Navigating Legal Frameworks for Effective Restructuring

Corporate restructuring is a complex process, influenced by various legal frameworks that guide companies through transitions. These legal frameworks include national legislation and international treaties that interact to shape the restructuring landscape. Companies must understand their specific obligations under the law to navigate these tumultuous waters effectively. While bankruptcy laws often provide a safety net, the strategic approach to restructuring must go beyond legal compliance. It necessitates a review of corporate governance, stakeholder interests, and operational changes. Legal advisors play an essential role by interpreting laws to mitigate risks and ensure a compliant strategy. These advisors often work in tandem with financial analysts to develop restructuring plans that serve both legal and financial objectives. Navigating through these frameworks involves balancing the interests of creditors, shareholders, and employees. Entities also should consider any potential litigation risks that could arise during the restructuring process. Evaluating these risks early can help refine strategies and promote smoother transitions. In addition, the engagement of professional consultants can provide an external perspective that is essential for identifying challenges and opportunities that may not be immediately apparent within the organization.

A key aspect of restructuring is recognizing the triggers that necessitate such interventions. Financial distress signals often prompt companies to reconsider their strategies and operational structures. These triggers may include consistent losses, declining revenues, and increasing debt levels. Identifying these early warning signs allows firms to act proactively rather than reactively. A robust evaluation of the internal and external environment is essential for pinpointing issues that could hinder financial health. This evaluation often involves gathering data from financial statements, market analyses, and stakeholder feedback. Companies may benefit from adopting a holistic approach to assess their operational efficiency and competitive positioning. Once the necessary issues are identified, restructuring strategies may encompass a range of options, including asset sales, mergers, or complete overhauls of the operating model. Each option comes with its own set of advantages and challenges, requiring careful consideration by the management team. Furthermore, the choice of which strategy to pursue can be influenced by the legal landscape and the regulatory framework. Ultimately, establishing a clear timeline and objectives is vital for implementing restructuring plans that bring about successful recovery and sustainability.

Stakeholder Engagement and Communication

The importance of stakeholder engagement cannot be overstated during the restructuring process. Effective restructuring requires transparency and clear communication with all relevant parties, including employees, creditors, and investors. Establishing open lines of communication can help assuage fears and uncertainties that typically accompany such transformations. Moreover, stakeholders often possess valuable insights that can inform restructuring strategies. Employees, for instance, may offer practical recommendations for operational improvements, while creditors can provide feedback on financial restructuring options. Managers should be attentive to the concerns and suggestions from these stakeholders throughout the process. Regular updates on progress, challenges, and the overall vision for the restructuring can foster trust and cooperation. Utilizing platforms for feedback will encourage ongoing dialogues that may lead to innovative solutions aligned with everyone’s best interests. Additionally, strong leadership is crucial to guiding the organization through these changes. Leaders must motivate teams, reassure stakeholders about the future, and remain visible to uphold morale. The incorporation of stakeholder feedback into the restructuring plan may enhance legitimacy and ultimately lead to a more successful outcome for the business. The interaction cultivates an environment where all parties feel invested in the outcome.

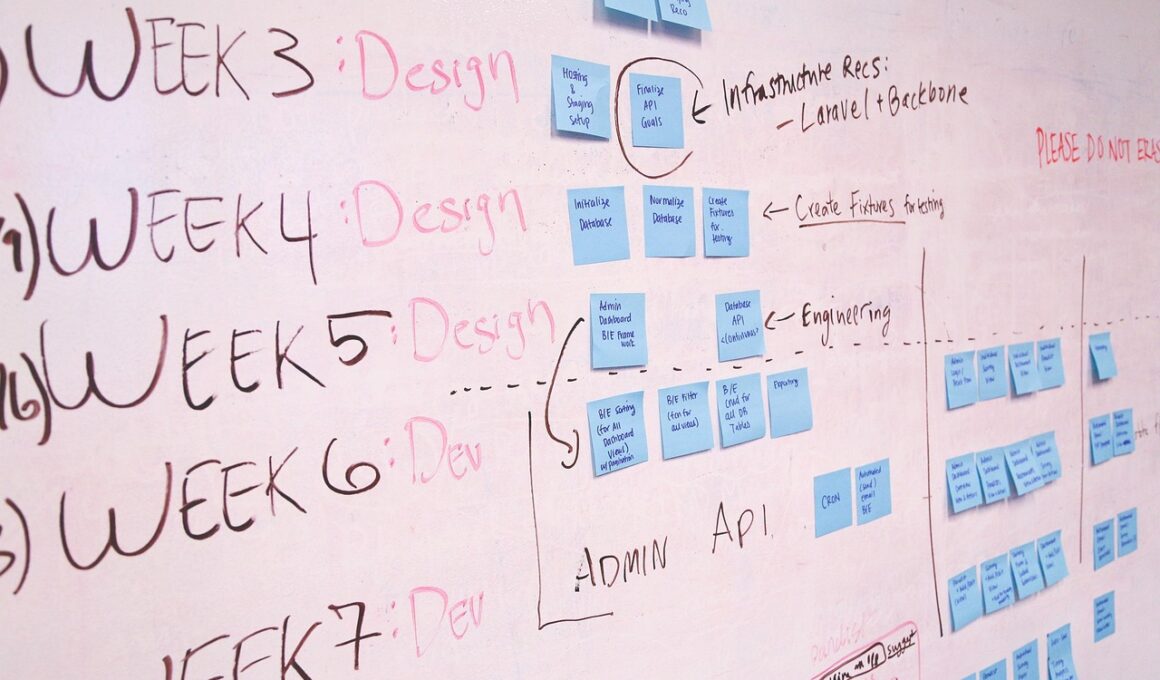

The timeline for restructuring can vary significantly depending on the scale and complexity of the operations involved. Companies facing severe financial distress may necessitate immediate actions to stave off insolvency. Conversely, organizations witnessing gradual declines might pursue longer-term strategies that are less disruptive to their daily operations. An effective restructuring plan generally aligns with the company’s broader strategic objectives while maintaining stakeholder commitments. Conducting a thorough assessment is essential in developing an achievable timeline, allowing time for adequate preparation, consultation, and evaluation. Key performance indicators (KPIs) should be established to track progress, helping to ensure that the restructuring remains on course. Milestones along the timeline serve as crucial checkpoints that determine whether the strategy is functioning as intended. Frequent monitoring allows for adaptive changes when encountering unexpected challenges or setbacks. Companies may also need to re-evaluate the timeline as new information becomes available, particularly in rapidly changing markets. Flexibility is essential, as external factors, such as changing regulations or shifts in consumer demand, can significantly impact the restructuring. Therefore, adjusting timelines and expectations in response is key to navigating the complexities inherent in corporate restructuring.

Legal and Financial Considerations

Legal considerations are paramount when devising restructuring strategies. Companies must ensure compliance with all jurisdictional laws governing bankruptcy and corporate restructuring. Legal non-compliance can lead to significant penalties and undermine restructuring efforts. Creditors’ rights, regulations on asset liquidation, and employment laws typically come into play during this phase of restructuring. To optimize outcomes, legal counsel should be integral to the restructuring team, guiding compliance and risk management. Financial modeling also plays an integral role in structuring successful strategies. Accurate projections help management assess the viability of different restructuring approaches. Companies may also investigate various financing options, including new equity investments or debt resignations, to facilitate the transition. Maintaining open lines of communication among all parties involved, including lawyers, accountants, and financial consultants, can help anticipate challenges and streamline tasks required for compliance. Legal frameworks may also provide mechanisms for negotiating with creditors and altering debt obligations. Adequate financial analysis is crucial for determining the potential benefits of these options. By prioritizing legal and financial disciplines, companies stand a better chance of achieving effective and sustainable restructuring outcomes.

Ultimately, the success of corporate restructuring hinges on a concrete execution plan formulated through meticulous analysis and collaboration. After developing initial strategies, organizations must implement operations that reflect their newly defined structures. Clear roles, responsibilities, and timelines should be established within teams for smooth execution. Involving all relevant stakeholders promotes accountability and encourages collective ownership over the restructuring outcomes. Training sessions and workshops may also be required to ensure that employees understand their new roles within the corporate structure. Furthermore, the integration of technology can streamline processes and enhance productivity during the transition. Organizations might consider adopting project management tools to oversee and communicate progress effectively. After the restructuring has taken place, continuing assessment and team adaptation can sustain long-term success and promote further evolution. Feedback mechanisms should be maintained, allowing stakeholders to highlight concerns and recommendations even post-restructuring. Organizations should also remain vigilant towards external market factors that could affect their new trajectories. Finally, documenting lessons learned from the restructuring process can provide critical insights for future strategies, ultimately strengthening the organization as it moves forward into a new chapter.

Conclusion

In conclusion, navigating the legal frameworks surrounding corporate restructuring is essential for achieving effective outcomes. Companies should proactively engage with stakeholders, putting emphasis on communication and transparency throughout the restructuring process. Understanding both the legal and financial implications can help management teams develop comprehensive strategies that address immediate concerns while laying the groundwork for future growth. Implementing a patient, collaborative approach while tracking progress against established KPIs can facilitate successful transitions. Flexibility, perseverance, and ongoing analysis are hallmarks of successful strategic execution. Reflecting upon gathering insights after completion can further empower companies when facing similar challenges in the future. Finally, a well-executed restructuring process will not only help businesses overcome financial distress but also position them competitively in their respective markets. Companies should embrace the challenges and possibilities that restructuring presents, with a focus on establishing resilient governance structures and operational practices. By aligning all elements of their restructuring plan cohesively, firms not only avert bankruptcy but also emerge revitalized in the corporate landscape—a testament to their adaptability and forward-thinking capabilities.

Ultimately, corporate restructuring is a multifaceted endeavor that requires legal, financial, and operational acumen. Organizations must become adept at navigating the legal landscape to ensure compliance while also addressing their business needs effectively. By prioritizing stakeholder engagement, open communication, and thorough risk assessments, firms can take definitive steps toward successful restructuring. Identifying potential issues early allows management to devise strategies proactively rather than reactively. A strong execution phase, framed within the realities of the legal environment, ultimately determines the success or failure of restructuring efforts. Organizations should aim to retain operational continuity while transforming their business models to adapt to new economic realities. Failure to address the complexities associated with legal frameworks may hinder potential recovery and growth. Continuing to innovate and adapt is essential not only during the restructuring phase but also in the period that follows, ensuring that the lessons learned are utilized for future initiatives. In the pursuit of effective restructuring, companies must recognize that adaptability and resilience are their truest allies. Thus, investing in legal advice and strategic planning can serve as valuable resources for any corporation looking to navigate the challenging waters of corporate transformation successfully.