How Peer-to-Peer Lending Supports Financial Inclusion

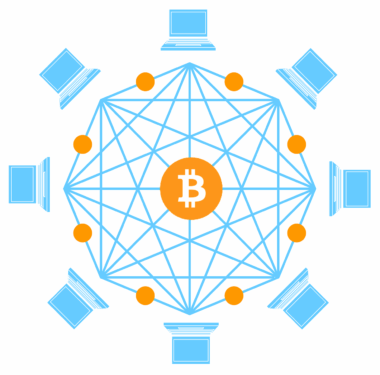

Peer-to-peer (P2P) lending is transforming finance by directly connecting borrowers with lenders. This innovative solution addresses the barriers traditional financial institutions impose. Such barriers often restrict access to financial products for underserved populations. With P2P platforms, individuals gain opportunities for loans often overlooked by conventional banks. It enhances financial inclusion, enabling borrowers to access funds that help meet their needs. Many P2P platforms use technology to assess creditworthiness, sometimes evaluating factors beyond traditional credit scores. This model helps deserving individuals secure loans based on criteria that reflect their true financial behavior. Investors, on the other hand, access new opportunities to invest while earning competitive returns. As a result, P2P lending presents a win-win situation for both parties. The entire process is often more efficient, reducing overhead costs and allowing for lower interest rates. This competitive atmosphere benefits borrowers and encourages responsible lending practices. Overall, peer-to-peer lending enriches the financial landscape by democratizing access to capital.

The rise of P2P lending has been accelerated by the infusion of technology into finance. Fintech companies leverage advanced algorithms and analytics, streamlining the loan application process. This tech-driven approach reduces the time and effort traditionally required to secure a loan. Online applications allow borrowers to apply from anywhere, eliminating geographical limitations. Furthermore, these platforms typically ensure a more user-friendly experience. Information is presented in ways that are easily understood, making this option accessible to a broader audience. Financial inclusion extends to those who might feel intimidated by traditional banking systems and their processes. Additionally, these platforms often charge lower fees than traditional lenders, further incentivizing borrowers. This improved accessibility means more individuals can invest in their education, business ventures, or home improvements. Communities benefit from increased financial activity as borrowers utilize funds for local economic growth. With ongoing advancements in technology, we can expect further innovations in the sector. These changes pave the way for a more inclusive financial future.

Empowering Marginalized Communities

P2P lending plays a crucial role in empowering marginalized communities often sidelined by traditional banking. These marginalized groups include low-income households, single parents, and minorities. Conventional financial institutions may view these individuals as high-risk borrowers, leading to denied applications. P2P platforms prioritize inclusivity, allowing individuals to showcase their creditworthiness in alternative ways. This access not only fulfills immediate financial needs but also builds long-term financial standing. The ability to secure loans can lead to successful business ventures, education, home ownership, and other essential financial milestones. Moreover, the social aspect of P2P lending fosters community connections. Borrowers may feel more supported when they recognize their lenders as individuals rather than impersonal institutions. This awareness creates a cycle of trust and lending within communities. Much of the success derives from individuals sharing their unique stories and experiences, motivating lenders to contribute. As more people participate in the P2P lending ecosystem, a sense of collective empowerment emerges. This system revamps financial expectations for marginalized groups, changing their roles within the economic framework.

Research shows that peer-to-peer lending reduces reliance on predatory lending practices. Traditional lenders sometimes impose exorbitant interest rates and fees that trap borrowers into cycles of debt. P2P lending creates alternatives, offering lower rates that benefit the borrowing community while still returning profits to individual lenders. As borrowers become financially educated, they gain the skills to make informed decisions. Understanding the terms of loans and the importance of timely repayments lays the foundation for healthier financial habits. In turn, more individuals can optimize financial literacy, shifting perceptions of debt from negative notions to tools for growth. This progress nurtures a generation that views financial responsibilities positively. Improved borrowing experiences empower individuals to build credit scores and secure future loans on better terms. Moreover, these dynamics stimulate the economy by retaining funds within the community. Money flows back and forth, leading to higher spending and investment opportunities. The P2P lending ecosystem encourages responsible financial behavior that can lead to sustainable community growth.

The Role of Regulation

Regulation plays a vital role in safeguarding the interests of both borrowers and lenders in peer-to-peer lending markets. Effective regulatory frameworks ensure transparency and minimize risks in the transaction process. Compliance with regulations significantly decreases the likelihood of fraud and mismanagement within P2P lending platforms. As the industry evolves, adhering to regulations builds credibility among users, fostering a sense of trust. Clear guidelines and oversight help potential borrowers feel more secure. Well-regulated platforms often offer standardized disclosures, which provide essential information on loan terms and conditions. Users are informed, making it easier to compare options across various platforms. Regulations also protect lenders by establishing risk mitigation measures that safeguard investments. As regulators enforce operations, they encourage financial stability, which is essential for long-term market viability. Furthermore, adapting to regulatory changes promotes innovation within the sector. Platforms that embrace these guidelines can develop better risk assessment techniques, improving the overall efficiency of lending. Thus, balanced regulation in the P2P lending industry drives positive outcomes for all stakeholders involved.

The success of peer-to-peer lending hinges on the evolving relationship between trust and technology. As more borrowers participate in these platforms, user-generated ratings and reviews establish essential trust mechanisms. Ratings allow potential lenders to assess the reliability of borrowers, improving the lending experience. Consequently, transparency is critical; it enhances the credibility of these operations that many users rely on. Trust is integral to P2P lending where lenders often prefer to lend to individuals who share similar values and stories. Ultimately, the emotional connection made through shared experiences is a significant influencer in decision-making processes. Such personal elements can motivate individuals to contribute financially, fostering community growth. Technology enhances this relationship by providing data that backs up trust expectations. Algorithms can analyze borrowers’ repayment history, refining the lending process. By sharing data transparently, platforms reinforce confidence in borrowers’ abilities. The unique blend of trust and technology in P2P lending builds an ecosystem that fosters cooperation. By making these connections, the sector propels itself toward further growth while maintaining a strong commitment to financial inclusion.

Future Directions in P2P Lending

Looking forward, peer-to-peer lending continues to adapt in response to market changes and consumer needs. Financial technology innovations introduce new features that enhance user engagement. Mobile applications simplify the borrowing and lending processes effectively, ensuring accessibility from anywhere. These features increase convenience and bring more users into the P2P lending space. Additionally, integration with alternative payment systems could streamline transactions further, breaking geographical barriers. Crowdfunding features are emerging, allowing users to pool resources for larger projects. These advancements broaden opportunities for both borrowers and investors while engaging a wider audience. Adapting to societal changes also means addressing sustainability and ethics in lending practices. P2P platforms are urged to prioritize responsible lending, ensuring borrowers don’t face overwhelming debt. As financial education becomes more prevalent, individuals will be better equipped to manage their obligations. Future innovations in data privacy will also play crucial roles, ensuring user information is safeguarded. As peer-to-peer lending evolves, it carries the potential to reshape the financial landscape. By remaining adaptable, the industry can continue breaking down barriers and promoting financial inclusion across diverse demographics.

P2P lending, in effect, helps bridge the gap between traditional finance and underbanked communities. As the demand for accessible financial solutions increases, platforms must innovate further to meet evolving consumer needs. By fostering connections among diverse groups, P2P lending strengthens economies and enhances lives. Peer-to-peer lending exemplifies the positive impact fintech has on achieving financial inclusion goals. Transitioning users from exclusion to engagement represents a vital shift, creating opportunities for countless individuals. Ongoing collaboration among stakeholders is essential for refining this approach. This innovation focuses on community building and shared success reflections through mutual support. In an environment where individuals understand the significance of responsible borrowing, everyone stands to gain. With further technological support, P2P lending can catalyze a broader movement toward inclusive finance. Recognizing each participant as integral to the process strengthens peer-to-peer lending’s objective. The future holds promises that include increased funding, better technology, and enhanced features. By continuing to prioritize empowerment, peer-to-peer lending can help redefine financial norms. In summary, the sector brings innovative solutions that reflect an ongoing commitment to ensuring everyone has access to financial resources.