The Future of Financial Ethics in a Globalized Economy

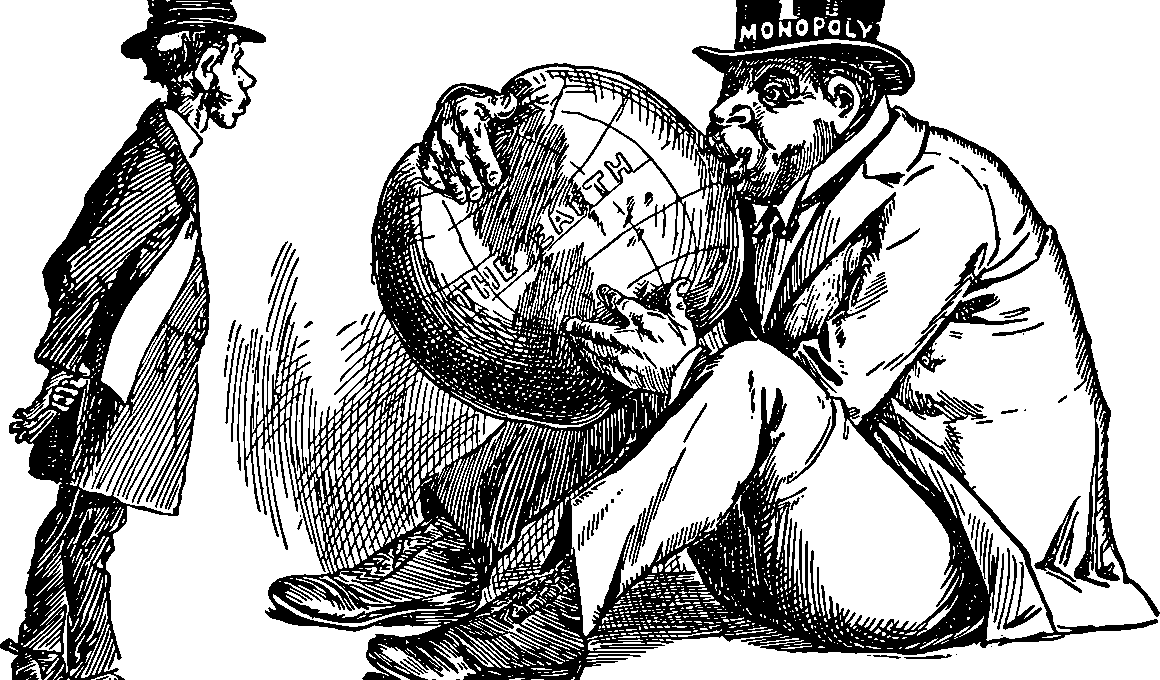

The global economy faces numerous challenges, compelling stakeholders to rethink the principles of financial ethics. In an interconnected world, organizations must align their practices with ethical standards that promote transparency, accountability, and sustainability. Companies engaging in ethical financial practices not only bolster their reputations but also gain the trust of investors and consumers alike. Emphasizing ethics within finance encourages responsible investment decisions, which ultimately alleviate risks associated with financial crises. As stakeholders demand higher ethical standards, organizations may experience a shift towards prioritizing long-term growth over short-term profits. Additionally, regulatory frameworks must evolve to address ethical dilemmas and encourage financial integrity. Establishing robust compliance systems and engaging in open dialogues about ethics can foster an environment of trust. Financial institutions can adopt comprehensive training programs that instill ethical values in their workforce. This requires emphasizing the importance of creating policies that incorporate ethical considerations in decision-making processes. Ultimately, financial organizations can leverage their collective influence to create a sustainable, ethical landscape that benefits society as a whole, establishing norms that foster trust and integrity in financial dealings.

The emergence of digital technology has transformed the financial landscape, necessitating a reevaluation of ethical standards. As organizations increasingly rely on artificial intelligence and data analytics, transparency in financial practices becomes crucial. Innovative technology enables financial institutions to gather and analyze data for better decision-making; however, it also introduces ethical concerns regarding data privacy and consent. Ensuring that consumer data is handled ethically should remain a priority, as any mismanagement can lead to significant breaches of trust. The financial industry must adopt rigorous data governance policies that protect individual privacy while promoting ethical usage. Furthermore, companies should ensure ethical AI programming by implementing standardized ethical frameworks guiding algorithmic development. As these technologies shape financial practices, stakeholders must hold organizations accountable for their ethical responsibilities. Regular audits and assessments can confirm adherence to ethical principles, fostering transparency and accountability. By prioritizing ethics in the design, deployment, and governance of financial technologies, organizations can create a more inclusive and equitable financial system. Addressing challenges accompanying digital transformation can drive innovation while ensuring that ethical considerations remain at the forefront of financial practices.

Integrating Ethics into Corporate Governance

To effectively navigate the complexities of a global economy, financial organizations must integrate ethical principles into their core governance structures. Governance ensures that organizations adhere to legal requirements while addressing ethical expectations set by society. Establishing a dedicated ethics committee provides a framework for addressing ethical concerns and ensuring compliance with regulatory standards. This committee can develop guidelines for ethical decision-making, regularly evaluating and updating them to reflect evolving societal norms. Furthermore, promoting a culture of ethics transcends mere compliance; it inspires employees at all levels to foster an ethical workplace culture. Employees are likely to feel more engaged and valued when they understand their company’s commitment to ethical practices. Transparency in corporate governance, paired with open channels of communication, allows employees to voice concerns and encourages them to be proactive in upholding ethical standards. Involving employees in decision-making reinforces the ethical framework within the organization, ensuring that decisions reflect a broad range of perspectives. Consequently, integrating ethics into corporate governance not only builds trust among stakeholders but also enhances the organization’s capacity to address ethical challenges in a globally integrated economy.

Financial literacy has emerged as a cornerstone of fostering ethical behavior within the financial sector. Enhancing public understanding of financial principles empowers consumers to make informed decisions, promoting responsible financial citizenship. Educational initiatives aimed at improving financial literacy should thus be prioritized by governments, educators, and financial institutions alike. By providing accessible resources, individuals can better grasp fundamental concepts such as budgeting, investing, and understanding risk. This increased awareness allows consumers to recognize unethical practices and advocate for their own financial rights. Moreover, institutions have a responsibility to provide clear and comprehensive information about financial products and services, enabling consumers to make well-informed decisions. Companies that prioritize transparency not only enhance their reputations but also contribute to a more ethical financial landscape. Fellow stakeholders can partner with community organizations to develop educational programs that promote ethical financial practices. By working together, sectors can provide invaluable knowledge to the public while building a foundation for financial accountability. Ultimately, prioritizing financial literacy can help bridge the gap between consumers’ needs and organizational practices, reinforcing a commitment to ethics in the ever-evolving global economy.

Regulatory Frameworks and Financial Ethics

The evolution of financial ethics is closely intertwined with the development of regulatory frameworks that promote ethical behavior. As globalization has increased, so too have the complexities regarding oversight and compliance. Regulators must adapt their policies to cater to the unique challenges posed by international financial markets while ensuring that ethical principles remain central to their frameworks. This requires ongoing dialogue between regulators, financial institutions, and other stakeholders to establish comprehensive guidelines. Collaborative efforts between diverse entities can enhance the collective understanding of what constitutes ethical financial practices, driving improvements across the sector. Additionally, incorporating feedback from stakeholders can help regulators identify gaps in existing policies. Regular reviews and updates to regulations ensure that they remain relevant in the context of rapidly evolving markets. Furthermore, regulators can reward organizations demonstrating superior ethical compliance through incentives, encouraging a shift toward ethical practices. This relationship creates a cycle of integrity that benefits the entire financial ecosystem, contributing to the establishment of a culture of ethics, accountability, and sustainability across borders. The integration of ethical standards into regulatory frameworks is essential for safeguarding the integrity of financial markets in the future.

The role of executive leadership is pivotal in shaping the ethical tone within financial organizations. Leaders must exemplify ethical behavior, guiding their teams in making principled decisions. By fostering an environment where values are prioritized, organizations can enhance overall ethics. Leaders should regularly engage in ethical training, ensuring that they stay informed about emerging issues in financial ethics. Encouraging open discussions about ethical dilemmas allows for a culture of transparency within organizations. Additionally, having a diverse leadership team can provide varied perspectives, enriching the ethical landscape. Diversity enables organizations to address ethical concerns more holistically, as different backgrounds lead to unique insights. This diversity, blended with ethical leadership, can improve organizational commitment to ethical principles. Implementing feedback mechanisms helps executives understand employee sentiments regarding ethical practices, enabling them to make informed decisions. Moreover, establishing consequence frameworks ensures that unethical behavior is addressed consistently and transparently. As organizations navigate the challenges of a globalized economy, the presence of ethical leadership remains critical in setting standards that resonate throughout financial institutions, allowing their ethical compass to guide their decisions.

Conclusion: The Path Forward

As we look towards the future, prioritizing financial ethics in a globalized economy is essential for organizations aiming for long-term success. The integration of ethical principles into corporate strategies enhances stakeholder trust and supports sustainable practices. Organizations must remain agile and responsive to emerging challenges by continuously assessing their ethical landscapes. Moreover, collaboration between regulators, organizations, and consumers fosters a shared commitment to ethical standards. By working together, stakeholders can co-create a financial ecosystem built on transparency, trust, and integrity. Furthermore, educational initiatives will equip future generations with the necessary tools to navigate the financial landscape responsibly. As financial technology continues to advance, fostering ethical practices in innovation becomes paramount. Leaders must champion ethical practices while ensuring that diversity and financial literacy are prioritized within their organizations. Doing so creates a more inclusive, equitable financial landscape that empowers consumers and organizations alike. Ultimately, nurturing a culture of financial ethics can pave the way for systemic change, ensuring that financial markets serve the common good. Embracing these principles will define the trajectory of financial ethics in the globalized economy, establishing a sustainable foundation for future generations.

In conclusion, the future of financial ethics hinges on collective efforts from all stakeholders involved in the industry. As organizations adapt to an increasingly complex landscape, prioritizing ethical practices will not only enhance their reputations but also drive sustainable growth. By encouraging open communication, fostering diversity, and understanding the importance of financial literacy, we can create an inclusive environment conducive to ethical decision-making.