Understanding Intermarket Analysis in Forex Trading: A Comprehensive Guide

Intermarket analysis is crucial in Forex trading. It enables traders to understand the connections between different asset classes, such as stocks, bonds, commodities, and currencies. By analyzing these relationships, traders can make informed decisions based on overall market trends rather than on isolated price movements. Essentially, intermarket analysis provides a broader perspective, allowing traders to see how economics influences various markets. Each asset class can impact currency values, creating a web of influence that traders need to analyze effectively. For instance, a rise in oil prices can strengthen the Canadian dollar due to Canada’s significant oil exports. Thus, understanding these correlations can enhance a trader’s ability to anticipate market movements. Moreover, traders often utilize technical analysis alongside intermarket analysis for more robust trading strategies. This integration helps in identifying critical levels of support and resistance. Additionally, keeping an eye on economic indicators from different sectors can also inform traders about potential currency movements.

Intermarket relationships take various forms, notably inversely and positively correlated assets. For example, traditionally, when bond prices rise, stock prices tend to fall, creating a negative correlation. This dynamic highlights how a trader’s understanding of bond movements can influence their Forex strategy. Another vital connection lies between commodities like gold and currencies such as the Australian dollar. As gold prices rise, the Australian dollar often strengthens due to the country’s rich mineral resources. A Forex trader can monitor these interdependencies to derive insights into market conditions. By recognizing these patterns, traders can better position themselves in the market. Furthermore, looking at economic reports like GDP growth or employment rates can provide additional context. A country’s economic health plays a significant role in determining its currency strength. Hence, traders should also consider geopolitical factors that might affect currency values, such as conflict or trade agreements. By taking a holistic approach, traders are better equipped to identify and act on profitable opportunities in Forex markets.

The Role of Correlation in Forex Markets

Correlation among different assets is at the core of intermarket analysis. Understanding these correlations allows traders to spot opportunities and risks in Forex trading. Positive correlations mean that two assets move in the same direction while negative correlations indicate an opposite trend. A trader can significantly enhance their strategy by understanding these correlations in the various markets. For example, if two currencies are positively correlated, a trader might prefer not to open positions in both as they would essentially bet on the same outcome. On the contrary, when currencies are negatively correlated, traders can hedge their positions against adverse market moves. To analyze these correlations effectively, tools such as correlation matrices can be helpful. Instead of relying just on price charts, traders can utilize these analytical tools to pinpoint relationships between pairs systematically. This method adds another layer to technical analysis, making it a valuable component of successful Forex trading. Thus, mastering correlations can provide insights that can directly affect trading performance.

Diversification is essential in managing risk, and intermarket analysis supports this strategy. By investing in assets with varied relationships, traders reduce the potential impact of negative trends in one area. When one market experiences volatility, other markets may remain stable or even thrive. Awareness of these dynamics allows traders to develop a more balanced and resilient portfolio. Forex traders can implement intermarket diversification by choosing currency pairs that behave differently based on prevailing economic conditions. For instance, during a downturn in the equity market, a currency like the Japanese yen can strengthen as investors seek safe-haven assets. Understanding these behaviors can make a trader’s approach more strategic. Furthermore, traders can lock in profits during uncertain times by using non-correlated assets as a buffer. Additionally, staying informed about macroeconomic trends across different regions can significantly enhance this diversification strategy. By employing intermarket analysis, traders can position themselves intelligently in the Forex market, ensuring they minimize risk while maximizing potential returns.

Technical Tools for Intermarket Analysis

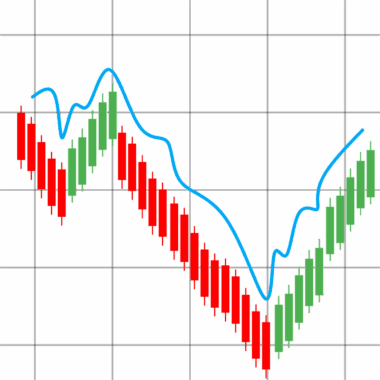

Traders can leverage various technical tools for effective intermarket analysis, enhancing their trading strategies. Charting software is one indispensable tool that allows traders to observe price movements across multiple asset classes. This software can provide insights into how different sectors react to economic data releases or geopolitical events. By maximizing these insights, traders can strategically position themselves. In addition, traders often utilize indicators like Relative Strength Index (RSI) and Bollinger Bands, which can help assess market momentum and volatility. Understanding how these indicators function in conjunction with intermarket dynamics allows traders to optimize entry and exit points. Trend analysis is another fundamental technique in Forex trading that can be made more potent through intermarket analysis. By gauging strength or weakness in related markets, traders can increase their probability of success. Moreover, analytical platforms offer features that allow traders to conduct backtests on their trading strategies, providing a historical perspective on the effectiveness of intermarket influences. This approach offers valuable data that can guide future trades, ensuring that strategies are continually refined and improved upon.

Emotions can often cloud judgment in Forex trading, making discipline essential for success. Intermarket analysis not only provides data-driven insights but also helps traders maintain a clearer path amidst market noise. When traders understand the underlying trends and relationships between different markets, they are less likely to react impulsively to price fluctuations. By relying on their analytical methods, traders can develop more structured plans that guide their trading decisions. Additionally, having a strategy grounded in intermarket principles can instill confidence, allowing traders to focus on their long-term goals. To enhance emotional discipline, traders should also apply position sizing techniques, which help in controlling account risk. By defining how much capital to invest in each trade based on intermarket observations, traders are less likely to overexpose themselves. Furthermore, employing stop-loss orders ensures that losses are minimized even during volatile market conditions. By controlling emotions and adhering to a well-defined trading plan rooted in intermarket analysis, traders can significantly improve their overall trading performance, fostering a sustainable approach to Forex trading.

Conclusion: Mastering Intermarket Analysis

In conclusion, mastering intermarket analysis is vital for Forex traders seeking to elevate their trading strategies. Understanding the interconnectedness of various asset classes provides a broader perspective on market behavior. By analyzing how economic factors influence multiple markets, traders can make more informed decisions and enhance their overall performance. Developing the ability to recognize correlations, maintaining diversification, and employing powerful technical tools are all crucial aspects of intermarket analysis. Furthermore, trading with emotional discipline based on robust intermarket insights ensures that traders remain focused on their objectives. Continuous learning and adaptation in this arena will lead to long-term success in Forex trading. It’s also important for traders to stay updated on global events, as they can significantly impact the intermarket landscape. By integrating intermarket analysis into their trading routine, Forex traders position themselves to capitalize on potential opportunities, while effectively managing risks. Through diligent observation and informed strategy adjustments, traders can achieve a comprehensive understanding of the Forex market dynamics. Ultimately, intermarket analysis is more than just a tool; it’s a fundamental aspect of modern trading practices.

Constantly evolving and adapting will be key to thriving in the Forex market. As market conditions change, the interpretations of intermarket relationships will also need to evolve accordingly. Traders should incorporate regular analysis of these relationships into their routine, leveraging technology and data analytics to sharpen their insights. Being proactive in charting these connections can reveal new trading opportunities. Implementing a journal to track trades based on intermarket analysis can prove invaluable for refinement. Documentation helps traders to learn from their successes and mistakes while iterating on strategies effectively. Ultimately, intermarket analysis facilitates a more holistic view of trading, making it essential for any serious Forex trader. This combined with an understanding of risk tolerance helps in creating a trading plan that aligns with the trader’s objectives. Moreover, as traders align their approaches with scientific analytical methods, they can target improved outcomes. Following global market trends will enhance their decision-making processes in Forex. Thus, intermarket analysis is not just relevant; it’s imperative for traders looking to optimize their strategies in an increasingly complex global economy.