Infrastructure Bonds in Developing Countries: Opportunities and Challenges

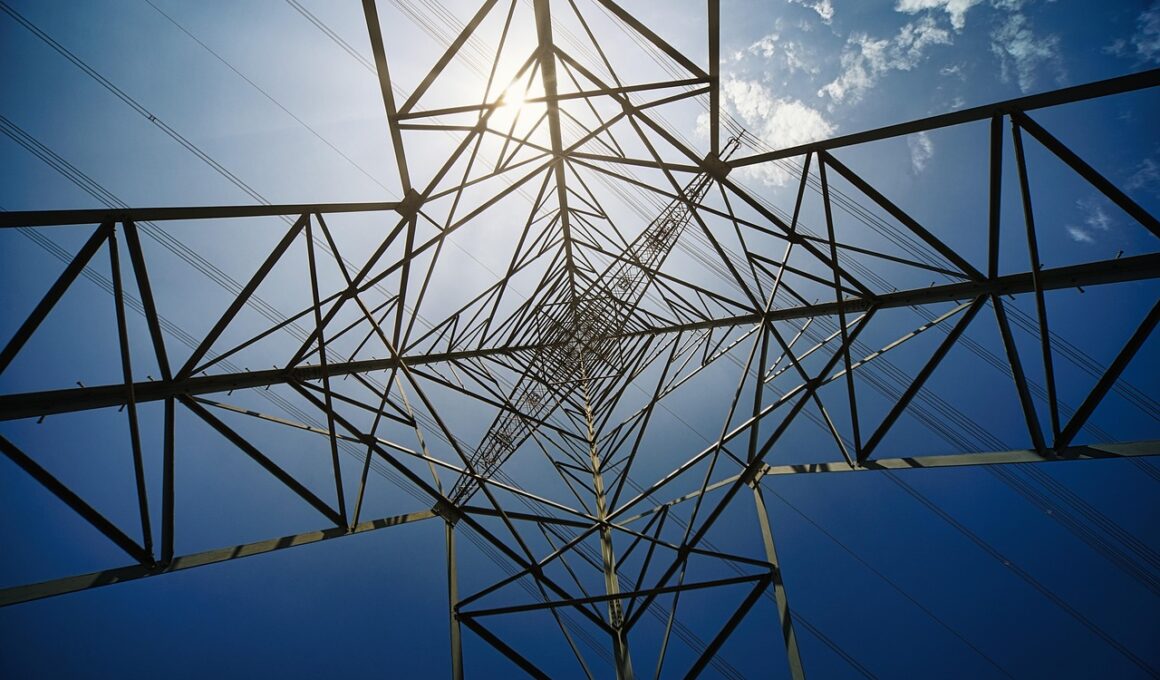

Infrastructure bonds represent a critical tool for financing large-scale public works in developing countries, offering a means to connect resources and investment with urgent needs. These bonds facilitate adequate funding allocations for essential infrastructure projects such as roads, bridges, and public transport systems. By tapping into private capital, governments can bridge the financing gap that often hampers project execution. The appeal of infrastructure bonds lies not only in their ability to harness diverse investors but also in their generally favorable risk-return profiles. As global economies face varied funding constraints, developing nations increasingly recognize the importance of developing a conducive environment for issuing these bonds. However, despite their potential, infrastructure bonds are often accompanied by challenges that can hinder their success. Regulatory barriers, lack of market knowledge among potential investors, and political instability can impact the issuance and attractiveness of such bonds. To make the most of these instruments, stakeholders must address these challenges. Enhanced policy environments, educational outreach, and robust governance structures can play fundamental roles in unlocking the true potential of infrastructure bonds in these regions.

Benefits of Infrastructure Bonds

One of the primary advantages of infrastructure bonds is their capacity to attract long-term investment, which is crucial for funding extensive projects. Investors are often encouraged by the fixed returns associated with these bonds, making them an appealing choice for pension funds and insurance companies looking for stable cash flows. Additionally, infrastructure bonds typically provide a relatively lower risk compared to equity investments, thus broadening their appeal to conservative investors. Projects financed through these bonds tend to support public welfare, contributing to economic growth, job creation, and improved living conditions for citizens. Furthermore, during periods of economic uncertainty, infrastructure bonds can act as a stabilizing force, offering a predictable income stream. They can also enhance local credit markets by promoting transparency and encouraging broader participation from private investors. The push for developing eco-friendly infrastructure further enhances the attractiveness of these bonds, as governments and investors alike seek opportunities that align with sustainability goals. Consequently, the benefits of infrastructure bonds extend beyond mere financial returns, enabling improvements in societal and economic resilience in developing nations.

On the flip side, one major challenge facing infrastructure bonds in developing countries is the lack of a strong regulatory framework. In many nations, the absence of clear guidelines can create uncertainty, deterring potential investors from entering the market. This uncertainty can manifest from inconsistent policies, unclear property rights, and inadequate legal protections for investors. Without a stable legal backdrop, investors may view the risks associated with these bonds as prohibitive. Furthermore, developing nations might struggle with issues related to corruption, which could impact both the governance of bond issues and the execution of financed projects. In some cases, successful project implementation is further hampered by a limited capacity among local authorities to manage and administer complex financing mechanisms. As a result, projects can face delays or even fail to realize intended benefits, leading to a negative backlash against future infrastructure initiatives. To overcome these hurdles, it’s essential for governments to prioritize the establishment of robust regulatory environments and fostering transparency, building investor confidence to facilitate the growth of infrastructure bonds.

International Cooperation and Partnerships

To strengthen both the effectiveness and reach of infrastructure bonds, international cooperation plays a vital role. Developed countries and multilateral organizations can offer technical assistance, capacity building, and financial incentives to support developing nations in creating effective bond frameworks. Through these collaborative partnerships, knowledge transfer can take place, helping countries to enhance their regulatory environments and understanding of bond markets. Furthermore, international financial institutions can provide seed funding, guarantees, or even insurance to mitigate risks associated with infrastructure investments. This additional support can encourage local governments to pursue these financing options more aggressively. Additionally, collaboration can involve pooling resources, allowing for innovative funding structures that disperse risk while maximizing capital. Partnerships with private sector actors can also lead to the formation of Public-Private Partnerships (PPPs), enhancing project delivery and operational efficiency. By leveraging resources and expertise from multiple stakeholders, it is possible to develop sustainable infrastructure that meets the growing demands of developing nations. Consequently, fostering international cooperation in the field of infrastructure bonds is essential to create a robust foundation for future growth.

The role of local market development is another crucial factor influencing the success of infrastructure bonds in developing countries. For these bonds to thrive, it is essential to create a vibrant local capital market that facilitates efficient transactions and provides a pool of potential investors. Developing such a market often requires concerted efforts from governments, financial institutions, and regulatory bodies to establish standards and infrastructure for bond issuance. Establishing a supportive ecosystem includes developing clear procedures for the issuance and distribution of bonds. It also involves educating potential investors about the benefits and risks associated with infrastructure bonds, thus fostering better market participation. Moreover, developing local rating agencies can provide necessary credit assessments, increasing investor confidence and improving the pricing of these bonds. A strong local market can enable infrastructure bonds to secure competitive interest rates, ultimately enhancing project viability. Therefore, investing in local market development is essential for ensuring the long-term sustainability and attractiveness of infrastructure bonds in the context of developing nations.

Risks Associated with Infrastructure Bonds

Despite their numerous benefits, infrastructure bonds are not without risks. Political instability can significantly affect the issuance and performance of these financial instruments. Investors are often wary of unpredictable political climates, which can lead to sudden policy changes, risk of expropriation, or project delays. Additionally, the financial health of issuing entities, such as local governments or state-owned enterprises, can fluctuate significantly, impacting their ability to service debt. Infrastructure projects themselves can encounter unforeseen challenges, including cost overruns or engineering failures, leading to potential revenue shortfalls. The reliance on external factors, such as international market conditions, interest rate fluctuations, and changes in economic growth, further exacerbates risk profiles. Consequently, it’s a priority for investors and governments to undertake thorough due diligence when considering infrastructure bonds. Mitigation strategies, such as diversifying investments and constructing contingencies in bond contracts, can enhance resilience against potential risks. Understanding these hazards is critical to fostering an environment where infrastructure bonds can successfully contribute to economic development in emerging markets.

Looking ahead, the future of infrastructure bonds in developing countries appears promising yet complex. Given the increasing demands for infrastructure improvements, there is a greater recognition of the need to mobilize private financing through these financial instruments. Emerging technologies can also play a transformative role, with innovations in fintech potentially creating more efficient processes for bond transactions. The advent of sustainable finance practices opens up new possibilities for environmentally-focused infrastructure projects, attracting investors interested in green initiatives. Furthermore, global initiatives that advocate for sustainable infrastructure development are likely to propel interest in infrastructure bonds. On an operational level, enhanced financial literacy and investment education within developing countries are vital for increasing participation in the bond market. As stakeholders across the public and private sectors collaborate effectively, it is essential to share best practices and address existing challenges. All these factors together present an opportunity to reimagine how infrastructure needs can be addressed and met through innovative funding structures backed by bond financing in evolving economies.

To summarize, infrastructure bonds hold remarkable promise for financing essential public infrastructure in developing countries, yet they are accompanied by a unique set of challenges. The successful implementation of these bonds can lead to better infrastructure, increased economic activity, and improvements in quality of life for citizens. Therefore, it becomes imperative that stakeholders work collaboratively to mitigate prevailing risks and address regulatory issues that hinder investment. This entails the development of robust frameworks that can guide bond issuance and bolster investor confidence. Enhanced international cooperation and partnerships can supply much-needed expertise and resources to support local governments in establishing successful infrastructure projects. Furthermore, fostering a conducive environment for local market development will be critical in allowing investors to maximize their returns while benefiting society at large. Understanding and addressing the risks associated with infrastructure bonds can enable their successful deployment and adaptive growth. The future of infrastructure bonds relies on innovative solutions and collaborative efforts that can pave the way for sustainable development within emerging economies. As we advance, it is essential to recognize and harness the potential of infrastructure bonds as a dynamic solution for addressing pressing infrastructure challenges in developing nations.