The Relationship between International Financial Institutions and National Sovereignty

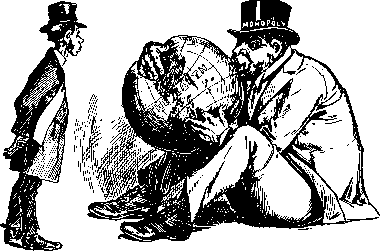

The intricate relationship between international financial institutions (IFIs) and national sovereignty has garnered significant attention in recent years. IFIs such as the International Monetary Fund (IMF) and the World Bank play crucial roles in providing financial assistance to countries facing economic challenges. However, the assistance often comes with strict conditions that require nations to implement specific economic reforms. This can lead to a perceived erosion of national sovereignty, as these reforms may conflict with domestic policies or priorities. The challenge lies in balancing the need for financial aid with the need for countries to maintain their autonomy. Additionally, the influence of IFIs can extend beyond financial matters, impacting political, social, and economic structures. Nations may find themselves under pressure to align with international standards or practices that do not always reflect their unique contexts. Consequently, the interactions between IFIs and sovereign nations are complex and multifaceted, necessitating a careful examination of the implications of such relationships. Understanding this dynamic is vital for both policymakers and researchers aiming to navigate the global finance landscape effectively.

Over time, the role of IFIs has evolved significantly, reflecting the changing dynamics of the global economy. Initially established to promote development and stability, IFIs now often focus on addressing crises and encouraging fiscal discipline among borrowing nations. This shift can create tensions as governments may argue that the conditions imposed by IFIs undermine their ability to make independent decisions regarding their economies. For instance, structural adjustment programs implemented by the IMF in the past have faced criticism for prioritizing austerity over growth. These programs often result in reduced public spending and social services, which can exacerbate poverty and inequality in affected countries. In light of these effects, it is important to explore how IFIs interact with domestic political agendas. Many countries seek to negotiate terms that mitigate the adverse impacts of IFI conditions while still accessing the necessary support. The dialogue between IFIs and sovereign nations is critical to ensuring that financial assistance fosters genuine development without compromising national interests. The evolution of these relationships will likely continue to shape the future of both international finance and national sovereignty.

The Economic Influence of IFIs

International financial institutions wield considerable economic influence over countries in distress through their lending capabilities. However, this power comes with strings attached—namely, the imposition of certain economic policy changes as prerequisites for receiving aid. These conditions often include measures such as budget cuts, tax reforms, and deregulation. While proponents argue that these policies aim to stabilize economies and promote long-term growth, critics contend that they often lead to social unrest and economic hardship. Furthermore, the pressure to conform to these stipulations can create conflicts between national priorities and international expectations, prompting debates about the true cost of financial aid. Examining specific case studies, one can discern the varied outcomes of IFI interventions. In some situations, nations have managed to recover and grow under the guidance of IFIs, while others have faced deeper economic woes. Assessing the overall impact of IFIs on national sovereignty requires a nuanced understanding of individual country contexts. Thus, as countries seek financial support, they must carefully navigate the challenges of maintaining sovereignty amid external pressures.

In addition to their economic influence, IFIs play a pivotal role in shaping global financial governance and standards. Their policies can dictate the frameworks through which nations interact in the global economy. For instance, the conditionalities tied to IFI loans often become benchmarks for acceptable economic practices among developing nations. This means that sovereign countries may feel compelled to adopt similar strategies to attract foreign investment and bolster their economic standings. However, this may inadvertently lead to homogenization, eroding the distinctive features that define national economies. Critics argue that this trend endangers the unique cultural and social identities of nations. As countries align their policies with IFIs expectations, they risk losing sight of their developmental needs and local contexts. This raises essential questions about the implications for democracy and governance within those nations. As legislators and leaders respond to international financial imperatives, they must consider the potential trade-offs regarding their autonomy and the socio-economic well-being of their citizens. Navigating these complexities is critical for sustaining a country’s sovereignty in an interconnected world.

Mitigating Sovereignty Loss

Recognizing the challenges posed by IFIs, many nations have begun to explore ways to mitigate the potential loss of sovereignty. Strategies include enhancing negotiation skills during discussions with IFIs and forming coalitions with other borrowing nations to amplify their voices. By collaborating and sharing experiences, countries can develop a stronger position when negotiating terms that align more closely with their specific needs. Additionally, creating alternatives to traditional financial assistance, such as regional financial institutions, can reduce reliance on IFIs. These initiatives provide countries with more agency in determining their financial futures without compromising their sovereignty. Furthermore, leveraging technology and innovation to foster economic growth can lessen the dependency on foreign aid, enabling countries to build sustainable economic frameworks. Policymakers must focus on designing inclusive strategies that involve not only governments but also civil society and the private sector. By embedding broader stakeholder participation in economic planning, nations can develop more resilient economic policies that respect both sovereignty and developmental needs. This multifaceted approach is essential for navigating the complexities of global finance while preserving national interests.

The discourse surrounding the relationship between IFIs and national sovereignty raises critical ethical considerations. As countries grapple with enforcing reforms dictated by financial institutions, the moral implications of sacrificing social welfare for economic stability become particularly salient. Policymakers are tasked with striking a balance between meeting external obligations and addressing the needs of their populations. Instances of civil unrest and protest against austerity measures illustrate the backlash that often accompanies stringent reforms. Consequently, it is imperative for governments to engage with their citizens transparently when negotiating terms with IFIs. Effective communication fosters public understanding of the necessity of certain economic policies while allowing governments to advocate for more favorable conditions. Additionally, the involvement of local stakeholders in the decision-making process can enhance accountability and ensure that reforms align with broader social goals. This approach not only strengthens national sovereignty but also promotes resilience against potential backlash from reforms. Therefore, fostering ethical dialogue surrounding IFI engagements is crucial for safeguarding the well-being of citizens and sustaining the social contract between governments and their people.

The Future of IFIs and Sovereignty

As the global financial landscape continues to evolve, so too will the relationships between IFIs and nations regarding sovereignty. Emerging markets and developing countries are increasingly voice their concerns over the influence of IFIs, seeking to reshape the narrative and engage in more equitable dialogues. This shift could potentially lead to reforms in how IFIs operate, demanding greater flexibility and understanding of local realities. One conceivable future might involve a redesign of IFI frameworks that prioritize country-led initiatives, empowering nations to dictate terms that reflect their unique economic contexts. Additionally, cooperation among various stakeholders, including governments, civil society, and international partners, will be key in promoting sustainable development. This collaborative approach may reduce the need for punitive measures, thereby preserving national sovereignty while meeting fiscal obligations. Ultimately, the success of this new dynamic will depend on the willingness of both IFIs and sovereign nations to adapt to changing circumstances and prioritize mutual benefit. As these relationships continue to develop, the balance between financial help and respect for sovereignty will remain a pressing concern for both parties moving forward.

In conclusion, the relationship between international financial institutions and national sovereignty is complex, requiring careful navigation by nations seeking financial support. As IFIs exert significant influence over the policies of borrowing countries, the potential consequences of accepting aid can include the erosion of sovereignty. However, recognizing this dynamic allows nations to develop strategies to mitigate adverse effects while still obtaining the necessary funds. By fostering collaborative relationships with IFIs, prioritizing public involvement in the decision-making process, and advocating for more flexible terms, countries can better safeguard their autonomy. The future of international finance will undoubtedly continue to influence national sovereignty, necessitating ongoing dialogue and engagement among all stakeholders. As global financial systems evolve, so too will the strategies employed by nations to preserve their sovereignty while addressing pressing economic challenges. It is crucial for policymakers to remain vigilant in ensuring that the interests of their citizens are prioritized. Ultimately, achieving a balance between international cooperation and national sovereignty will be essential for promoting sustainable economic growth and robust financial governance in an interconnected world.