Unemployment Hysteresis and Monetary Policy Interventions

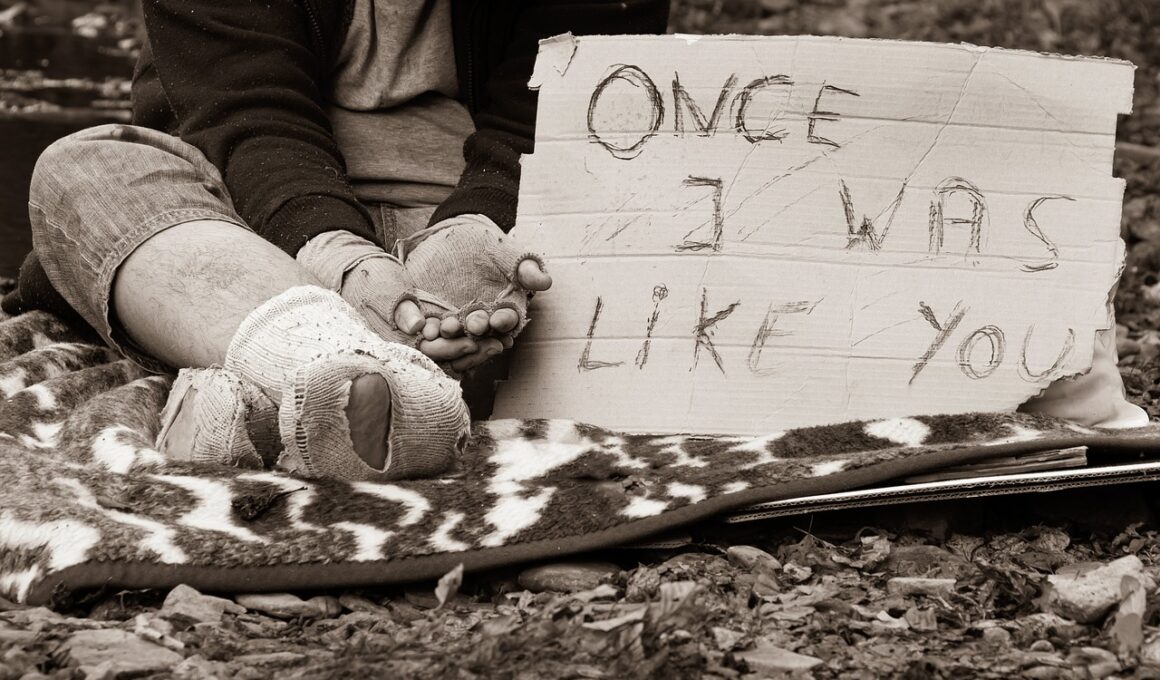

Unemployment hysteresis refers to the phenomenon where elevated levels of unemployment persist over time, even after the economic conditions that caused them have improved. Traditional economic theories suggest that unemployment rates fluctuate according to economic systems, and recovery from recessions should restore employment levels. However, hysteresis indicates that prolonged unemployment can lead to skill erosion, reduced worker motivation, and negative psychological impacts, thus inhibiting the labor market recovery. Monetary policy plays a crucial role in addressing these challenges. Through interventions like interest rate adjustments and quantitative easing, central banks attempt to stimulate economic growth and restore employment levels. However, the effectiveness of these monetary policy interventions can diminish over time if the labor market conditions remain unfavorable. Policymakers must take into consideration the potential long-term effects of prolonged unemployment, and the role monetary policy can play in mitigating these effects. The continuous assessment of monetary policy tools in conjunction with labor market dynamics becomes essential for sustaining economic growth. Furthermore, understanding the mechanisms of hysteresis can help guide more nuanced policy interventions to combat persistent unemployment.

One of the key aspects of unemployment hysteresis is its relationship with labor market policies. Structural factors such as skill mismatches and regional disparities often exacerbate the effects of hysteresis. When unemployment persists, individuals may lose their skills, thus making it more challenging for them to return to the labor force. This creates a vicious cycle where lower-skilled individuals struggle to find work, leading to further marginalization in a competitive job market. Therefore, it is essential for monetary policy to not only focus on interest rates and inflation but also address underlying labor market dynamics. Policymakers might need to implement targeted training programs to assist the long-term unemployed in reacquiring skills that align with market demands. In addition, inclusive labor policies can reduce barriers to employment for those most affected by hysteresis. By combining monetary interventions with labor market policies, a comprehensive approach to reducing unemployment can be established. This method not only addresses immediate economic downturns but also fosters resilience in the labor market against future shocks, ultimately aiming to minimize the severity and duration of unemployment.

To fully understand the implications of monetary policy on unemployment hysteresis, it is also vital to analyze the role of inflation targeting within a central bank’s strategic objectives. Inflation targeting, often perceived as a key tool of monetary policy, can influence labor market outcomes indirectly. When a central bank sets a low inflation target, it may lead to restrictive monetary conditions, ultimately resulting in reduced growth and increased unemployment rates. Conversely, overly aggressive monetary policies aimed at rapid growth can contribute to economic overheating and instability. Resilient labor markets thrive in environments where monetary policy successfully balances inflation and unemployment. A careful calibration of policy, in line with labor market conditions and inflation expectations, is needed to mitigate the effects of unemployment hysteresis. Policymakers are thus faced with the challenge of navigating between stimulating growth and maintaining price stability. This balancing act not only impacts short-term economic recovery but also influences long-term labor market dynamics and the potential for hysteresis to take root during economic cycles.

The Impact of Global Economic Factors

Global economic factors significantly contribute to the dynamics of unemployment hysteresis. Events such as financial crises, geopolitical tensions, and trade wars can have profound impacts on domestic labor markets. For instance, during global economic downturns, countries may experience significant increases in unemployment rates that exhibit hysteresis effects. As a result, it becomes crucial for central banks to consider how external shocks affect their monetary policy strategies. The interconnectedness of global markets means that localized unemployment issues can often stem from international influences, complicating monetary policy decisions. Additionally, external pressures can limit a central bank’s ability to effectively implement policies aimed at reducing unemployment. For example, in a world characterized by low-interest rates, aggressive monetary responses in one country may lead to unwanted capital flows and currency fluctuations. This further complicates the challenge of addressing hysteresis, as the effectiveness of local monetary policies may be undermined by global market dynamics. Consequently, a thorough understanding of these global economic factors is essential for devising strategies that effectively mitigate long-term unemployment.

Long-term unemployment often leaves significant scars on an economy, amplifying the need for timely, robust interventions from policymakers. The potential for hysteresis to take hold can result in a permanently lower level of output, which, in turn, affects overall economic health. This underscores the critical nature of proactive approaches in monetary policy that aim to shorten the duration of high unemployment. When central banks monitor trends in unemployment, they can adjust their policies to ensure smoother and swifter economic recoveries. Moreover, improving unemployment metrics requires a commitment to flexible monetary strategies that adapt to changing labor market conditions in real-time. Beyond mere interest rate policies, initiatives that support workforce training, apprenticeships, and inclusion can aid in reducing the impact of unemployment hysteresis. This multifaceted approach involves a concerted effort between monetary policy and labor market interventions, creating a more resilient economy. By acknowledging the relationship between monetary policy and labor market health, policymakers can create conditions that not only foster immediate job creation but also build long-term economic stability.

Conclusion on Policy Implications

The implications of unemployment hysteresis for monetary policy spotlight the need for comprehensive frameworks that go beyond traditional methods. As research continues to illuminate the mechanisms and consequences of hysteresis, monetary authorities must integrate insights into their strategic planning. Shifting from a sole focus on inflation control to embracing a broader set of labor market objectives could significantly alter the efficacy of policy interventions. Furthermore, fostering collaborations with labor experts, educational institutions, and community organizations can enhance the flow of information and resources needed to combat unemployment effectively. Investing in long-term solutions designed to address the root causes of hysteresis can yield substantial returns in terms of labor force participation and productivity. Ultimately, the pursuit of full employment should encompass an understanding of both cyclical and structural factors affecting job availability. By leveraging a more holistic approach to monetary policy, the risks associated with unemployment hysteresis can be mitigated, thus establishing stronger foundations for economic prosperity.

In summary, unemployment hysteresis presents complex challenges for monetary policy and employment strategies. When prolonged unemployment persists, it poses significant risks to economic stability and growth. Decisions made by central banks not only impact immediate economic conditions but also have far-reaching effects on the labor market trajectory. The interplay of monetary interventions, labor market policies, and global economic factors must be recognized and managed effectively. Policymakers are thus encouraged to adopt adaptive frameworks that accommodate the shifting realities of labor markets. Collaboration with stakeholders across sectors is crucial in ensuring that monetary policies yield favorable outcomes in the realm of employment. Through this cooperative effort, policymakers can create a more resilient economic landscape that empowers individuals and communities. In conclusion, addressing the challenges of unemployment hysteresis requires a commitment to innovative policymaking that embraces comprehensive strategies. Engaging with emerging research and data will equip central banks with the tools needed to navigate the complexities of the labor market, ultimately facilitating stronger economic conditions for all.

By investing in research and innovative metrics to measure the impact of unemployment hysteresis on economic conditions, we can foster resilience that minimizes the long-term effects of unemployment in the labor market. This accumulated understanding aligns with proactive monetary policy and labor market interventions, ensuring that we are prepared for future economic challenges. In doing so, we build a foundation for sustainable employment growth that contributes to economic stability and societal well-being. Central banks and policymakers must remain vigilant in addressing the risks of hysteresis, taking a holistic approach that combines monetary policy with structural initiatives aimed at combating joblessness. As new challenges emerge, the tools available to policymakers must evolve accordingly, facilitating a dynamic response to labor market shifting dynamics. By integrating insights from various disciplines, including behavioral economics and sociology, monetary policy can be enriched to address unemployment effectively. In the long run, the focus should embrace a collaborative approach among all stakeholders to create a labor market that is resilient against the shocks that bring about hysteresis. Working together, we can drive inclusive growth that mitigates the adverse consequences of prolonged unemployment.