Using Moving Averages for Forex Swing Trading

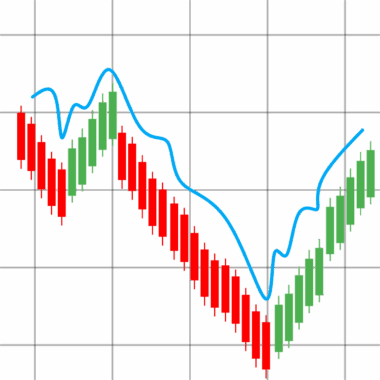

Moving averages serve as essential tools in Forex swing trading strategies. They help traders identify the trend direction and potential reversal points. A moving average smooths past price data to create a single flowing line, which traders use to analyze trends. There are several types of moving averages, including Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). The SMA calculates average prices over a defined period, while the EMA gives more weight to recent prices, making it more responsive to new information. Using both types provides insightful data, allowing traders to make informed decisions. Many swing traders utilize a combination of short-term and long-term moving averages to spot potential buy and sell signals. The crossover technique, where a short-term moving average crosses above a long-term moving average, can indicate a bullish trend. Conversely, a crossover below might suggest a bearish trend. Employing these methodologies can enhance market analysis significantly, leading to potential profitability. Learning how and when to apply moving averages is a pivotal step for any trader looking to succeed in the Forex market.

Identifying the correct parameters for moving averages can greatly influence trading outcomes. Selecting the right period settings is crucial; common periods include 10, 20, 50, and 200 days. For swing trading, shorter periods may provide more signals but can produce false ones. Conversely, longer periods reduce noise but may delay entries. Additionally, different pairs may react differently to various moving averages, making it vital to test them across diverse currency pairs. Utilizing backtesting techniques can help traders determine which moving average settings yield the most favorable results over time. Traders might consider using software tools that automate this process, enabling them to analyze historical performance systematically. Error margins can be minimized through proper risk management techniques in conjunction with moving averages. Setting stop-loss orders based on average price levels can enhance risk mitigation. Moreover, implementation of trailing stops can secure profits as the price moves favorably in the trader’s direction. Using a proper blend of technical indicators alongside moving averages, such as RSI or MACD, can further refine entry and exit points for enhanced trading performance.

Integrating Moving Averages with Other Indicators

Moving averages can be even more potent when integrated with other technical analysis indicators. For instance, combining moving averages with Relative Strength Index (RSI) can provide traders a comprehensive view of market momentum. The RSI gauges overbought or oversold conditions, which, when aligned with moving averages confirmations, can lead to high-probability trading opportunities. When the RSI indicates an overbought condition while the moving average shows a bearish trend, this may prompt a careful reconsideration of long positions. Likewise, an oversold RSI condition alongside a bullish moving average trend can signal potential buy opportunities. Another excellent companion for moving averages is the Bollinger Bands indicator. Combining these tools allows traders to observe price volatility and breakout possibilities. A price touching the upper Bollinger Band during an uptrend and validating using moving averages could suggest imminent price retracement. Furthermore, ensuring that proper risk management practices are adhered to is vital in these scenarios. By taking into consideration multiple indicators’ signals collaboratively, traders can build a well-rounded decision-making framework that significantly enhances their success rates in swing trading.

Trade management is a crucial aspect of success in Forex swing trading, especially when utilizing moving averages. Once a trade signal is generated based on moving average crossovers, managing the trade effectively becomes paramount. One of the most important practices includes setting stop-loss orders to limit potential losses. These stop-loss points can be placed using recent swing highs or lows, giving room for price fluctuations. Moreover, traders should consider setting take-profit points in conjunction with moving average levels. For instance, if operating within an upward trend, aiming for resistance levels aligned with the moving average can provide a strategic exit point. Additionally, adjusting stop-loss orders upward as prices increase can help protect profits without prematurely closing positions. Regularly reviewing trades and adjusting for market conditions ensures that strategies remain robust and adaptive to changes. Maintaining a trade journal to evaluate previous trades can also help traders refine their strategy and moving average application. Staying informed and responsive to evolving market dynamics can be the edge that makes a significant difference in long-term Forex trading success.

Common Mistakes to Avoid with Moving Averages

Despite their usefulness, many traders make common mistakes while using moving averages in their strategies. One prevalent error is solely relying on moving averages without considering the overall market context. An overemphasis on these indicators may lead to missed opportunities caused by significant economic news or underlying market sentiment shifts. Additionally, using moving averages without adequate filtering for volume or price action can result in trades based on low-quality signals. Ensuring thorough analysis of current market conditions is crucial to complement moving average trading signals. Traders must also avoid overcomplicating their strategies by introducing too many moving averages. This can lead to analysis paralysis, making decision-making cumbersome rather than efficient. Another mistake is disregarding the significance of waiting for confirmation before executing trades. Moving average crossovers can occur frequently, but not every crossover is a good trade signal. Waiting for price action to confirm direction can prevent traders from jumping into positions prematurely. By being mindful of these pitfalls and staying educated about market trends, traders can use moving averages effectively to enhance their swing trading results.

Emotional discipline plays a crucial role in Forex trading success, especially when leveraging moving averages. The psychological aspect of trading cannot be overstated; it is often responsible for numerous trading failures. When utilizing moving averages, sticking to a pre-defined trading plan allows traders to navigate emotional highs and lows effectively. Fear and greed can compromise judgment, leading to hasty decisions and unnecessary losses. Training oneself to approach trading logically rather than emotionally fosters discipline and patience. An effective approach is to practice consistently through paper trading, which can build confidence and reduce impulsive actions. Establishing realistic goals based on historical performance utilizing moving averages can also bolster emotional stability. Remember, losses are part of trading, and embracing them as learning opportunities rather than failures can enhance resilience. Regularly reflecting on performance and understanding personal triggers will enable traders to maintain focus and control. Ultimately, cultivating a professional trading mindset when combining emotional discipline with technical strategies will empower traders to make sound decisions. Forex swing trading with moving averages can be a rewarding venture when approached responsibly and methodically.

Conclusion on Moving Averages in Forex Trading

In conclusion, moving averages can serve as powerful allies in a Forex trader’s toolkit, especially for swing trading strategies. Their ability to clarify trends enables traders to make informed decisions, but the effectiveness is heavily dependent on skillful implementation. Understanding the various types of moving averages and how to employ them in conjunction with other indicators can greatly improve a trader’s success rate. Avoiding common mistakes, practicing emotional discipline, and managing trades properly will further enhance the potential of using moving averages. Continuous learning and adjustment of strategies based on past performances is paramount for long-term success in Forex trading. With the right mindset and approach, traders can capitalize on market opportunities to achieve significant profits. Remaining informed of market conditions and global events is essential for navigating the complexities of Forex. Ultimately, moving averages, when utilized mindfully, can lead to more significant gains, reducing risks inherent in trading. Traders who embrace these principles will find themselves equipped for the Forex market’s challenges.

Using Moving Averages for Forex Trading

The Forex market is known for its volatility, which is both a challenge and opportunity for traders. Swing trading, where trades are held for several days to capitalize on expected price movements, can be effectively enhanced by applying moving averages. A moving average smooths price data over a specific period, offering a clearer view of potential trends. Traders often use moving averages to identify support and resistance levels, enabling them to determine optimal entry and exit points. Typically, the most widely used moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA gives equal weight to all prices, while the EMA gives greater weight to the most recent prices, hence responding faster to price changes. Understanding and applying these tools can elevate one’s trading strategy, as they serve not just to display historical data but can also signal potential reversals. As such, integrating moving averages into swing trading methodologies can bolster a trader’s performance significantly. The ability to make informed decisions grounded in statistical data rather than feelings is vital in this complex environment.