Analyzing Variances Between Forecast and Actual Results

Financial forecasting is a crucial aspect for any business, allowing stakeholders to make informed decisions based on projected performance. Typically, forecasts will predict future revenues, expenses, and financial position. Variances between forecasted results and actual outcomes can be both enlightening and challenging. Understanding these variances provides insights into business operations and external conditions that affect performance. This analysis can unveil underlying trends or issues that warrant attention. By examining variances, organizations can adjust their strategies, allocate resources effectively, and enhance future forecasting efforts. Accurate financial forecasting impacts budget planning and liquidity management, making it vital for long-term success. Companies need robust processes to analyze variances regularly. This includes collecting accurate data, collaborating across departments, and applying analytical tools to interpret results. Variance analysis not only improves decision making but also strengthens accountability among teams. Focused review of discrepancies often leads to identifying areas for process improvement and operational efficiencies. Implementing best practices in variance analysis can lead to better performance management and continuous growth for the organization.

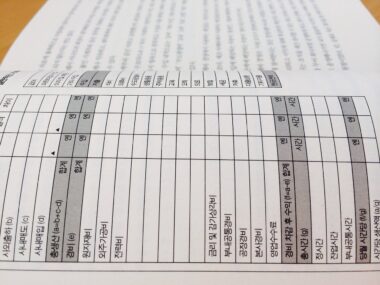

The key components of variance analysis include understanding the types of variances, their impact on the financial statements, and identifying root causes. Two primary categories of variances are favorable and unfavorable. Favorable variances arise when actual results surpass forecasts, positively influencing profitability. In contrast, unfavorable variances occur when actual performance falls short of expectations, potentially threatening the organization’s financial health. Regular monitoring of these variances is vital, as it enables quick corrective actions to rectify adverse trends. Moreover, it’s imperative to distinguish between controllable and uncontrollable variances. Controllable variances stem from factors the management can influence, like operating expenses, while uncontrollable variances could relate to market conditions, such as demand fluctuations. Clear identification of these categories furthers effective management through targeted strategies. Using variance analysis effectively can illuminate not just financial performance but also operational effectiveness, where thoughtful adjustments can be made. Regularly scheduled variance analysis discussions should be incorporated into corporate governance, involving key stakeholders from finance and operations. Proactive engagement in variance analysis fosters a culture of accountability and data-driven decision making.

Implementing Effective Variance Analysis

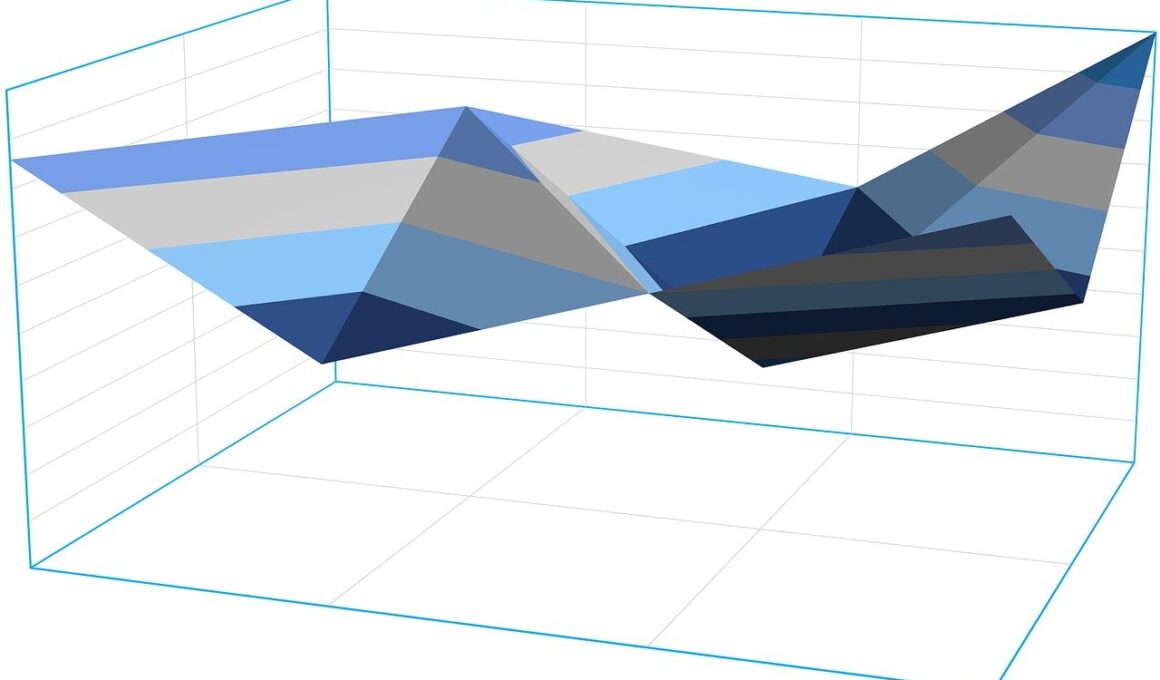

To sustain an effective variance analysis process, organizations must adopt certain practices that promote diligence and accuracy. First and foremost, establishing a strong forecasting framework is essential. This foundational step involves setting realistic goals and employing reliable data sources. Incorporating historical data alongside market trends can significantly enhance forecasting accuracy. Furthermore, using financial modeling software can automate calculations and improve efficiency in tracking variances. The next step is to develop clear communication channels among different departments. This ensures that results with a significant impact on forecasts, like sales or production changes, are well documented and communicated. Engaging employees in the variance analysis process can foster a culture of accountability and involvement in the company’s financial health. Regular training and workshops can enhance staff understanding of financial metrics and variance significance, ultimately leading to informed behaviors. To analyze variances effectively, it is crucial to have a structured approach, utilizing dashboards or visual aids wherever possible. These tools can display actual versus forecasted figures clearly and effectively, allowing stakeholders to identify deviations promptly.

Another critical aspect of variance analysis is proper documentation and record-keeping. Maintaining a clear record of analyses, findings, and the rationale behind variances provides a comprehensive view over time. This documentation can serve future forecasting cycles, enabling businesses to learn from past mistakes while adjusting methodologies. It also allows management to review decisions made in response to prior variances, promoting continual improvement within the forecasting and variance analysis process. Engaging with external financial experts can also enhance internal perspectives on variance issues. They can offer insights from diverse industries, allowing companies to benchmark their analysis processes against best practices. Comparisons can lead to rethinking existing strategies and optimizing forecasting techniques. Furthermore, technology innovation plays a vital role. Utilizing advanced analytics, machine learning, and big data solutions can provide deeper insights into financial variances, predicting outcomes with improved accuracy. This technological edge is becoming increasingly crucial in a rapidly evolving economic environment. By investing in these innovations, businesses can enhance their forecasting capabilities and adapt to changes such as market volatility effectively.

Challenges in Variance Analysis

Despite its importance, variance analysis can present several challenges that organizations need to address. One primary challenge is the complexity of obtaining accurate and timely data. Various data silos may exist within a company, resulting in inconsistent information that complicates variance analysis. Organizations must implement integrated systems that ensure data accuracy and real-time availability. Moreover, frequent fluctuations in the market and economic landscape can make accurate forecasting increasingly difficult. Companies need to remain agile and adjust their forecasts based on evolving conditions regularly. Another challenge arises from the subjective nature of analyses, as interpretations of variances can differ between departments. Establishing a standardized approach to document and analyze variances can reduce disagreements and streamline decision-making. Effective variance analysis also requires skilled personnel who understand both financial data and its implications. Continuing education and training programs can help develop these necessary skills within the workforce, leading to better overall performance. Lastly, leadership must foster a culture that values transparency. Encouraging open discussions about variances can help teams collaboratively address issues and identify solutions.

In conclusion, variance analysis is an invaluable tool in the realm of financial forecasting. By identifying discrepancies between forecasted and actual results, businesses can understand their performance and adapt their strategies accordingly. Companies that prioritize robust variance analysis practices position themselves for improved decision-making and operational efficiency. This encompasses understanding the nature of variances, implementing high-quality forecasting processes, and adjusting strategies in light of emerging trends and challenges. It is vital to create an environment where collaboration among various departments enhances the overall effectiveness of variance analysis. By investing resources in training, technology, and best practices, organizations can refine their financial forecasting models. This ultimately contributes to maintaining a competitive advantage in the marketplace. Continuous monitoring and refinement of the overall forecasting strategy should be emphasized. Variance analysis, when rooted in a comprehensive understanding of operations and finance, serves as both a check on performance and a roadmap for future growth. Embracing a proactive approach to variance analysis can lead to sustainable success in rapidly changing business environments.

To effectively analyze variances, it is also critical that organizations embrace change management principles. Financial forecasts are susceptible to changing external factors such as market conditions and regulations, which can significantly influence actual results. Therefore, organizations must adopt a mindset that is ready to respond to these changes with agility. Teams should be equipped to ensure that their forecasting processes reflect these shifts quickly. Utilizing forecasting software that allows for quick adjustments based on new information is a best practice. Communication is paramount, especially when sharing updates on forecasts as new data becomes available. The role of leadership is crucial in reinforcing the importance of flexible forecasting and variance analysis. Organizations should aim to create a feedback loop where insights from variance analyses lead to improvements in forecasting methods. Recognizing patterns in variances over time also aids in creating more accurate forecasts in the future. Additionally, engaging stakeholders in the analysis process fosters a sense of ownership over financial outcomes. This involvement, combined with reliable data and transparent communication, leads to a culture of continual improvement and strong financial performance.