Hedging Strategies to Protect Against Currency Risk

In the global marketplace, businesses frequently face risks from fluctuating exchange rates. These fluctuations can significantly impact profit margins and overall financial stability, making it crucial for companies involved in international trade to implement effective hedging strategies. Hedging against currency risk involves using financial derivatives and other instruments to offset potential losses due to exchange rate movements. A key aspect of any successful hedging strategy is to assess the specific exposure a business faces and then choose the most appropriate instruments to mitigate that risk. Companies can adopt a variety of methods, including forward contracts, options, and currency swaps, which allow them to lock in exchange rates and reduce uncertainty. While these strategies can provide a safety net, it’s essential for businesses to understand the costs and complexities involved in implementing them. In this article, we will explore different types of hedging techniques and their effectiveness in minimizing currency risk, guiding businesses toward making informed decisions tailored to their financial situations and risk tolerances.

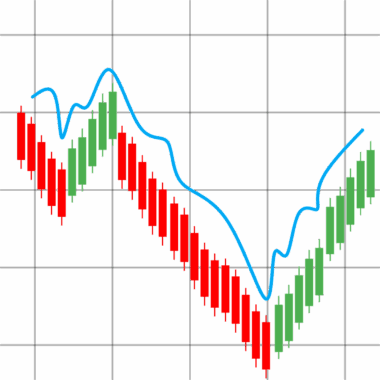

One common method of managing currency risk is through forward contracts. These contracts allow businesses to lock in a specific exchange rate for a predetermined amount of foreign currency at a future date. By doing this, companies can mitigate the impact of fluctuating rates on their financial outcomes, ensuring predictability in their cost structure. Forward contracts are particularly useful for organizations that know their future cash flows in foreign currency, as they enable firms to budget accurately without the worry of adverse exchange rate movements. However, companies need to be cautious, as they may miss out on favorable rate changes if the market moves against them. Additionally, firms should consider the counterparty risk associated with forward contracts, as the agreement is typically made with a financial institution. It is important to choose a reputable counterparty to minimize potential default risks. Businesses should also assess their operational flexibility while utilizing forward contracts, as there may be restrictions when changes to cash flow projections occur unexpectedly. Overall, forward contracts can provide a reliable means to hedge currency risk effectively.

Utilizing Options for Currency Risk Mitigation

Another effective strategy for hedging against currency fluctuations is through the use of options. Currency options grant businesses the right, but not the obligation, to exchange a specific amount of currency at a predetermined rate within a specified timeframe. This flexibility differentiates options from forward contracts and allows companies to benefit from favorable exchange rates while still providing protection against unfavorable movements. For instance, if a company expects to receive payments in a foreign currency but is concerned about potential depreciation, it can purchase a put option that becomes profitable if the exchange rate moves against them. The premium paid for the option will define the cost of this security, and businesses must weigh this expense against the potential losses they might face without it. Additionally, companies can establish various strategies using options, such as straddles or collars, to manage different levels of risk exposure. By evaluating their cash flow needs and risk environment, businesses can incorporate options into their hedging arsenal for more effective currency management.

Currency swaps are another advanced tool in hedging against exchange rate risk. These financial agreements involve two parties exchanging principal and interest payments in different currencies. This method benefits companies engaged in long-term international operations, allowing them to obtain favorable terms and reduce their overall borrowing costs. By entering a swap agreement, businesses can effectively manage their currency exposure while benefitting from potentially lower interest rates. Additionally, swaps can provide flexibility, permitting participants to renegotiate terms, which can adapt to their changing financial situations. Companies must, however, consider the complexities involved in setting up currency swaps, as they often require a thorough understanding of the terms and valuation methods involved in these contracts. To optimize swaps’ effectiveness, businesses should analyze their cash flow patterns and potential exposure before entering into an agreement. Furthermore, effective monitoring and management of the swap position are vital to ensuring continued alignment with overall risk management strategies and financial objectives.

Strategic Planning for Hedging Implementation

The implementation of a hedging strategy requires careful planning and thorough evaluation of multiple factors that influence currency exposure. Companies must conduct a comprehensive analysis of their business operations and international commitments to identify areas most susceptible to exchange rate risk. This analysis involves evaluating historical data, market trends, and potential future events that may impact currency values. By establishing a clear understanding of their risk profile, businesses can determine the most effective hedging instruments and techniques suited for their specific needs. Furthermore, they should establish a systematic approach to monitor and adjust their hedging strategies to respond to changing market conditions. Regular review and updates will ensure that hedging remains aligned with the organization’s overall risk management framework. Another crucial aspect is involving key stakeholders in the decision-making process to ensure alignment among different departments within the organization, such as finance and operations, as both areas play essential roles in managing foreign exchange risk.

Effective communication and education about currency risk and hedging strategies are critical to ensuring an organization’s success in its hedging efforts. Employees across various departments must understand the rationale behind hedging decisions, as well as the potential impact of market changes on their operations. Training sessions and workshops can provide valuable insights into the intricacies of currency management, enabling teams to make informed choices. By fostering a culture of awareness, companies can encourage proactive approaches to risk management, encouraging team members to share insights and contribute actively to the hedging strategy. Additionally, keeping up with market developments and regulatory changes can enhance organizational adaptability in the face of uncertainty. Engaging with financial advisors or hedging specialists can provide valuable guidance in optimizing strategies, ensuring that businesses remain equipped to address emerging challenges and opportunities effectively. A well-informed organizational culture will not only reinforce commitment to the hedging initiative but also add resilience against currency fluctuations that could adversely affect financial performance.

Evaluating the Effectiveness of Hedging Strategies

Monitoring the performance of hedging strategies is vital for businesses to determine their effectiveness in managing currency risk. Companies should establish key performance indicators (KPIs) to evaluate their hedging outcomes and assess whether the chosen instruments are delivering the desired results. Metrics such as the reduction in potential losses due to unfavorable movements or the overall net benefits arising from hedging initiatives are essential for this analysis. Regular assessments will also help organizations identify opportunities for refinement and improvement in their strategies. Authors should look at both quantitative data and qualitative feedback from stakeholders to gain a well-rounded understanding of how hedging impacts their overall risk management. Adjustments may be necessary based on these evaluations to ensure that strategies remain effective and aligned with the organization’s financial objectives. Being proactive in reviewing hedging strategies ensures that businesses are poised to navigate an ever-changing currency landscape and reduces the potential for financial disruption resulting from unforeseen exchange rate fluctuations.

In conclusion, effectively managing currency risk through hedging requires comprehensive strategies and a solid understanding of the various financial instruments at businesses’ disposal. Forward contracts, options, and swaps all provide unique mechanisms for protecting against exchange rate fluctuations, enabling organizations to stabilize their cash flows and safeguard profits. Successful implementation hinges on strategic planning, stakeholder engagement, and ongoing evaluation of performance metrics to adapt to changing market conditions. As businesses continue navigating the complexities of the global economy, developing a robust hedging framework will be crucial in mitigating risks associated with foreign exchange. Ultimately, a well-executed hedging strategy not only protects monetary interests but also fosters resilience against unforeseen market shifts. Armed with the right tools and knowledge, companies can fortify their financial positions, enabling them to thrive in the ever-evolving landscape of international trade. This preparation cultivates confidence, empowering firms to seize growth opportunities and build sustainable operations, solidifying their market presence. Incorporating education into corporate culture can yield long-term benefits and ensure all team members contribute to achieving strategic goals.