Implementing Fourier Transform Methods in Option Pricing

In the realm of quantitative finance, option pricing stands as a fundamental concept, shaping strategies for investors and traders alike. The beauty of Fourier Transform methods lies in their ability to efficiently compute option prices under various conditions. Using these methods can significantly reduce the time complexity associated with traditional pricing techniques often seen in Black-Scholes approaches. Fourier Transform allows us to transform complicated pricing equations into simpler forms, enabling rapid computation of price, implied volatility, and the behavior of other derivatives. Understanding the concept of characteristic functions becomes essential in this context because it plays a crucial role in implementing Fourier methods effectively. Additionally, Fourier techniques support the pricing of European and American options and can also handle exotic options, expanding their applicability. Overall, the utilization of Fourier Transform methods in option pricing is a powerful tool in a quant analyst’s toolkit, providing speed, accuracy, and flexibility. Therefore, mastering these techniques can enhance your quantitative finance skills, giving you an edge in developing robust financial models for practical trading applications.

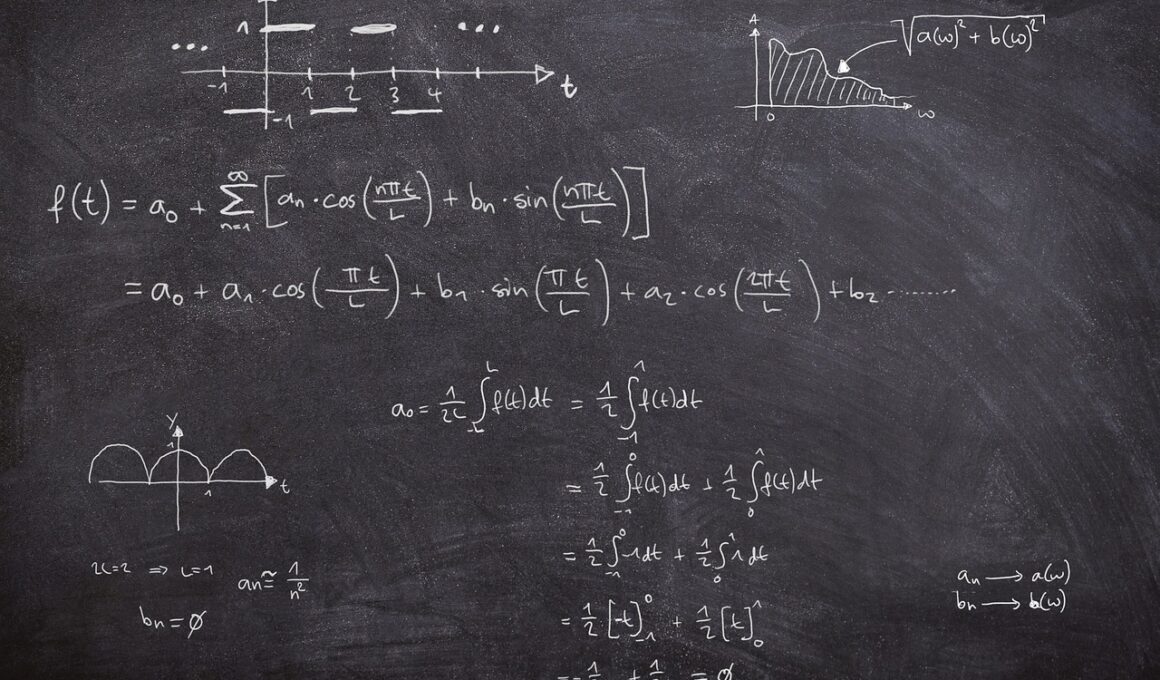

As we delve deeper into Fourier Transform methods in option pricing, it is crucial to understand the mathematical formulation surrounding these concepts. The Fourier Transform takes a function defined in the time domain and converts it into the frequency domain, which can transform the problem structure into a more manageable form. In finance, a key aspect is the pricing kernel or risk-neutral probability measure, which reveals how cash flows can be discounted back to their present value. This conversion is particularly useful for exotic options where conventional models fail. The application of the Fourier Transform yields the characteristic function of asset returns. This function can directly provide option prices through numerical techniques like the Fast Fourier Transform (FFT). FFT’s effectiveness stems from it being a computationally intensive process that operates in O(n log n) time, significantly faster than direct integrations. Furthermore, as market dynamics evolve, continuously adapting and applying Fourier Transform techniques presents opportunities for traders to analyze sophisticated assets and improve risk management strategies. Thus, the integration of these methods reshapes the landscape of option pricing.

Next, let’s explore the Fast Fourier Transform (FFT) in greater detail, particularly concerning its utility in option pricing. The FFT algorithm serves to efficiently compute discrete Fourier Transforms, reducing computational demands and speeding up calculations critical in real-time trading scenarios. In contexts of high-frequency trading, where millisecond calculations can make a significant difference, leveraging FFT is not just beneficial; it is often essential. Additionally, FFT accompanies various stochastic models, such as Heston’s model or stochastic volatility, ensuring that their complicated payoffs are computed accurately. By integrating FFT within Python or MATLAB frameworks, financial engineers can create simulations to price different derivatives under varying market conditions. This practical application of FFT creates a significant bridge between theory and practice, allowing analysts to deal with large datasets while maintaining accuracy. Furthermore, the employment of FFT can help optimize capital allocation strategies amidst dynamic market conditions. Skillful implementation facilitates risk assessment techniques that are paramount for portfolio management and hedging in today’s volatile financial environments, enhancing the integrity of trading activities and investment strategies.

Applications and Case Studies

Real-world applications of Fourier Transform methods reflect the versatility and efficiency of these techniques in option pricing scenarios. Financial institutions have deployed these techniques across varied markets, showcasing their adaptability to unique conditions like volatility smiles or shifts in market trends. A prime example is the calibration of models that accommodate local volatility or jump diffusion processes, where Fourier methods provide elegant solutions compared to conventional approaches. Several hedge funds utilize these methods to optimize trading strategies, aligning them with underlying market realities. The ability to dynamically price complex derivatives can significantly enhance profitability through informed decision-making. Moreover, numerous empirical studies substantiate the superior performance of Fourier methods when matched against traditional models across extensive datasets. These advantages illustrate the fundamental shift in quantitative finance towards embracing computational methods that offer both speed and precision. Within the regulatory context, these methods have enhanced risk assessment, creating robust frameworks for stress testing portfolios, and satisfaction of compliance requirements. Hence, continuous exploration of these techniques will enable ongoing innovations in quant finance, fostering advancements in derivative pricing.

Despite the significant advantages of Fourier Transform methods, challenges still persist, requiring careful consideration when implementing this powerful approach in practice. Numerical stability becomes a critical concern, especially with the potential for aliasing and truncation errors manifesting in poorly designed algorithms. Additionally, the capability to accurately estimate characteristic functions is vital, as any inaccuracies can lead to drastic pricing errors. Implementing appropriate checks and balances amidst this framework is essential. Furthermore, integrating Fourier method solutions with ensemble models or machine learning techniques can provide new insights but introduces additional complexity. Careful parameterization and validating results through back-testing with historical data remains paramount for success. Investors must also be aware of market anomalies or regulatory changes that may affect results. Consequently, successful integration requires a robust understanding of both the theoretical and practical dimensions of Fourier methods. Continuous learning and adaptation will allow financial analysts to stay ahead and address any emerging challenges in option pricing. Therefore, collaboration between quantitative analysts, traders, and technology teams becomes indispensable in navigating this intricate landscape.

Future Perspectives

Looking ahead, the future of Fourier Transform methods in option pricing is intertwined with advancements in technology and machine learning. As computing power continues to increase, utilizing these methods for real-time, high-frequency data analysis will become even more prevalent. The integration of artificial intelligence in finance paves the way for enhancing predictive analytics through advanced modeling capabilities, including Fourier methods. Additionally, algorithmic trading systems will leverage these techniques for rapid pricing and execution of derivatives, ultimately influencing market behavior. The future is likely to witness firms using hybrid models that synthesize both traditional and Fourier-based approaches, optimizing workflows and yielding higher efficiency in financial operations. Furthermore, as digital currencies and alternative investment strategies emerge, Fourier methods can adapt to new asset classes. Researchers and practitioners should collaborate to explore innovative applications, ensuring these methods evolve with market demands. Continuous refinement of algorithms and enhancing integration with big data platforms will fuel advancements in risk management and trading strategies. This journey of discovering and honing Fourier Transform methods will contribute significantly to quantitative finance’s next frontier, culminating in more sophisticated pricing mechanisms for derivatives.

In conclusion, the implementation of Fourier Transform methods represents a paradigm shift in option pricing within quantitative finance. These methods not only enhance computational efficiency but also enable analysts to tackle complex financial derivatives effectively. As the financial landscape continues to evolve, mastery of these analytical tools is essential for traders seeking to maintain a competitive edge. The exploration into Fourier Transform methods opens new avenues for research and practical application, ultimately enriching the understanding of market dynamics. For practitioners, understanding the mathematical underpinnings of these techniques is as crucial as knowing their application in real-time scenarios. As quantitative finance advances, the integration of FFT and machine learning will demonstrate the collaborative potential, reflecting the growing importance of computational finance. While challenges persist, the overall trajectory of Fourier methods remains promising, ensuring their relevance in future markets. Ultimately, as technologies intersect, finance professionals capable of integrating advanced pricing methods will shape the future landscape of risk management and investment strategy, paving the way for innovations that redefine market operations.

In summary, implementing Fourier Transform methods in option pricing offers immense potential for enhancing both efficiency and accuracy in quantitative finance. The dynamic nature of financial markets necessitates continuous adaptation of these techniques to meet emerging challenges. As we’ve explored, Fourier methods enable efficient computations that traditional methods cannot compete with, allowing traders to respond swiftly to market shifts. This adaptability will be key as financial products grow more complex in the coming years. The integration of Fourier methodologies with data analysis will prove instrumental in developing robust financial models that withstand scrutiny in varying market conditions. For investors, understanding these underlying principles will be vital for navigating the increasingly sophisticated landscape of derivatives trading. Consequently, keeping pace with advancements in computational finance requires a commitment to learning and innovation from finance professionals. The synergy between Fourier Transform methods and traditional statistical approaches holds promise for improving risk assessment frameworks and market predictions. Therefore, active engagement in exploring these methodologies will benefit analysts striving to enhance their repertoire in quantitative finance. This journey into the heart of Fourier Transform methods can thus indeed result in significant contributions to the field, forging pathways toward future financial excellence.