Using Intermarket Analysis for Currency Portfolio Diversification

Intermarket analysis is a powerful tool for Forex traders focused on currency portfolio diversification. This approach evaluates market interrelationships, including how various markets influence one another. Understanding these connections can significantly enhance trading strategies by providing insights into market trends. Traders should begin by studying the correlation between different asset classes, such as stocks, commodities, and bonds, and how these relationships impact currencies. It’s essential to grasp the underlying factors driving changes in market dynamics. For instance, when oil prices rise, the Canadian dollar often strengthens due to Canada’s oil exports. This is just one example of how intermarket analysis informs trading decisions. Utilizing market data and historical trends can help traders identify patterns and correlations, contributing to more informed Forex trades. Furthermore, analyzing economic indicators from various countries can create a comprehensive view of the market landscape. By diversifying currency portfolios based on intermarket relationships, traders can manage risk more effectively, increase the potential for profit, and ultimately achieve better results in their trading endeavors. This analysis leads to smarter financial decisions based on market context.

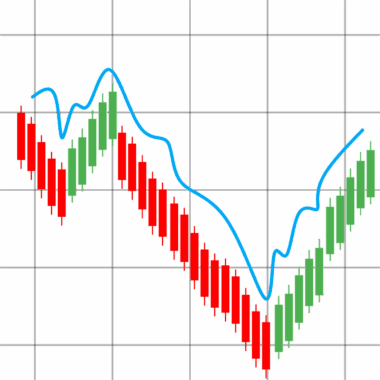

When implementing intermarket analysis into Forex trading strategies, traders must focus on key indicators that influence various market segments. For example, interest rates directly affect currency values and have ripple effects on other asset classes. Keeping an eye on central bank announcements allows traders to anticipate currency movements and adjust portfolios accordingly. Additionally, inflation data impacts purchasing power and can trigger significant currency fluctuations. Cross-referencing these economic indicators alongside stock and commodity prices can yield valuable insights. An important aspect of successful intermarket analysis is understanding risk appetite among investors; shifts in this sentiment often lead to currency swings. For instance, during economic uncertainty, traders may flock to safe-haven currencies like the Swiss franc or Japanese yen, impacting their value relative to others. This dynamic creates opportunities for diversification, allowing traders to leverage differentials among currencies. To enhance a trading strategy, it may be helpful to use analytical tools to visualize these relationships, increasing comprehension of complex market environments. In doing so, market participants can make better-informed decisions, minimizing risks while optimizing capital allocation across a diversified Forex portfolio.

Furthermore, mastering technical and fundamental analysis is critical in applying intermarket analysis effectively. Traders must utilize technical indicators, such as moving averages, relative strength index (RSI), and Fibonacci retracement levels, to gauge market sentiment. These tools can help identify potential entry and exit points when multiple markets align. Emphasizing the importance of fundamentals, traders should recognize the role of economic data releases and geopolitical events in altering market sentiment. Currency strength is often influenced by political stability and fiscal policies, which may affect investor confidence. Thus, keeping abreast of breaking news can position traders advantageously within the Forex market. Additionally, employing a systematic trading approach, driven by intermarket analysis, can lead to improved trading results. This systematic approach can involve the creation of a trading plan that includes risk management strategies tailored to the Forex market’s unique characteristics. An adaptive method facilitates capitalizing on emerging trends while preserving capital in times of uncertainty. Educating oneself continuously about the impact of various market forces strengthens overall trading proficiency and enables traders to navigate complex environments successfully.

Building an Intermarket Analysis Framework

Creating an effective intermarket analysis framework involves defining clear rules and a structured approach to analysis. Traders should prioritize understanding correlations in asset prices and consistently apply them in their analysis. A robust framework begins with gathering historical data, assessing its relevance to current market conditions, and evaluating asset relationships. For instance, maintaining a correlation matrix can provide traders with a visual representation of how diverse markets interact, aiding decisions on currency pair selection. In tandem with this, traders should also allocate time to developing a well-rounded research process that evaluates economic reports, political shifts, and key market timings. Together, this research contributes to a trader’s situational awareness and fosters effective responses to market movements. Emphasizing the importance of strategy over speculation reduces impulsive trading decisions that often lead to losses. Furthermore, consistently reviewing one’s performance and refining strategies based on outcomes ensures continuous improvement. By adopting this structured framework, traders gain confidence in their analysis and decisions, setting the stage for consistent performance and the successful diversification of their currency portfolios.

Another vital component of intermarket analysis is recognizing shifting trends within the global economy. Forex traders must remain vigilant about macroeconomic shifts since these changes may reflect in currency valuations. Key economic factors to monitor include changes in GDP, trade balances, and employment statistics. These indicators help traders formulate informed opinions about potential currency movements, allowing for strategic adjustments. Furthermore, changes in global sentiment can lead to sudden and significant currency swings, emphasizing the need for adaptive portfolios. By staying current with global market trends and adjusting strategies accordingly, traders can seize emerging opportunities that align with their investment goals. Diversification across different currencies can ultimately protect traders from adverse currency movements, creating a more resilient portfolio. Moreover, leveraging intermarket analysis can aid in identifying undervalued currencies that have the potential for appreciation. Utilizing critical thinking and analysis helps traders recognize the broader narrative in the financial markets, all while making calculated decisions. This ongoing assessment keeps traders agile and receptive to new information, ultimately enhancing their odds of success in the Forex market.

Implementing risk management strategies alongside intermarket analysis is integral for effective Forex trading. Identifying potential risks and developing action plans is essential for navigating the ever-changing market landscape. By utilizing tools like stop-loss orders and risk-to-reward ratios, traders can mitigate losses while optimizing profit opportunities. Moreover, diversification acts as a shield during periods of volatility, minimizing exposure to any one currency. It’s important for traders to maintain an accountability mindset, keeping track of their performance and adjusting strategies as needed. Having a diversified currency portfolio informed by intermarket analysis allows for greater control over potential pitfalls during market fluctuations. Continuous assessment of asset correlations can signal when it’s time to rebalance a portfolio, ensuring investments align with overall trading goals. In addition, implementing a disciplined approach promotes resilience amid turbulent market conditions. More significantly, a well-defined risk management strategy plays a crucial role in traders’ psychological fortitude, supporting rational decision-making. Overall, the combination of intermarket analysis and solid risk management establishes a robust foundation for building and maintaining successful currency investments.

Conclusion

In conclusion, employing intermarket analysis in Forex trading is essential for achieving currency portfolio diversification. By deepening market understanding, traders can maximize opportunities while minimizing risks. Identifying correlations among various markets fosters informed trading decisions and supports the resilience of diversified portfolios. Moreover, monitoring macroeconomic indicators and market sentiment allows traders to effectively navigate the complexities of the Forex market. A disciplined approach combined with robust risk management strategies enhances traders’ ability to adapt to market changes and embrace new opportunities. As the financial landscape continually evolves, staying abreast of market dynamics and refining strategies is crucial for long-term success. Traders should prioritize education, using resources available to deepen their knowledge. Ultimately, the effective incorporation of intermarket analysis will lead to more sustainable trading practices and better overall results in the Forex realm. Thus, investing time and effort into understanding these interrelationships strengthens traders’ capabilities to make strategic moves that yield significant returns.