How to Use Financial Statements for Personal Financial Planning

Financial statements are essential tools for grasping your personal finances. They provide a clear picture of your income, expenses, assets, and liabilities, allowing you to make informed choices about spending and saving. The primary types of statements you will analyze are the balance sheet, income statement, and cash flow statement. Each serves a distinct purpose and contributes to an understanding of your financial health. The balance sheet displays your overall financial condition at a specific moment. Meanwhile, the income statement reveals how much you earn and spend over a period, offering insight into your profitability.

Finally, the cash flow statement tracks the movement of cash into and out of your finances. Together, these documents create a comprehensive picture that aids in effective money management. By actively reviewing these financial statements, you can identify patterns in spending and earning, allowing you to adjust your budget accordingly. It can also pinpoints areas where you might cut costs or increase savings. Whether you’re planning for retirement or aiming to purchase a home, financial statements play a crucial role, serving as your guide toward achieving your financial goals.

Interpreting the Balance Sheet

The balance sheet is a critical component of understanding your financial position. It lists your assets on one side and liabilities on the other, with the difference representing your net worth. Assets might include your home, bank accounts, and investments. Liabilities comprise loans, credit card debts, and mortgages. By reviewing your balance sheet regularly, you gain insight into how much wealth you are accumulating and the balance between what you own and what you owe. A positive reflection on your balance sheet shows favorable financial health.

Additionally, tracking changes in your balance sheet over time can highlight trends in your financial situation. Are your assets increasing while liabilities decrease? This is a positive indicator. Conversely, if liabilities rise faster than assets, it may signal the need for better budgeting or financial strategies. By engaging with your balance sheet, you can facilitate informed decision-making regarding purchasing or investment opportunities, ultimately impacting your overall wealth strategy.

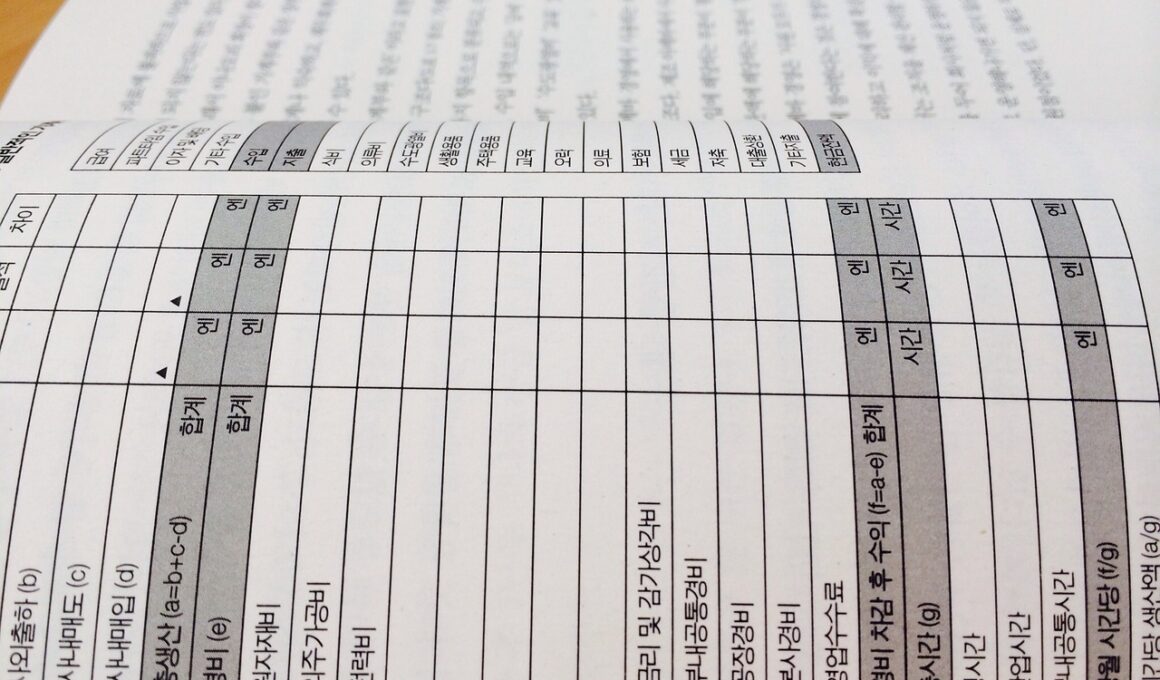

Understanding the Income Statement

Next, the income statement is vital for evaluating your earning and spending patterns. It details your total income, including salaries and passive income streams, alongside total expenses such as bills, groceries, and entertainment. This statement helps you determine your net income after subtracting expenses from total revenue. Having a clear picture of income versus outgoings allows for more targeted budgeting. You can identify areas where you may overspend or find unexpected savings opportunities.

By maintaining an accurate income statement, monthly or annually, you will be better equipped to forecast future earnings and expenses. It also provides a foundation for making significant financial commitments, like investments or loans. Regularly assessing your income statement is key for developing a sustainable lifestyle aligned with your financial goals. This practice helps create awareness and promotes healthier financial habits that you can implement over time.

Analyzing Cash Flow Statements

The cash flow statement is another vital document to consider when planning your finances. This statement showcases where your money is coming from and where it’s going, creating a clear layout of your cash inflows and outflows. Cash flow is crucial because it helps determine your ability to meet short-term obligations, such as bill payments. Cash flow statements are categorized into operating, investing, and financing activities, each reflecting different facets of your personal finance activities.

Understanding your cash flow offers profound insight into how well you manage your day-to-day finances. A consistent positive cash flow means you have surplus funds available for saving or investing. Conversely, if your cash flow shows consistent deficits, it’s time for an immediate reevaluation of spending habits and budgeting strategies. By focusing on cash flow, you can address potential financial crises before they happen and ensure that your budget remains balanced, supporting your financial well-being.