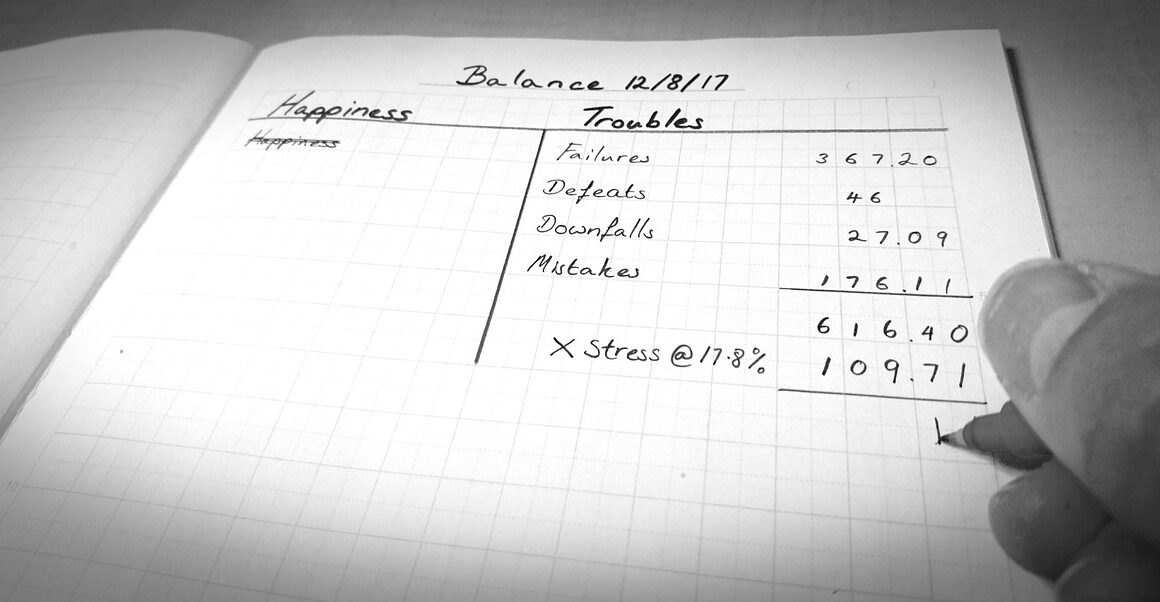

Modeling Balance Sheets: Essential Concepts

Understanding balance sheets is fundamental for anyone engaged in financial analysis. A balance sheet provides a snapshot of a company’s financial position at a specific moment, detailing assets, liabilities, and shareholders’ equity. The equation that governs this is Assets = Liabilities + Equity, which underscores the balance of the financial equation. Assets are what the company owns, including cash, inventories, and property. Conversely, liabilities consist of obligations the company must fulfill, such as loans and accounts payable. Shareholders’ equity represents the owners’ claim after subtracting liabilities from assets. Each component plays a critical role in evaluating a company’s financial health and liquidity. Analyzing balance sheets allows for better investment decisions and helps stakeholders understand how effectively a company utilizes its resources. Regular updates to this financial statement improve forecasting and strategic planning. Ultimately, proficiently modeling balance sheets is essential in corporate finance as it aids in assessing risks, profitability, and operational efficiency. Financial professionals must ensure data integrity and accuracy during this process to provide reliable insights for potential investors and current stakeholders.

Key Components of a Balance Sheet

The balance sheet comprises three primary sections: assets, liabilities, and shareholders’ equity. Within the assets section, current and non-current assets are identified. Current assets include cash, inventory, and receivables expected to be realized within a year. Non-current assets, however, include long-term investments, property, and equipment that provide value over more than one year. The liabilities section reflects current obligations, such as accounts payable and short-term loans, alongside long-term debts like mortgages and bonds. This section clarifies how much the firm owes and its financial obligations at different time frames. Shareholders’ equity captures the net worth of the company by showcasing retained earnings and stock issued. Understanding these components is pivotal in financial modeling, guiding analysts to develop insights regarding liquidity, operational efficiency, and financial stability. Each section’s total provides vital data for stakeholders interested in profitability and long-term performance. By analyzing the relationship between these components, professionals can project future cash flows, assess risk factors, and evaluate overall operational effectiveness. A deep understanding of these elements enhances strategic decision-making in a corporate environment.

When constructing a balance sheet model, the balance sheet must reflect accurate and organized financial data. Clarity is key, as stakeholders will reference this data when making financial decisions. A well-structured format helps to promote transparency and ease of understanding. Financial modeling tools often utilize software platforms where data can be inputted and manipulated efficiently. Including formulas within the model enables automatic calculations and real-time updates, ensuring the balance sheet remains current. Sensitivity analysis can be introduced to project various financial scenarios and outcomes based on different variables. Keeping the model flexible allows analysts to assess different strategies and their potential financial implications swiftly. Financial professionals should incorporate historical data into their models to strengthen accuracy, providing context for trends and potential future predictions. Consistent reviews of the model help refine it over time, ensuring it meets the evolving needs of the organization and its stakeholders. Mastery of these modeling basics is crucial in guiding informed decisions for both financial management and corporate strategies. Analysts play an essential role in maintaining this process diligently, as financial data compiles complexities that determine a company’s viability.

Common Pitfalls in Balance Sheet Modeling

While modeling balance sheets, various common pitfalls can be encountered. One major issue stems from data inconsistency, which can arise from input errors or misalignments between financial reports and the model. To avoid this, analysts must have established protocols for verifying data integrity and performing regular reconciliations. Furthermore, overly complex models can obscure vital information, making interpretation difficult for end-users. Keeping the model straightforward enables better comprehension and usability. Additionally, failing to update the model regularly is another frequent mistake, resulting in outdated analyses that could mislead decision-making. Financial environments can change rapidly, meaning that timely updates based on the most current data are imperative. Another critical oversight is neglecting to consider external economic factors affecting balance sheet components, like market changes that can significantly impact asset valuations or liabilities. Effective communication regarding assumptions and methodologies used in the model is essential for transparency. Ultimately, understanding and addressing these pitfalls allows financial analysts to enhance their balance sheet models, contributing to accurate forecasting and strategically informed conclusions.

To enhance balance sheet modeling skills, financial analysts must engage in continuous learning and practice. Familiarity with advanced financial modeling techniques empowers professionals to analyze complex data sets more effectively. Participating in workshops or online courses is a great way for analysts to network with peers and gain insights into the latest industry trends. Also, reading industry publications and financial journals keeps professionals up-to-date on economic indicators that influence balance sheets. Analysts may also consider seeking mentorship from experienced colleagues who can share their knowledge and best practices developed over time. Regularly assessing one’s skills and identifying areas for improvement leads to more effective financial modeling capabilities. Utilizing financial modeling best practices, such as clear documentation and structured approaches, is essential for creating reliable models. Innovative software tools enable quicker calculations and thorough data analysis, providing analysts with a competitive edge. By incorporating new tools and methods, individuals can adapt their models to changing market demands. Commitment to refining modeling skills is critical in a fast-paced financial environment, ensuring analysts remain adaptable and effective in their roles.

Real-World Applications of Balance Sheet Models

Finance professionals regularly utilize balance sheet models to support investment and lending decisions. Lenders assess balance sheets to evaluate a borrower’s solvency and creditworthiness before approving loans. This assessment helps minimize the lender’s risk by ensuring that the borrower possesses adequate assets to cover liabilities. Additionally, investors analyze these models to determine a company’s financial position, particularly its ability to generate long-term returns. They assess debt levels, operational efficiency, and asset utilization to forecast a firm’s potential for growth. Mergers and acquisitions often involve comprehensive evaluation of balance sheets to ascertain whether a target company is a wise investment. Analysts use modeling techniques to compare historical and projected data in making these decisions. Moreover, publicly-traded firms present balance sheets quarterly, providing insights that influence stock prices. Understanding how external factors such as market conditions, regulatory changes, and industry trends can impact balance sheet items is crucial. Overall, practical applications of these models extend beyond traditional finance, influencing decisions in various sectors, including consulting and strategic planning, where financial health assessments are required for projecting sustainability and performance.

Financial analysts should continuously seek to refine their understanding of balance sheets for effective modeling. Regular collaboration with colleagues leads to diverse perspectives that enhance analytical capabilities. Critical discussions surrounding financial data and assumptions can illuminate aspects otherwise overlooked. Establishing a framework for team reviews ensures accuracy and consistency within models, reducing errors. Furthermore, creating templates for common financial scenarios can reduce modeling time and streamline reporting processes. Financial professionals might wish to incorporate graphical representations, such as charts or graphs, to enhance communication of critical data points. Visual aids facilitate quick comprehension of complex financial concepts for stakeholders who may not possess extensive financial literacy. Additionally, employing scenario analysis provides insights into potential future financial states, allowing for better strategic planning. Engaging stakeholders in model developments also fosters ownership and encourages collaboration, leading to richer feedback and innovation. As the dynamic financial landscape continues to evolve, mastering balance sheet modeling empowers analysts to make informed decisions, drive corporate strategies, and ultimately enhance organizational performance. A commitment to continual improvement and collaborative efforts ensures that these models remain relevant and beneficial across various financial engagements.

In the financial analysis domain, balance sheets serve as gateways to understanding a firm’s economic status. The integration of technology has greatly simplified the modeling process, enabling analysts to maintain databases for sophisticated computations. This technological integration safeguards against missed data and inconsistencies within projections. Analysts often utilize tools like Microsoft Excel or specialized financial modeling software, which permits automation of calculations and updates. Such tools enhance the accuracy of balance sheet modeling significantly, thus facilitating more streamlined and clearer presentations of financial status to stakeholders. Additionally, incorporating visual analytics assists in elevating presentations, as stakeholders often prefer graphical representations of data instead of extensive numerical tables. These representations also help clarify complex information quickly, ensuring that major points are communicated effectively without overwhelm. Remote collaboration tools allow teams to work jointly irrespective of geographical barriers, enhancing information sharing and collective problem-solving. By comprehensively modeling balance sheets and making data-driven decisions, financial analysts contribute to robust financial planning and strategy development for companies. This integration of technology and collaboration fosters an environment conducive to innovation and strategic insight, moving the field of financial analysis forward into a bright future.