, and adverse effects on personal relationships. Individuals may find themselves reluctant to make necessary purchases or investments due to their damaged credit history. However, it’s crucial to remember that while the consequences are significant, they are not insurmountable. Seeking financial advice can help you develop a plan for recovery, focusing on rebuilding credit and potentially correcting any injustices related to your loan circumstances. Protection laws also exist that may provide some relief in severe cases. Maintaining an optimistic outlook and understanding that loan defaults are common issues can inspire individuals to take action. It’s vital to stay informed about recovery options to pave the way for overcoming future obstacles.

In conclusion, understanding loan terms and conditions is essential to avoid default and its overwhelming consequences. By proactively managing loans, communicating effectively with lenders, and budgeting wisely, individuals can safeguard their financial future. Understanding implications, rights, and obligations allows borrowers to navigate the often-complex landscape of loans. Moving forward, regular financial assessments should be part of one’s routine to ensure awareness of risks and manage obligations effectively. Remember, timely payments not only protect your credit score but also build financial confidence. If facing potential issues, taking immediate action can prevent defaults as well as foster better arrangements with lenders willing to negotiate feasible options. Financial education is vital, and seeking resources for learning about loans can empower individuals in making informed decisions. Engaging with financial advisors or online resources can further enhance understanding, helping to develop improved financial literacy. Moreover, fostering a collaborative relationship with lenders may yield better results in times of difficulties. Ultimately, remaining informed and proactive is key to ensuring a healthy economic state, thus avoiding the dangers of loan defaults and establishing a stable financial trajectory.