The State of SME Financing and Banks’ Role in Supporting Small Businesses

Small and medium enterprises (SMEs) play a crucial role in driving economic growth and job creation worldwide. These businesses constitute a significant portion of businesses and employment across various sectors. Yet, despite their importance, SMEs often face substantial challenges in accessing finance. Traditional banks have historically been reluctant to lend to smaller businesses, citing perceived risks and lower profitability. This has created a funding gap that stifles innovation and growth among SMEs. In response to these challenges, banks are increasingly recognizing the need to adapt to better serve this segment. Many have launched specialized financing products and services aimed directly at SMEs, streamlining their application processes and offering tailored support. Additionally, banks are now leveraging technology to enhance their risk assessment processes, making it possible to evaluate SME borrowers more accurately and efficiently. As these institutions evolve, effective collaboration between banks, alternative lenders, and government programs may become vital in bridging the financing gap. With the right strategies, banks can play a pivotal role in supporting SMEs and fostering a healthier economy in the long term.

The landscape of SME financing has been undergoing significant changes in recent years. Alternative financing options such as crowdfunding and peer-to-peer lending have gained considerable traction. These platforms provide small businesses with opportunities to secure funding without relying solely on traditional banks. With the rise of fintech companies, technology has reshaped the way SMEs access capital. Applications and platforms allow business owners to compare financing options and apply online instantly. Additionally, many fintech firms offer innovative solutions tailored specifically for SMEs, often with faster approval times compared to conventional banks. Banks, in recognizing this shift, are compelled to innovate their processes and products. They are exploring partnerships with fintech firms to enhance their service offerings and customer experience. By integrating new technologies and digital channels, banks can not only keep pace with changing market dynamics but also redefine their role in the SME lending landscape. Moreover, the collaboration between traditional banks and new entrants can lead to a more inclusive financial ecosystem that effectively addresses the unique challenges faced by SMEs seeking financing.

Challenges in SME Financing

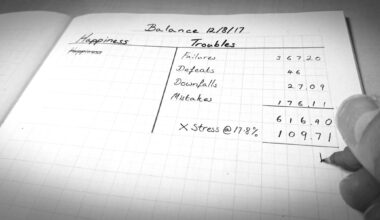

Despite the advancements in financing options, SMEs still face various challenges when obtaining capital. One significant hurdle is the lack of comprehensive financial records, which can impair a business’s ability to convince lenders of its creditworthiness. Many small business owners struggle with bookkeeping and financial planning, leading to incomplete or inaccurate financial statements. This results in an assessment process filled with uncertainty and risk for lenders. Additionally, SMEs often lack the collateral required by traditional banks for securing loans. Unlike larger firms, many small businesses do not possess substantial assets that can be used as guarantees in case of default. The recent economic shifts, coupled with global uncertainties, can exacerbate these issues. For many SMEs, this environment increases the perceived risks associated with lending, causing banks to tighten their lending criteria even further. Consequently, many potential SME borrowers find themselves unable to access the funding necessary for expansion or overcoming financial hurdles. To address these challenges, greater financial literacy and support programs tailored for SMEs are essential in improving their funding prospects.

Another critical challenge is the evolving economic landscape, which significantly impacts the banking sector’s willingness to lend. Economic downturns or crises can create an environment of uncertainty, making banks more hesitant to provide financing. During such times, banks might prioritize lending to established businesses with portfolios that reflect lower risk profiles, often overlooking emerging SMEs. This behavior can stifle the growth potential of innovative ideas and startups that require financial backing to scale. Furthermore, the competitive market landscape means that small businesses are often forced to seek out non-traditional financing sources, which may involve higher interest rates or less favorable terms. As economic conditions fluctuate, banks must navigate this delicate balance, seeking to manage their risk while still supporting the development of SMEs. This requires a shift in perspective to view SMEs not just as high-risk clients but as valuable partners in economic growth and community development. Understanding the unique needs of SMEs allows banks to create products that cater specifically to them while reducing the perceived risks associated with lending.

The Role of Government and Policy

The role of government in facilitating SME financing cannot be overstated. Public policy plays a vital part in shaping the lending landscape by providing frameworks and incentives for banks and financial institutions to engage with SMEs. Governments can implement policies promoting access to finance, which may include guarantees or subsidies for loans provided to small businesses. Such initiatives aim to reduce the lending risks perceived by banks and create a more favorable environment for SME financing. Furthermore, governments can also establish dedicated funds or programs specifically targeting underserved sectors to ensure equitable access to credit. Comprehensive training programs on financial management for business owners, supported by governmental initiatives, can enhance the financial literacy of SMEs. Increased financial literacy equips entrepreneurs with the knowledge necessary to navigate the lending landscape effectively. Additionally, government-backed initiatives can encourage banks to adopt more innovative, tech-driven approaches in serving the SME market. As a result, the collaboration between private and public sectors can create a more supportive infrastructure for SMEs, ultimately driving growth and innovation.

Additionally, as sustainability becomes an increasingly integral part of business practices, banks face pressure to align their lending strategies with social and environmental responsibility. The growing emphasis on sustainability means that SMEs looking to obtain financing may also be required to demonstrate their adherence to sustainable practices. This could involve showcasing their commitment to reducing carbon footprints or supporting community initiatives. Consequently, banks must develop a deeper understanding of how to assess risks associated with sustainability and incorporate those considerations into their valuation models. For SMEs, effectively communicating their sustainability initiatives may enhance their attractiveness to lenders. On the other hand, banks can adopt innovative approaches and metrics to evaluate a company’s commitment to sustainability within their lending criteria. This evolving focus on sustainability also opens new opportunities for SMEs by attracting green financing options specifically designed to support eco-friendly initiatives. By integrating sustainability into their lending practices, banks not solely comply with emerging regulations but also foster a more responsible business landscape that champions necessary change.

Conclusion

The state of SME financing is multidimensional, characterized by challenges and evolving solutions. Banks play an increasingly significant role in addressing these challenges while fostering a conducive environment for small businesses to thrive. By embracing new technologies, partnering with fintech firms, and enhancing their risk assessments, banks can evolve to meet the unique needs of SMEs. Furthermore, collaboration with governmental and policy frameworks can help create a favorable lending landscape conducive to growth. Importantly, as sustainability takes center stage, banks must adapt to the changing expectations of both the market and society. Small businesses have the potential to drive innovation and economic development; however, achieving that potential relies heavily on access to financing. By reforming lending practices and proactively supporting SMEs, banks not only help build a more robust economic foundation but also ensure long-term growth within communities. The synergy between banks and SMEs can pave the way for a resilient economy that thrives on innovation, collaboration, and adaptability in a rapidly changing world.

By understanding the challenges and opportunities within SME financing, banks can position themselves as partners in growth. This collaborative spirit is essential for navigating the complexities of today’s financial landscape.